Shares of tech giants Microsoft and Apple fell 4.71 percent and 6.89 percent, respectively, in October.

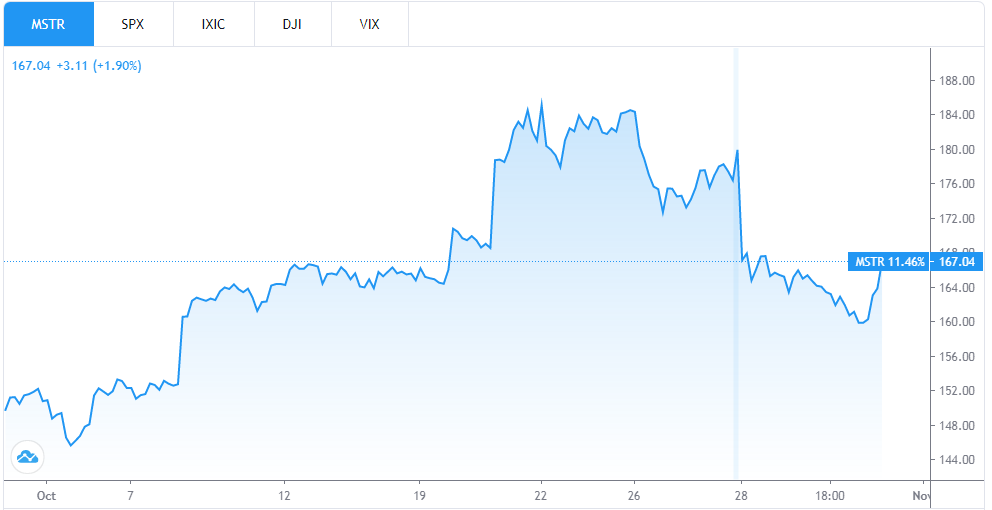

MicroStrategy’s (MSTR) stock rose 11.3 percent over the same period and has climbed alongside the company’s decision to move 75 percent of its cash reserves into leading cryptocurrency bitcoin. Since August, when the company made its first BTC investment, MicroStrategy’s stock has ballooned by more than 35%. Over the same period, Apple’s stock has been flat while Microsoft has declined by 6.4%.

BeInCrypto previously reported that CEO Michael Saylor described his company’s erstwhile cash reserves as a “$500 million melting ice cube.” Following his decision to move $425 million into bitcoin, he then praised bitcoin as a “harder asset than gold.’

MicroStrategy Sitting Pretty

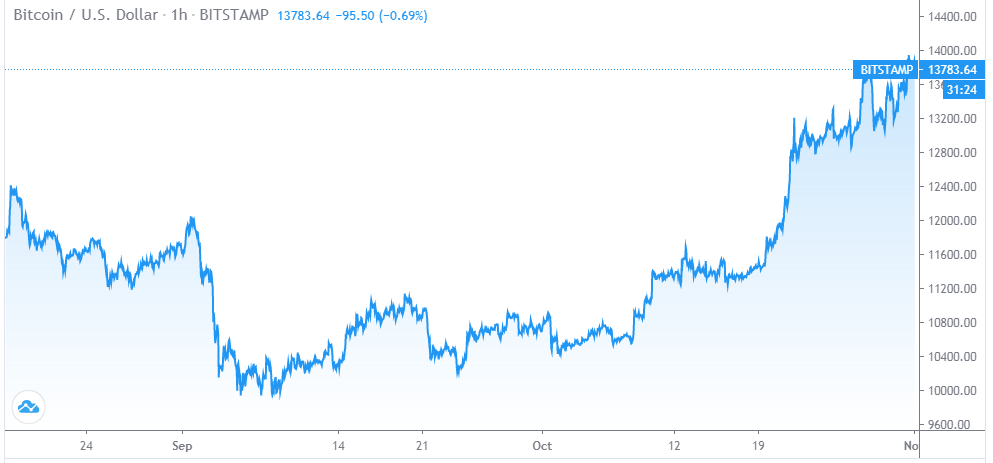

In August and September, Saylor’s company made two purchases of 21,454 BTC and 16,796 BTC at price levels of $10,951 and $10,461, respectively. Bitcoin’s current price stands at $13,965, which means that these purchases are up 27.5 percent and 33.5 percent, respectively. Cumulatively, MicroStrategy’s $425 million purchase is now worth roughly $534 million.

Raoul Pal On MicroStrategy’s Bitcoin Play

Former Goldman Sachs hedge fund manager Raoul Pal is bullish on MicroStrategy’s bitcoin investment. Speaking on the Real Vision Finance platform recently, Pal predicted that tech giants like Microsoft and Apple will follow Saylor’s lead by adding bitcoin holdings to their portfolios inside five years. Pal both referenced and endorsed Saylor’s viewpoint, describing bitcoin as an “incredible” reserve asset that cannot be killed, controlled or inflated due to its decentralization and fixed supply. He said:“In this world of a distributed ledger which is owned by everybody and owned by nobody, there’s almost no chance except you shut down the internet entirely to get rid of bitcoin — it’s impossible. It’s like a cockroach in finance; something you can never kill. That is its power. That is what makes it so incredible. That’s what makes it such a great reserve asset.”

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

David Hundeyin

David is a journalist, writer and broadcaster whose work has appeared on CNN, The Africa Report, The New Yorker Magazine and The Washington Post. His work as a satirist on 'The Other News,' Nigeria's answer to The Daily Show has featured in the New Yorker Magazine and in the Netflix documentary 'Larry Charles' Dangerous World of Comedy.'

In 2018, he was nominated by the US State Department for the 2019 Edward Murrow program for journalists under the International Visitors Leadership...

David is a journalist, writer and broadcaster whose work has appeared on CNN, The Africa Report, The New Yorker Magazine and The Washington Post. His work as a satirist on 'The Other News,' Nigeria's answer to The Daily Show has featured in the New Yorker Magazine and in the Netflix documentary 'Larry Charles' Dangerous World of Comedy.'

In 2018, he was nominated by the US State Department for the 2019 Edward Murrow program for journalists under the International Visitors Leadership...

READ FULL BIO

Sponsored

Sponsored