Strategy (formerly MicroStrategy) just bought 20,356 more Bitcoin, per an announcement from Michael Saylor. This is the company’s largest purchase in over two months, but its stock price has been dropping.

Strategy has been funding these acquisitions through multibillion-dollar stock sales, which are apparently shaking confidence in the company. If Bitcoin’s own price doldrums continue, it could have a severely negative impact on the firm.

Saylor Keeps Buying Bitcoin

Strategy, which recently rebranded from MicroStrategy, has once again extended its lead as one of the world’s largest Bitcoin holders. Earlier today, the firm completed a $2 billion stock offering, and Michael Saylor just announced that the proceeds are being used on Bitcoin acquisitions.

“Strategy has acquired 20,356 BTC for $1.99 billion at $97,514 per bitcoin and has achieved BTC Yield of 6.9% YTD 2025. As of February 23, we hold 499,096 BTC acquired for ~$33.1 billion at ~$66,357 per bitcoin,” Saylor claimed.

Today’s acquisition is the firm’s largest purchase in over two months. Despite the outward bullish appearance, however, some concerns are beginning to surface.

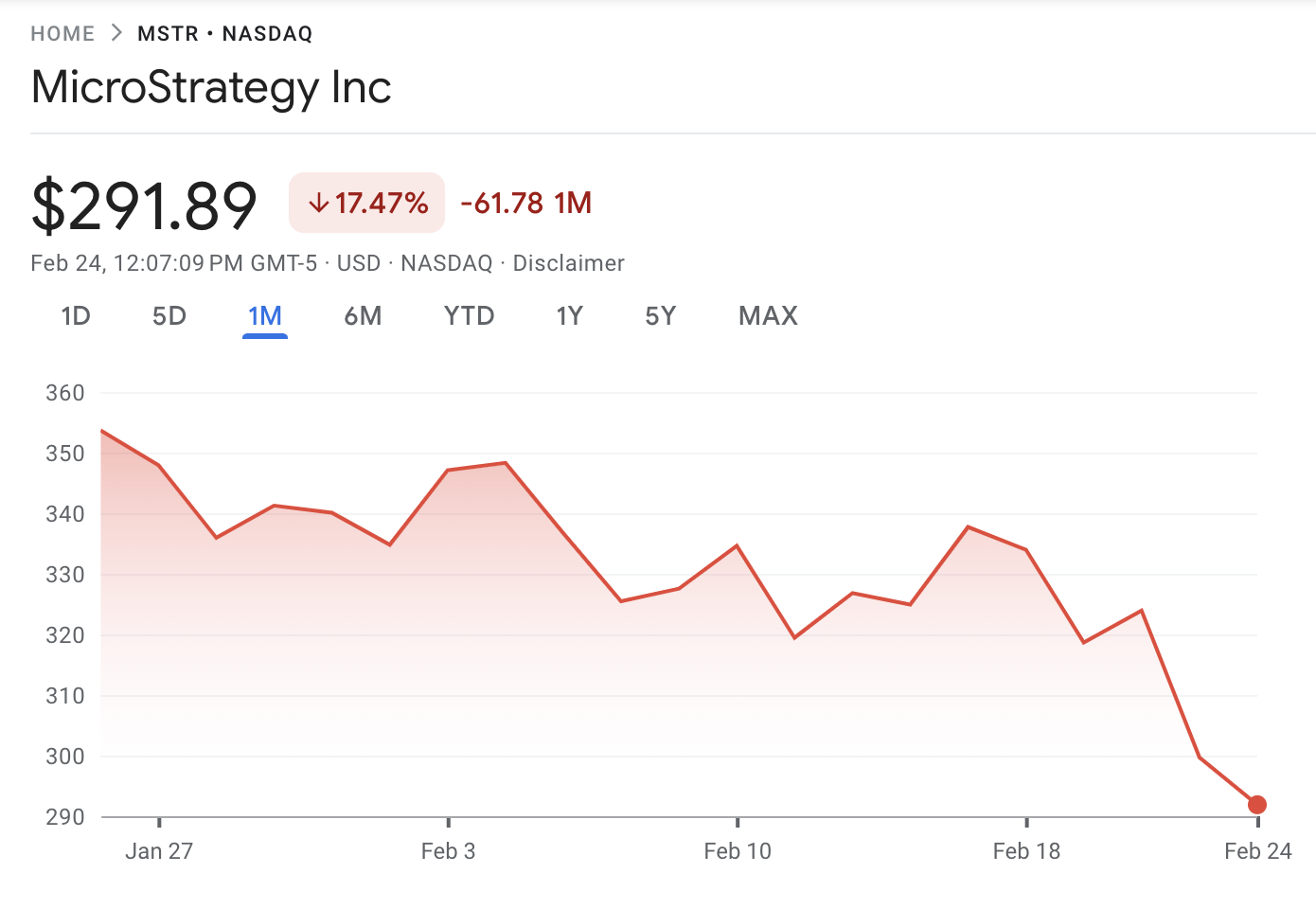

Saylor has continued these massive Bitcoin purchases for months, but there were multiple significant pauses in February. Despite the latest purchase, the company’s stock MSTR has underperformed so far this year.

There are likely a few reasons why MSTR has seen a decline in the stock market. Last year, MicroStrategy’s stock performance showed a clear correlation with Bitcoin’s market growth.

However, Bitcoin’s own price has suffered recently thanks to bearish market conditions, and this hasn’t helped Saylor’s company.

More to the point, these massive stock sales are impacting Strategy itself. For example, the firm carried out another $2 billion sale in January, and today’s sale included another optional offering of up to $300 million.

Strategy also launched a new perpetual security, diversifying its offerings. BlackRock alone holds 5% of the company, a clear signifier of how much stock the firm has sold.

Rumors have been building that these Bitcoin purchases may be creating a tax dilemma, and Saylor seems content to keep plowing ahead with acquisitions.

Overall, Saylor is still looking at the long term. Offloading huge quantities of shares is visibly impacting MSTR. Yet, this could significantly change when Bitcoin enters another bullish cycle.

Previously, BeInCrypto analysts noted that BTC supply on exchanges has plummeted to 2.5 million, which means a supply shock is imminent. MicroStrategy or Strategy’s continued purchases could add to this pressure.