MicroStrategy chief Michael J. Saylor took to Twitter today to confirm that the company has acquired a loan to acquire more Bitcoins.

As per the release, Silvergate Bank issued a $205 million interest-only term loan to MacroStrategy LLC, a subsidiary of MicroStrategy. Which essentially is a Bitcoin-collateralized loan to acquire more Bitcoin.

This means the loan is secured by certain Bitcoin held in MacroStrategy’s collateral account with a custodian mutually authorized by Silvergate and MacroStrategy.

The value of the collateral is approximately $820 million worth of Bitcoin for the non-guaranteed loan, as per notification to the stock exchange.

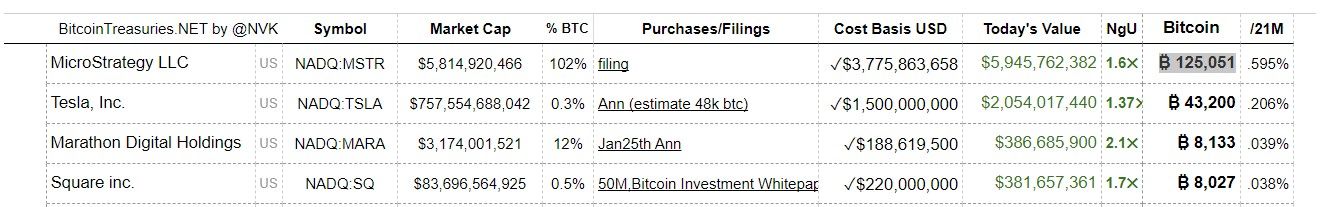

What is worth noting is that MicroStrategy is already the largest public company to hold over 0.5% of the total Bitcoin supply at 125,051 tokens. Bitcoin makes 102% of MicroStrategy’s total market cap at the time of writing, as per estimates by Bitcoin Treasuries.

With the new loan, MacroStrategy plans to not only purchase more Bitcoins, but it will also use the funds to pay fees and interest related to loan transactions and other corporate purposes of the two entities.

Saylor said, “The SEN Leverage loan gives us an opportunity to further our position as the leading public company investor in bitcoin,”

Further, adding that the company will be using the capital to turn Bitcoin into a productive collateral for the business. Such an arrangement comes under the Credit and Security Agreement of the SEC. The securities’ regulator has specified on its website that the loan matures on March 23, 2025, and bears interest at a floating rate.

Alan Lane, Chief Executive Officer of Silvergate commented, “We’re thrilled to add MicroStrategy to our growing list of SEN Leverage borrowers. Their innovative approach to treasury management is an exceptional example of how institutions can utilize their bitcoin to support and grow their business.”

Having said that, Saylor has long been a strong proponent of Bitcoin.

However, his accumulation of Bitcoin is not without critics. Crypto commentator Mr.Whale had alleged last year that the company led by him is “dumping” the holdings to a “shady LLC”.

What do you think about this subject? Write to us and tell us!