Meme coins are starting February with renewed momentum as speculative appetite returns across the market. Fresh launches, strong community growth, and aggressive price action are putting select tokens in the spotlight.

BeInCrypto has analysed three such meme coins for investors to keep an eye on during the first week of February.

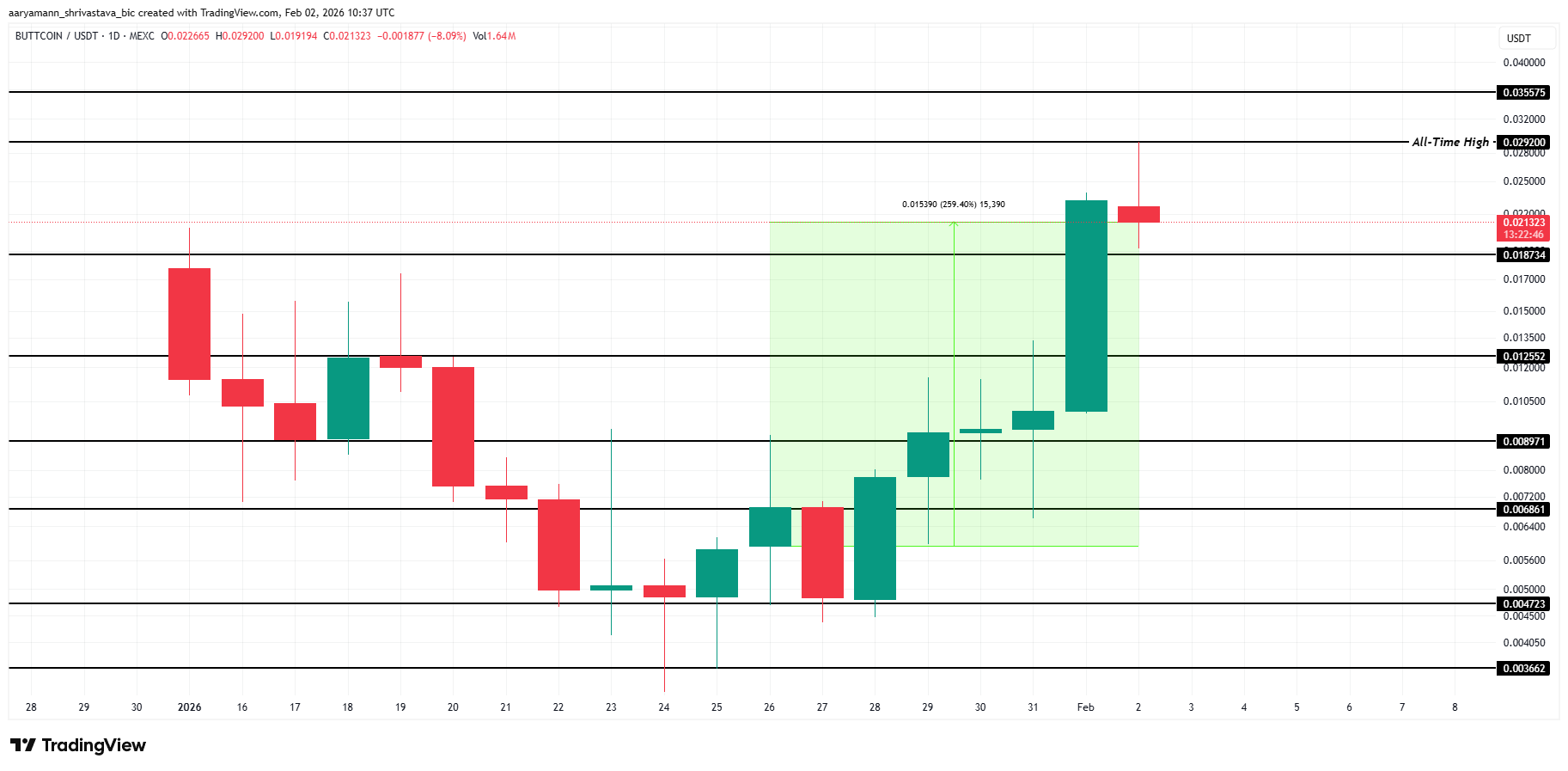

Buttcoin (BUTTCOIN)

BUTTCOIN emerged as one of the top-performing meme coins this week, drawing strong speculative interest. The newly launched token has already attracted more than 10,000 holders. At the time of writing, BUTTCOIN is trading near $0.0213, reflecting rapid adoption and heightened short-term demand.

The meme coin surged 259% over the past seven days, setting a new all-time high at $0.0292. With price discovery still underway, BUTTCOIN faces limited technical resistance. This structure supports continued upside, as momentum-driven traders often push prices higher during early expansion phases.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk centers on profit-taking behavior. Early investors may choose to lock in gains after the sharp rally. If selling pressure increases, BUTTCOIN could fall below the $0.0187 support. A deeper pullback toward $0.0125 would invalidate the bullish thesis and signal momentum exhaustion.

