At $1 million each, the entire circulating supply of an estimated 18 million Bitcoins will achieve a market capitalization of $21 trillion. In total, this would be worth around 25 percent of the world’s entire circulating money supply, allowing Bitcoin to realistically cover the day-to-day volume necessary to compete as a truly global currency.if not, I will eat my dick on national television.

— John McAfee (@officialmcafee) July 17, 2017

The Method Behind The Madness

In order to achieve the staggering growth predicted by McAfee, Bitcoin (BTC) would need to undergo one of the most rapid expansions in world history. It would need to grow by more than 2,500 percent over the next 21 months. Starting at today’s $3,967 BTC valuation, Bitcoin would need to grow at an average rate of almost 32 percent per month for the next 20 months — a growth rate not seen since Bitcoin’s earliest days. To put this into perspective, Bitcoin would need to gain value at a faster rate than even some of the most impressive stocks in recent history — making the 50 percent gains seen by Amazon (AMZN) in 2017 look like nothing but price volatility. In recent times, Bitcoin has struggled to maintain its momentum and has entered a significant downtrend in early 2018 after coming off what can only be described as a huge bull run in 2017. However, to achieve such radical growth amid this downtrend, Bitcoin and the cryptocurrency industry as a whole need to overcome some rather challenging obstacles — many of which are slowly, but surely, being broken down.

When Bitcoin Retail Adoption?

The largest of these are retail adoption, which would require that large well-established merchants and retailers begin to accept cryptocurrencies for their goods and services. At first, this will likely be achieved through payment gateways that instantly convert it to fiat to protect retailers against price volatility. Despite being a solution based on compromise, the ability to pay with BTC at popular stores, restaurants and other venues could massively boost the utility of BTC — which should, in turn, drive up demand among retail investors looking to benefit from the speed and security offered by the technology. Increasing retail adoption would also have the downstream effect of improving Bitcoin liquidity, making it far easier for Bitcoin owners to extract value from their portfolios. At the moment, actually exchanging your Bitcoin for goods and services is a challenging endeavor in most cases, typically requiring either a Bitcoin debit card or a special payment app to pay in places that don’t directly accept Bitcoin. With efforts underway to reduce the technical challenges involved in purchasing and accepting Bitcoin, it is likely that the way Bitcoin is received and spent now is very different to how it will be in a mass adoption scenario. One of the ways this could change is with the implementation of a Bitcoin name service, which would see the complicated 34-character Bitcoin addresses replaced with a much more convenient human-readable name, making both interpersonal and retail payments less challenging. Other blockchains, such as Ethereum (ETH) and Bitcoin Cash (BCH), already have such a system in place — and there appears to be no major reason why the same system couldn’t work for Bitcoin.

When Bitcoin Lightning Network?

The technologies that are expected to facilitate such extraordinary scale are already in development. One of these technologies is second layer solutions such as the Bitcoin Lightning Network. Operating on the basis of ‘quid pro quo,’ or a favor for a favor, the Bitcoin Lightning Network allows money to be routed between nodes on the network via lightning channels — which are, essentially, payment lanes that allow two parties to transfer funds to one another. Currently, the Bitcoin Lightning Network has a capacity of just over $2.8 million — allowing lightning users to transmit value practically anywhere in the world at a fraction of the cost of a standard Bitcoin transaction. However, to achieve the scale needed to support the huge number of transactions a truly world-scale Bitcoin network would need to handle, the Lightning network will have to experience a similarly-huge explosion in growth — ensuring that payments always have a path between any two nodes on the network. Every day, VISAnet handles more than 150 million transactions — compared to the 350,000 currently managed by the Bitcoin blockchain. Moreover, there are over 46 million merchants connected to VISAnet worldwide, whereas there are only approximately 14,500 merchants accepting Bitcoin worldwide. Assuming it would take VISA-scale coverage to reach the $1,000,000 per BTC valuation, Bitcoin merchant adoption would need to grow by close to 32,000 percent by the end of 2019 — which is equivalent to adding 70,000 retailers per day until Dec 31, 2019. As far as we are concerned, that seems extraordinarily unlikely.

A New Breed of Billionaire

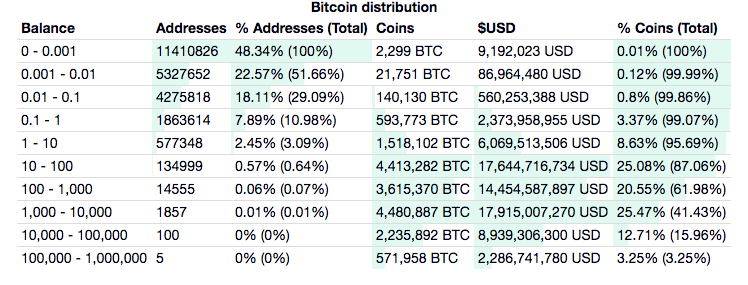

However, should Bitcoin (BTC) genuinely soar to $1 million, the world may see a radical change to the “Forbes Billionaires” list — with a much higher proportion of this list being occupied by the crypto wealthy.Similarly, looking at the Bitcoin address rich list, we find that there are more than one hundred addresses containing over 10,000 bitcoins — which, at the $1 million BTC price point, would mean that, combined, there are more than 100 businesses or individuals sitting on more than $10 billion in BTC. At the highest end of the scale, we find that the absolute wealthiest BTC addresses contain over 100,000 BTC, which will be worth $100 billion, should John McAfee’s bold prediction ring true. Granted, the great majority of these addresses are likely custodial, hedge funds, and exchange addresses. However, the inactivity of several of these addresses indicates a single long-term holder, meaning these ultra whales may find themselves on top of the Forbes rich list very soon.People are waking up to the fact that Bitcoin will be $1,000 000. But when? "Someday". "Maybe 5 years". "WIthin a decade". I'm the only one giving you a hard date: Dec 31st, 2020.https://t.co/rst3BcypFz"will-be-1-million-someday-says-jesse-lund-vp-of-blokchain-at-ibm.html

— John McAfee (@officialmcafee) February 22, 2019

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.