According to its quarterly financial results, MicroStrategy has increased its bitcoin holdings in Q3 2021 by 8,957 BTC. The company remarked that it will continue to focus heavily on bitcoin as part of its corporate strategy.

MicroStrategy released its financial results for the third quarter of 2021 on Oct 28, revealing that it had increased its total bitcoin holdings by 8,957. At bitcoin’s current price of approximately $61,500, the new addition amounts to $550.85 million.

The company describes two main parts to its corporate strategy, an enterprise analysis business intelligence segment and the acquisition and holding of bitcoin. Concerning the latter, MicroStrategy will focus on acquiring bitcoin through the use of excess cash flows, and debt and equity transactions.

The company’s total revenue stands at $128 million, which is a slight increase year-over-year. Outside of its bitcoin strategy, MicroStrategy finds its demand for enterprise analytics growing.

But the crypto community finds MicroStrategy’s bitcoin focus of more interest. The company notes that the Q3 addition had been purchased at an average price of $46,876 per BTC, at a cost of roughly $420 million. That represents a $110 million profit at the current price.

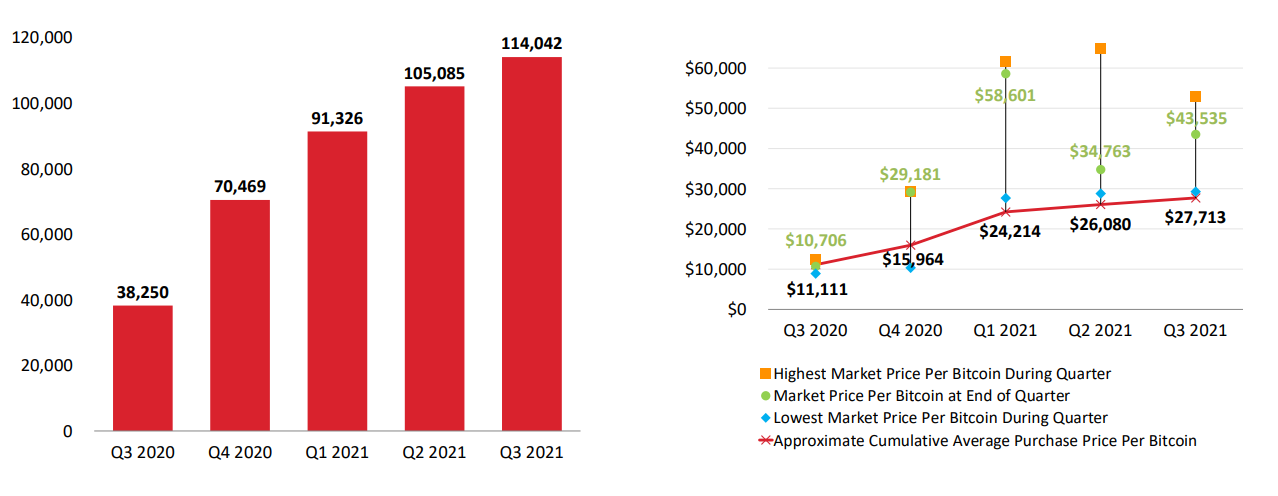

MicroStrategy’s total bitcoin holding stands at 114,042 BTC, which costs $3.2 billion, with a carrying value of $2.4 billion. The market value of the holdings, however, amounts to approximately $5 billion. Thus, it represents cumulative impairment charges of $755 million.

Additionally, MicroStrategy will aim to provide leadership among the bitcoin community. It is already doing this to a certain degree, with CEO Michael Saylor particularly focused on encouraging green energy solutions for bitcoin mining.

MicroStrategy among the leading bitcoin investing companies

MicroStrategy was once dismissive of bitcoin, but that has all changed in the past two years. The firm is among the strongest established businesses to be championing the asset, with its relationship with bitcoin quite profound. To put the conviction in context, the bitcoin holdings have almost tripled since Q3 2020, increasing from 38,250 to the current 114,042.

During the earnings conference call, Saylor doubled down on the company’s bitcoin strategy, calling it a great long-term investment. He also pointed to Square’s Cash App and the tipping feature on Twitter as examples of how bitcoin will impact end-users.

Besides buying bitcoin consistently, Saylor is also part of the Bitcoin Mining Council, a committee dedicated to improving the sustainability of the practice. It’s evident that MicroStrategy is not going to back away from the asset, which Saylor sees as being better than gold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.