The first presidential debate between Vice President Kamala Harris and former President Donald Trump ended with zero mention of cryptocurrencies. This left many crypto enthusiasts disappointed.

As a result, the crypto market reacted sharply, particularly affecting meme coins associated with Donald Trump.

Odds of Donald Trump Winning the Election Decrease After the Debate

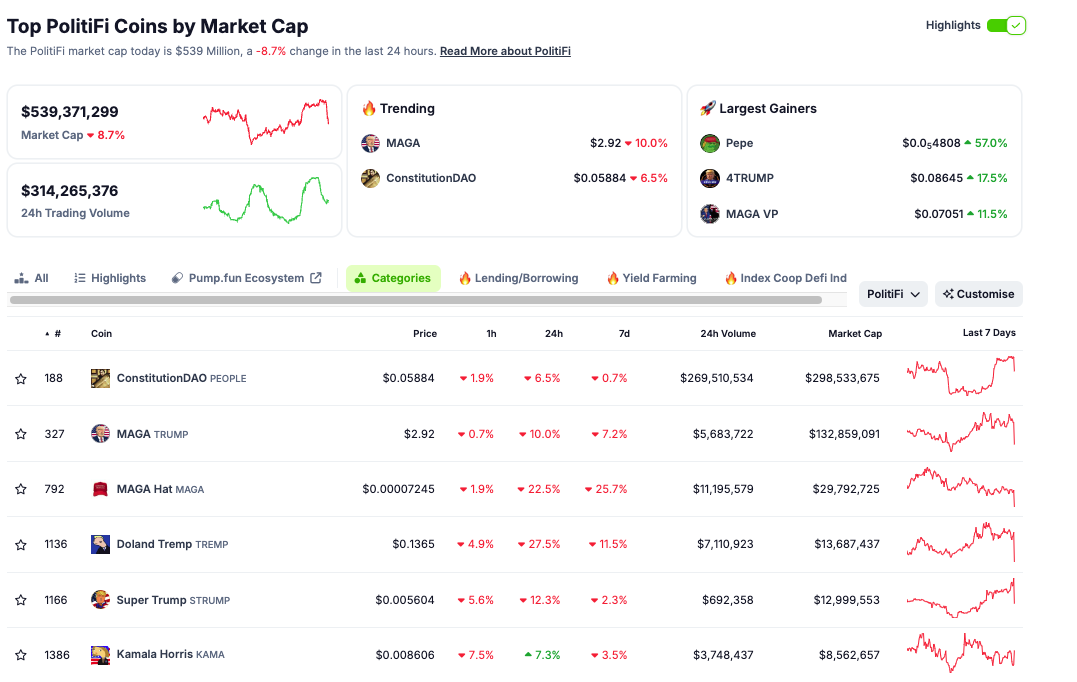

In the aftermath of the debate, which focused on the economy, immigration, and foreign policy, several Trump-themed meme coins witnessed significant declines. For instance, the total market capitalization of PolitiFi meme coins fell by 8.7%.

Specific coins suffered even more; MAGA (TRUMP) dropped by 10.0%, and MAGA Hat (MAGA) plummeted by 22.5%. Doland Tremp (TREMP) saw a decline of 27.5%, while Super Trump (STRUMP) decreased by 12.3%. On the other hand, the Kamala Horris (KAMA) meme coin surged by 7.3%.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