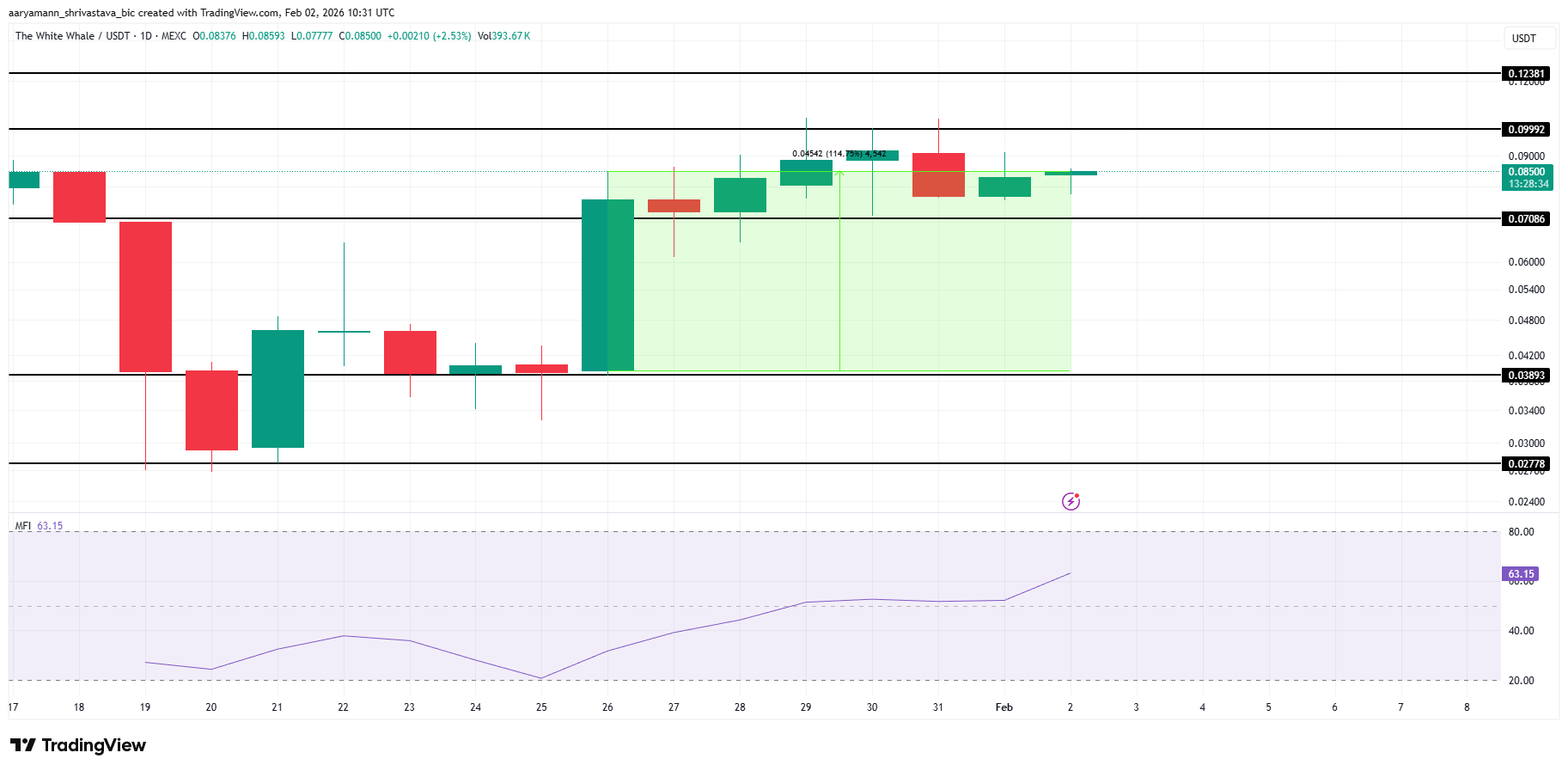

The White Whale (WHITEWHALE)

WHITEWHALE has emerged as a leading small-cap meme coin, rising 114% over the past week despite recent controversy. The token is consolidating after the surge, trading in a range between $0.099 and $0.070. This pause reflects cooling momentum following aggressive speculative inflows.

The consolidation phase may signal a reset rather than exhaustion. The Money Flow Index remains elevated, indicating buying pressure is still strong. Sustained demand could allow WHITEWHALE to break above $0.099.

A confirmed breakout would open a path toward $0.123 and potentially higher levels.

Downside risk remains if sentiment shifts. Should buying pressure fade and selling accelerate, WHITEWHALE could lose the $0.070 support. A breakdown would expose lower targets near $0.048 or even $0.038. Such a move would invalidate the bullish thesis and extend the correction.

