Strategy, formerly known as MicroStrategy, has made a strong entry into the market with its Strike Preferred Stock (STRK).

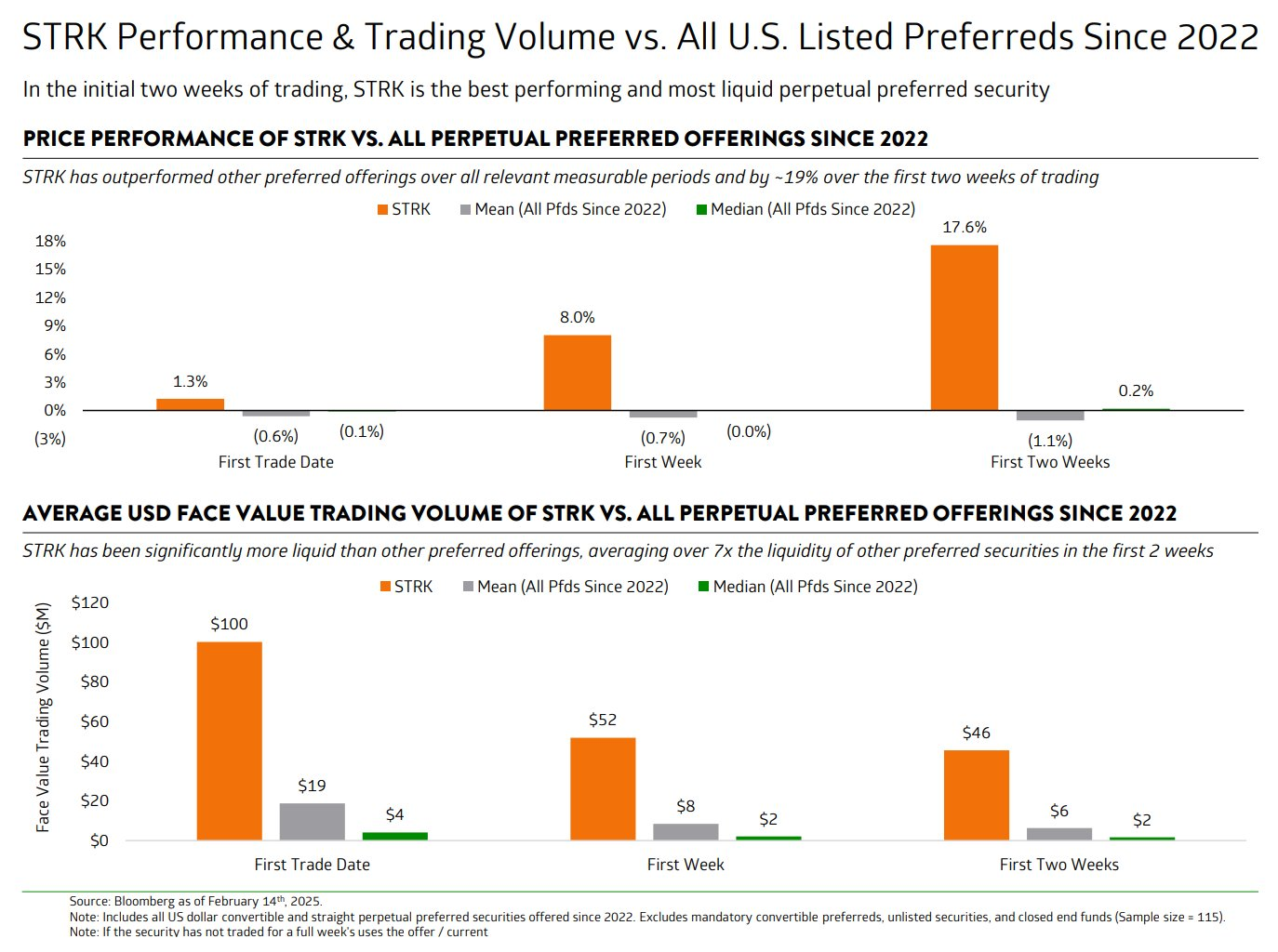

Within two weeks of its launch, STRK has become the best-performing and most liquid perpetual security among US-listed offerings since 2022.

Strategy’s STRK Trading Volume Hits Seven Times the Average as Demand Surges

On February 15, MicroStrategy’s founder, Michael Saylor, shared insights into STRK’s rapid rise.

“Strategy’s first IPO in 25+ years had record performance in its first 2 weeks. Compared to the 115 US-listed preferreds issued since 2022, $STRK ranks first in price performance, 19% higher than average, and first in trading volume, 7x the average,” Strategy emphasized on X.

According to the data, the stock gained 1.3% on its first day and 8% in the first week. By the end of the second week, it had risen 17.6%, outpacing competing securities by approximately 19%.

Meanwhile, STRK has also demonstrated strong liquidity, averaging seven times the trading volume of comparable offerings. However, despite initially reaching $100 on launch day, it later dipped to $52 within a week and settled at $48 after two weeks.

Strategy introduced STRK on January 27 to raise capital for Bitcoin acquisitions. The firm stated that the offering exceeded expectations, securing $563.4 million—nearly triple the projected amount, which reflects strong investor demand.

Michael Saylor and Nayib Bukele Discuss Bitcoin

STRK’s strong market performance comes as two of Bitcoin’s biggest supporters—Michael Saylor and President Nayib Bukele—met to discuss Bitcoin at El Salvador’s presidential palace.

On February 14, Saylor revealed that their discussion focused on expanding Bitcoin’s role globally, with El Salvador positioned as a leader in this effort.

“Bukele and I had a great discussion about the opportunities for El Salvador to benefit from and accelerate global Bitcoin adoption,” Saylor posted on X.

Meanwhile, the crypto community speculated about a possible relocation of Strategy’s headquarters to El Salvador, following a similar move by Tether.

However, this scenario remains unlikely, given Strategy’s solid presence in the US, where regulatory developments are showing signs of improvement

Under Bukele’s leadership, the country has become one of the largest sovereign Bitcoin holders, while Strategy remains the biggest corporate investor in BTC.

According to data from the Bitcoin Treasuries, Strategy owns 478,740 BTC, while El Salvador’s national reserve holds 6,079 BTC.