Metaplanet, often referred to as Asia’s (Micro) Strategy, has officially entered the ranks of the top 5 public companies with the largest Bitcoin (BTC) holdings.

The company announced today that it added 1,005 BTC to its holdings, bringing the total to 13,350 BTC.

Metaplanet Buys 1,005 Bitcoin

Metaplanet CEO Simon Gerovich shared that the company spent around $108.1 million (15.6 billion yen) to complete its Bitcoin purchase. Each coin was acquired at an average price of $107,601 (15.5 million yen).

As of the latest data, the firm holds 13,350 Bitcoin. The average acquisition cost stands at $97,832 per Bitcoin, totaling an investment of about $1.31 billion.

Moreover, Metaplanet’s Bitcoin holdings have not only grown in size but also delivered strong returns. The firm reported a Bitcoin yield of 129.4% in the second quarter. So far this year, the company has achieved a Bitcoin yield of 348.8%.

With over 13,000 BTC, Metaplanet has surpassed CleanSpark and Galaxy Digital Holdings, securing its position as the fifth-largest publicly traded Bitcoin holder. Notably, the rise to the top was quite swift.

Earlier this month, BeInCrypto reported that the firm officially secured the number 10 spot among public companies with Bitcoin treasuries. Metaplanet continued its Bitcoin purchases, and its holdings exceeded Coinbase’s by mid-month. Most recently, the firm overtook Tesla and Hut8, thanks to a 1,234 BTC purchase last week.

“Just 3 months ago, we announced live at our shareholder meeting that we hit 3,350 BTC — and now we’ve added 10,000 more to reach 13,350 BTC,” Gerovich posted.

The CEO also affirmed Metaplanet’s commitment to growing its Bitcoin treasury. Coinciding with the latest purchase announcement, the firm announced the issuance of its 19th Series of Ordinary Bonds, totaling approximately $207 million (30 billion yen).

The funds raised from these bonds will be partly used to buy back and cancel the company’s 3rd Series of Ordinary Bonds. The remaining capital will be allocated toward further Bitcoin acquisitions. The new bonds bear no interest and will mature on December 29, 2025.

This aligns with the company’s strategic focus on expanding its Bitcoin holdings to 30,000 by 2025 and to 210,000 Bitcoin by 2027.

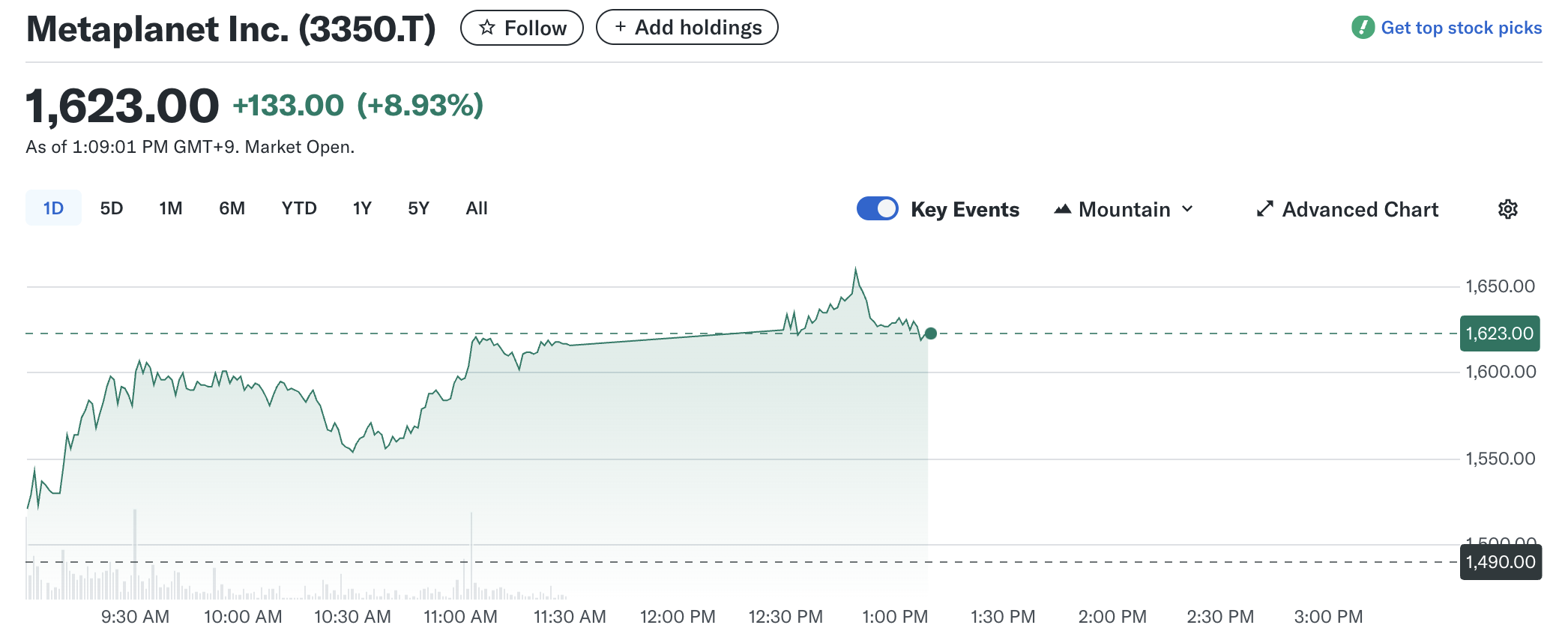

Meanwhile, Metaplanet’s stock, 3350.T, also benefited from its latest moves. According to Yahoo Finance Data, stock prices were up 8.9% at the time of this writing. Year-to-date, the 3350.T’s value has appreciated over 350%.

This surge reflected investor confidence in the company’s Bitcoin-centric approach, which has delivered notable financial results in Q1 2025.