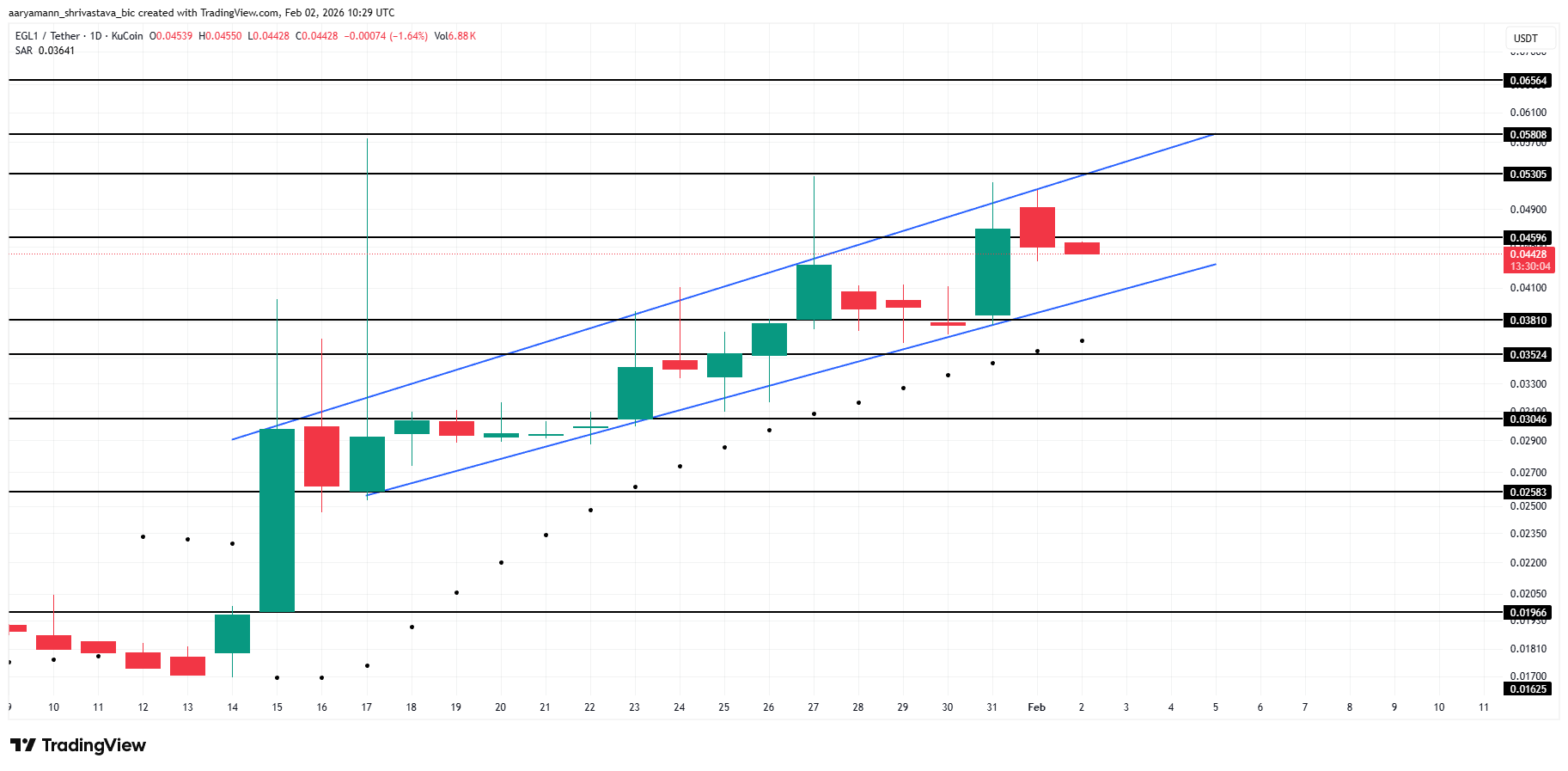

EGL1 (EGL1)

EGL1 has remained in a steady uptrend for the past three weeks, trading near $0.044 at the time of writing. The meme coin is supported by more than 55,000 holders. This expanding holder base has helped sustain demand and reinforces EGL1’s continued upward momentum.

Trend indicators favor further upside. The Parabolic SAR remains positioned below the price, confirming the prevailing uptrend. This signal suggests bullish momentum still has room to run. If buying pressure holds, EGL1 could extend gains and attempt a move toward the $0.053 level in the near term.

Caution is warranted despite the bullish structure. An ascending wedge is forming on the chart, a pattern often linked to reversals. If EGL1 breaks below the $0.038 support, selling pressure may accelerate. A drop toward $0.030 would confirm the bearish breakdown and invalidate the bullish thesis.