Metaplanet Inc. boosted its Bitcoin reserves to 18,113 BTC following the purchase of 518 more in August 2025, bringing its total investment close to $1.85 billion. The Tokyo-listed firm’s accelerating treasury strategy cements its status among the world’s significant public Bitcoin holders.

Since adopting Bitcoin as a core business in December 2024, Metaplanet has aggressively expanded both its holdings and ambitions. Recent regulatory filings and financial presentations demonstrate rapid buying, new performance metrics, and a dynamic approach to capital markets funding.

Metaplanet Acquires Additional BTC

In August 2025, Metaplanet’s acquisition of 518 Bitcoin for roughly 9.1 billion yen marked a notable leap. This latest move raised its total to 18,113 BTC. As outlined in the official disclosure, the company is now firmly among the most prominent corporate Bitcoin treasury holders globally. Its aggregate purchase cost totals 270.364 billion yen ($1.85 billion), averaging about 14.9 million yen ($100,000) per Bitcoin.

Metaplanet’s announcement also introduced innovation in performance tracking. Instead of emphasizing only traditional metrics, the company deploys a unique KPI called “BTC Yield,” which measures total Bitcoin holdings relative to fully diluted shares over time. According to filings, BTC Yield soared to 309.8% in Q4 2024, recorded 129.4% in Q2 2025, and registered 26.5% between July and August 2025.

“BTC Yield is a key performance indicator (KPI) that reflects the percentage change in the ratio of Total Bitcoin Holdings to Fully Diluted Shares Outstanding over a given period. The Company uses BTC Yield to assess the performance of its Bitcoin acquisition strategy, which is intended to be accretive to shareholders,” Metaplanet stated.

This method reflects Metaplanet’s intensified focus—since December 2024, Bitcoin treasury operations have become a central business activity, and the pace of acquisition has accelerated.

Metaplanet Maintains Its 6th Position

Metaplanet funds its multi-billion-yen Bitcoin purchases primarily through capital markets. The company raises cash by issuing shares and bonds, a strategy detailed in financial reports and benchmark equity research. Official presentations chart Metaplanet’s journey from holding zero Bitcoin at the start of 2024 to 1,762 by fiscal year-end.

Furthermore, equity research traces Metaplanet’s escalation from 141 BTC in mid-2024 to 12,345 by June 2025, culminating at 18,113 in August. The report details more ambitious targets, including the goal of reaching 100,000 BTC by the close of 2025. Public statements and official filings highlight clear, goal-oriented messaging.

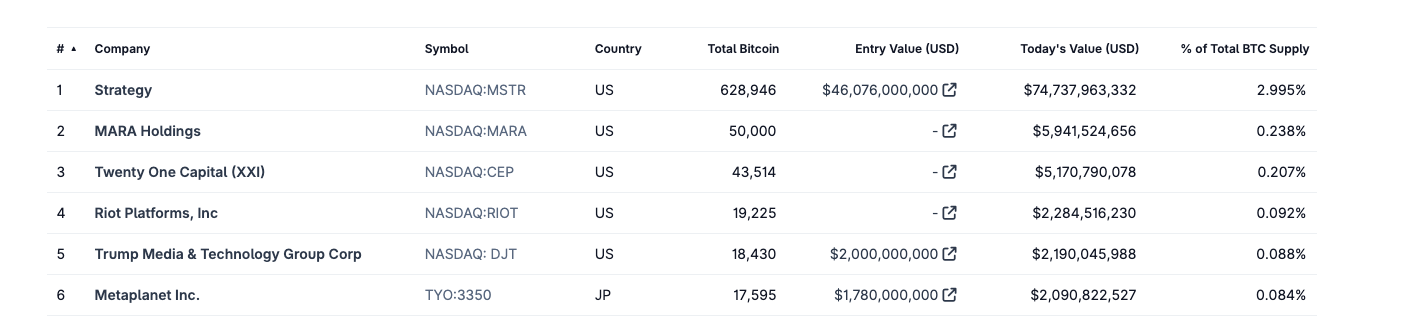

After the current purchase, Metaplanet still maintains its position as the sixth-largest publicly traded Bitcoin holding company. There is a very narrow gap between Trump Media & Technology Group Corp and Metaplanet for the 5th position.

Bitcoin Holdings by Public Companies. Source: CoinGecko

Strategy (MicroStrategy) maintains its top position with 628,946 BTC, which are worth $74 billion, based on the current market price. On Monday, Michael Saylor announced the purchase of 155 new BTC for roughly $18 million.