Strategy (formerly MicroStrategy) made its most substantial Bitcoin purchase since November 2024, just a day before Bitcoin’s price dropped below the $90,000 threshold.

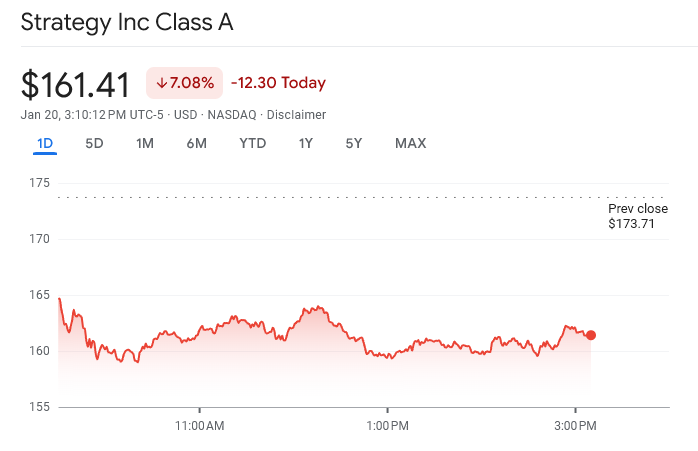

Despite the company’s consistent commitment to its aggressive accumulation playbook, Strategy’s shares dropped by over 7%.

Strategy’s Biggest Bitcoin Buy Since 2024

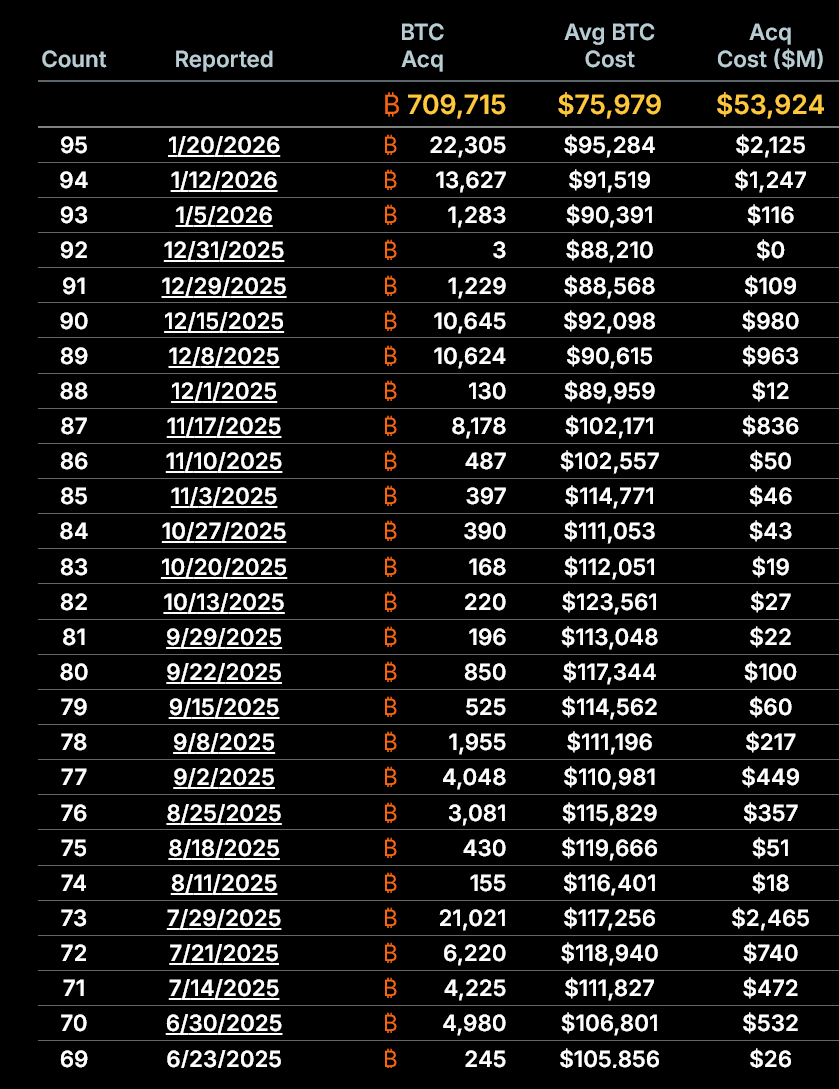

On Tuesday, Strategy announced the acquisition of 22,305 Bitcoin for approximately $2.13 billion, bringing its total Bitcoin holdings to 709,715.

The transaction, which was carried out on Monday, marked Strategy’s largest Bitcoin purchase since November 2024. It also followed two additional acquisitions completed earlier in January, reaffirming the company’s continued commitment to expanding its Bitcoin treasury.

Despite the scale of the latest purchase, market reaction remained muted. Similar to the acquisition announced last Monday, the move failed to bolster investor confidence in Strategy’s long-term outlook.

Over the past 24 hours, the company’s shares declined 7.39%, with MSTR trading at $160.87 at the time of writing.

The company’s approach to timing its Bitcoin purchases has also drawn scrutiny.

Bitcoin Accumulation Continues Despite Market Weakness

According to Monday’s disclosure, Strategy paid an average price of $95,284 per Bitcoin. Yet on the same day, Bitcoin was trading near $92,500 and briefly fell below $90,000 the following day.

The timing highlighted a recurring pattern in which Strategy has failed to capitalize on short-term price declines.

In December, BeInCrypto reported that the company spent nearly $1 billion to acquire 10,624 Bitcoin. Although Bitcoin had dropped to around $86,000 at the time, Strategy executed the purchase after the price rebounded to approximately $90,615.

This approach has raised ongoing questions about the firm’s entry-point strategy and its apparent willingness to accumulate Bitcoin at elevated price levels rather than during market pullbacks.

It has also done little to ease shareholder concerns about its broader capital allocation decisions.

Despite a modest recovery over the past month, Bitcoin has been unable to reclaim the $100,000 level. At the same time, growing analyst concerns about a potential bear market have heightened uncertainty about the asset’s near-term price outlook.

Against this backdrop, Strategy has continued to press ahead with its accumulation plan.

While the approach is intended to signal confidence in Bitcoin’s long-term prospects, it has so far done little to alleviate investors’ short-term concerns.