Bitcoin markets have held on to their gains so far into the new year. However, some of the bigger players in the industry could be selling related stocks, which suggests a higher potential for a market correction.

According to a January 2 filing with the US Securities and Exchange Commission, MicroStrategy executive chairman Michael Saylor has started selling company stock. However, he has previously said that proceeds from the sales would go towards buying more Bitcoin.

Saylor Exercising Stock Options

Michael Saylor has engaged with the regulator to exercise MicroStrategy stock options. According to the filing, he will sell 315,000 shares worth around $216 million.

In a fourth-quarter conference call, Saylor explained that he was granted a stock option in 2014 for 400,000 shares. This will expire in April if he doesn’t exercise it by then, he added.

“For almost a decade now, at my request, the company has only paid me a $1 salary and I have chosen not to be eligible for any cash bonuses,”

Exercising this option will enable him to address financial obligations “as well as to acquire additional Bitcoin for my personal account,” he said.

Saylor will sell 5,000 shares each trading day beginning on January 2 and ending on April 25. He said he would still have a “very significant” equity stake in the company even after the sales.

In late December, Saylor said the potential approval of a spot Bitcoin ETF may be the biggest Wall Street development in 30 years.

Read more: Empower your investments with BTC price predictions

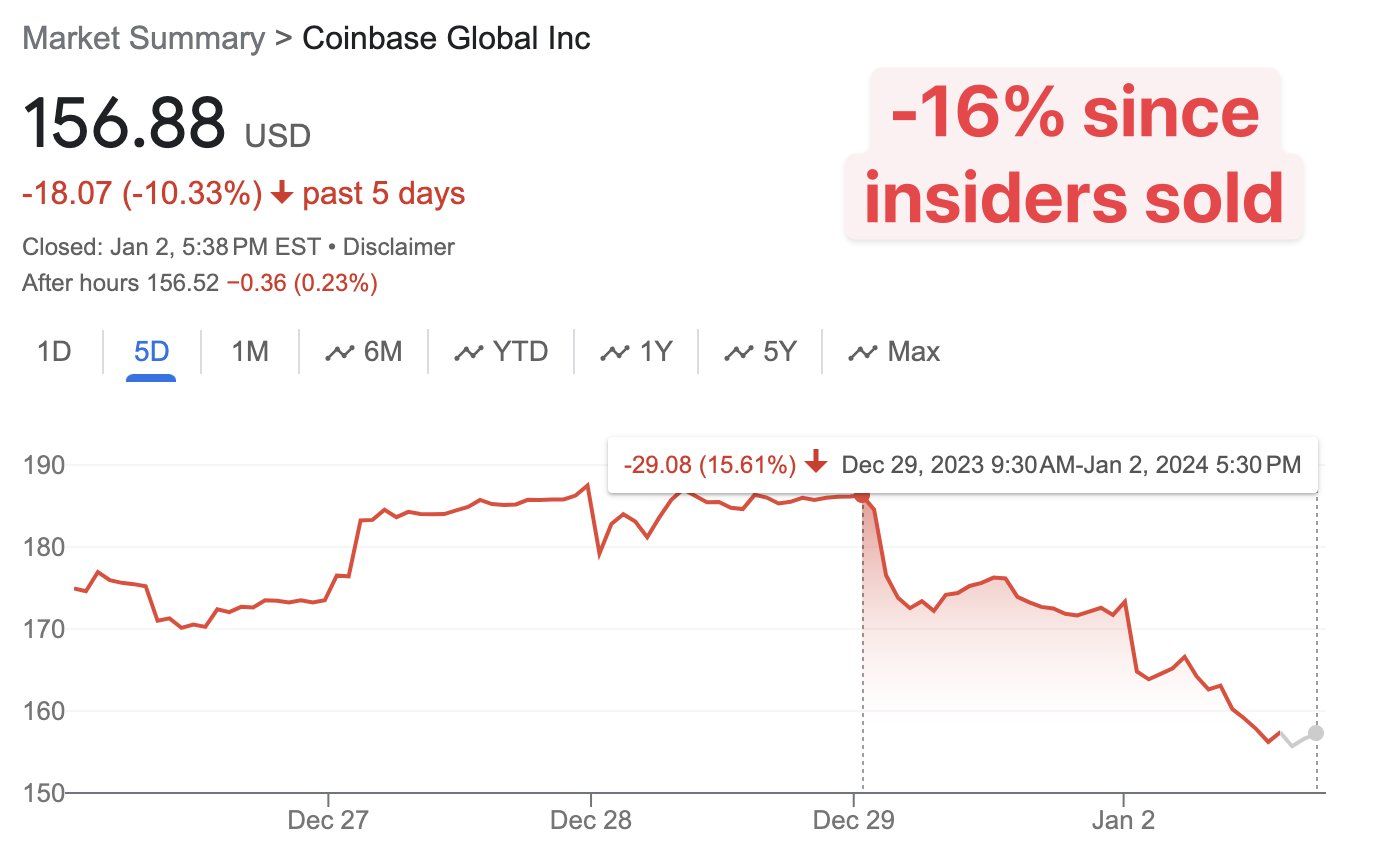

According to “Insider Tracker,” which tracks the stock trades of CEOs, executives, and congress members, Coinbase insiders have also been offloading company stock.

Furthermore, COIN prices have dropped 16% since the sales began, it reported. It has declined 10% since the beginning of trading this year, falling to $157 after hours on January 2.

Stock Cooldown Predicted

Moreover, investment strategists are predicting a stock market cooldown

“It’s not uncommon for markets to pause to digest a bull run of the magnitude experienced in the fourth quarter just ended,” John Stoltzfus, chief investment strategist and managing director at Oppenheimer, wrote in a note to clients on January 2.

A correction in US stock markets is likely to be mirrored by crypto markets. However, they have remained flat on the day at $1.81 trillion, with BTC holding steady at $45,216 at the time of writing.

Additionally, several technical indicators, including the Puell Multiple, have signaled over-bought conditions, which could be a sign of a pullback.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.