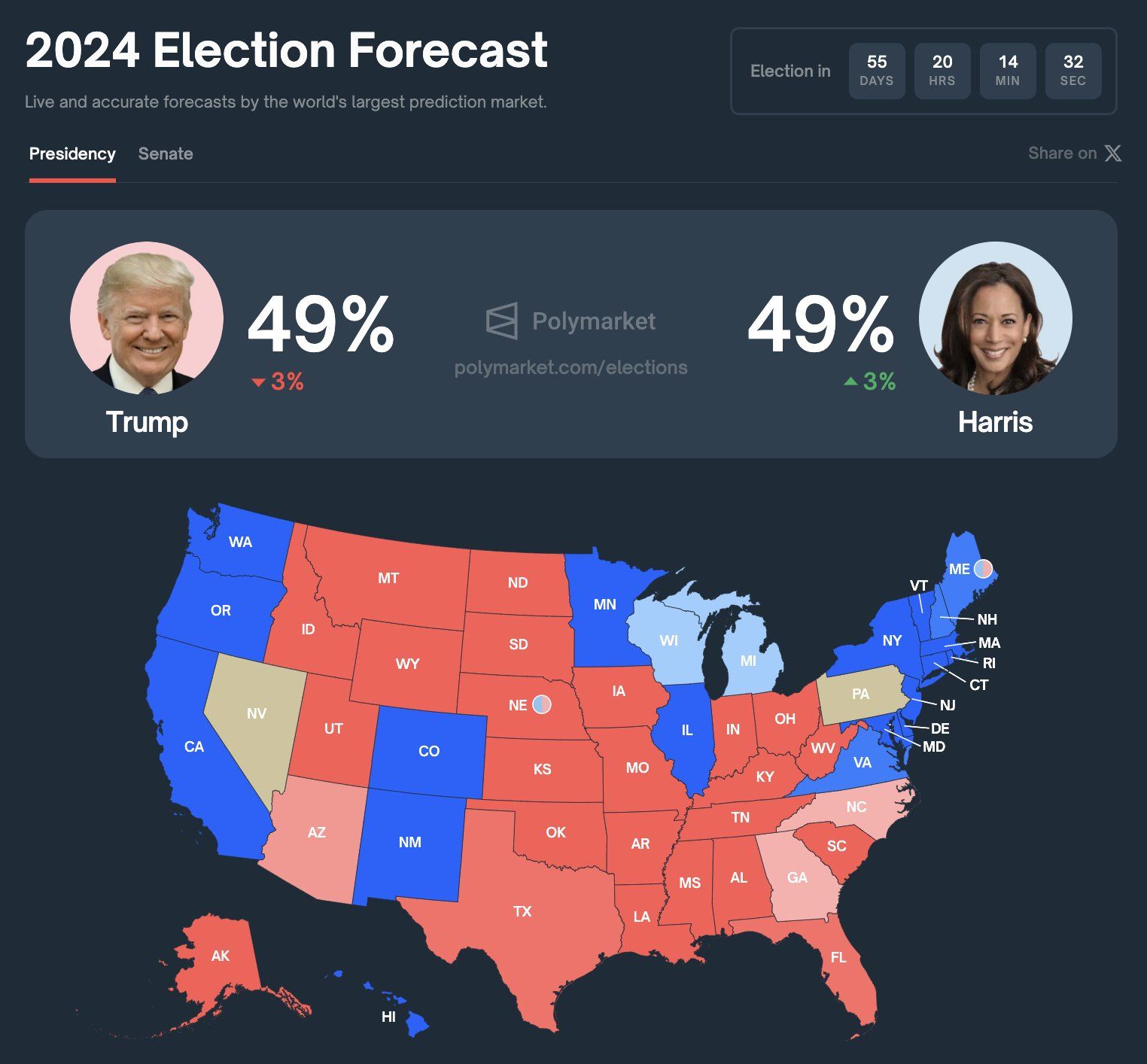

This fluctuation in meme coin values aligns with shifts in election odds on platforms like Polymarket. After the debate, Harris’s odds of winning increased by 3%, whereas Trump’s decreased by the same amount.

Consequently, the two presidential hopefuls are now neck and neck on this decentralized betting platform.

Analysts have long debated the influence of political figures on the cryptocurrency market. For instance, Bernstein analysts predicted that a Trump victory in November could propel Bitcoin to as high as $90,000 by year-end.

This expectation stems from Trump’s pro-crypto stance. In contrast, the crypto market’s outlook under a Harris presidency remains uncertain, with some analysts fearing Bitcoin could drop to as low as $40,000.

Moreover, the crypto industry has made substantial political investments. Crypto companies, including Coinbase and Ripple, have invested over $119 million in the 2024 elections. Their objective is to support candidates who favor clear crypto regulations.

The largest beneficiary of these contributions is Fairshake PAC, receiving $202.9 million, with $107.9 million—over half—coming from crypto corporations like Coinbase and Ripple.

Since 2010, crypto corporations have become major political donors, contributing $129 million and accounting for 15% of all known corporate political expenditures, which total $884 million. Their financial influence is second only to the fossil fuel industry’s election spending.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Despite heavy investment to support pro-crypto candidates, the absence of cryptocurrency discussions during presidential debates has disappointed many in the crypto community.

“1 in 5 American adults own crypto. And yet it hasn’t been mentioned in the Presidential debates as an issue voters care about. If you love crypto, make sure your voice is heard this November and pledge to vote,” Coinbase stated.