Meme coins often mirror the emotional extremes of market cycles, whether bullish or bearish. However, according to prominent analyst Murad Mahmudov, the success of these projects hinges significantly on their community support.

Currently, the market capitalization of meme coins shows a modest increase of 0.1%, standing at $41.48 billion. Leading this sector are Dogecoin, Shiba Inu, Pepe, Dogwifhat, Bonk, and Floki, each enjoying a strong and loyal following.

Community Accounts for 70% of Meme Coin Project Success

Meme coins, like memes themselves, have unpredictable lifespans and attract speculative investors, often referred to as “Degens.” These investors seek rapid profits, quickly selling off their assets and moving on to the next trend or narrative.

According to Mahmudov, the aesthetics and ticker symbol play crucial roles in a project’s development. He notes that the meme itself only contributes about 30% to a coin’s success. The remaining 70% hinges on the strength of its community. Without an active and engaged following, even the most cleverly designed meme coin is likely to fade into obscurity.

“When you’re buying Memecoins you are, first and foremost, betting on People,” he wrote.

Read more: What Are Meme Coins?

Meme coins have recorded a meteoric rise in the crypto arena, fueled by whimsical branding, viral marketing, and passionate online communities. These factors have captivated retail investors, who are drawn to the blend of humor and speculative opportunity.

Despite their lighthearted image, the success of meme coins hinges on a crucial balance between community engagement and solid project fundamentals. Whether driven by savvy investors or enthusiastic supporters, the community remains the most critical asset for these projects.

“Meme Popularity” doesn’t immediately translate to “Memecoin Market Cap”; otherwise, Wojak, Skibidi, and Hammy would be trading in the Billions already. It’s clearly more complicated than that. Meme Popularity is just one of ~50 factors to consider,” the analyst added.

Indeed, the collective belief of community members, their efforts to promote the coin, and their defense against skeptics create a strong sense of unity and momentum, which are vital for a coin’s success.

Crypto executive Justin Sun highlights the importance of capturing public attention but places even greater value on genuine community engagement. He looks beyond follower counts, focusing on the depth of interaction and support before making investment decisions.

“I will check on the real social engagement. Are those likes real, or it’s just general bullshit? Do they have lots of influence, and the people really believe them? Also, I will see the founders, see their material, and see the memes they made and the videos they made. I will see if this is the right video and the right social engagement,” Sun elaborated during a discussion on the Crypto Banter YouTube channel.

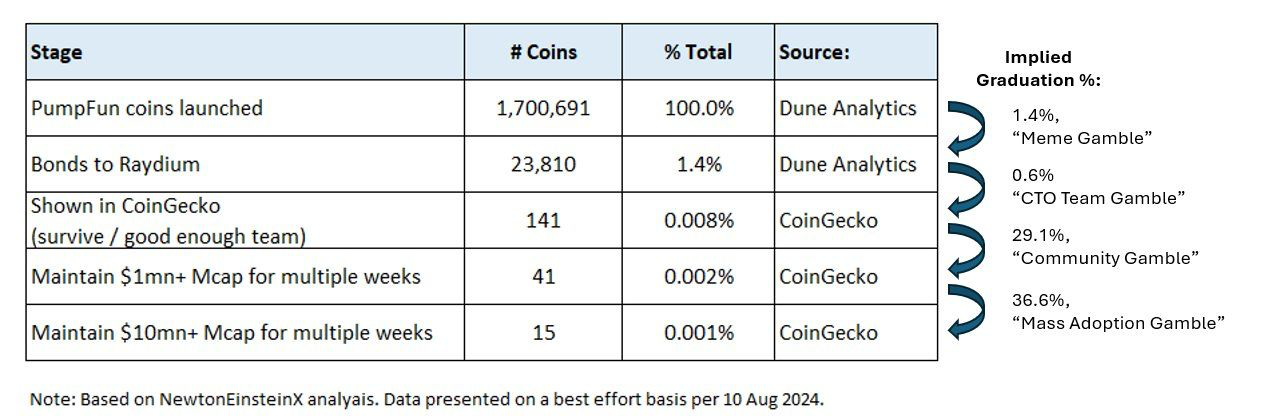

Many projects in this sector fail due to weak or non-existent community support. According to BeInCrypto, a mere 15 out of 1.7 million meme coins succeed, translating to a success rate of just 0.0001%.

As Mahmudov stresses out the importance of community, the crypto market remains divided between Tron’s SunPump and Solana’s Pump.fun. Although SunPump entered the market recently, it quickly outpaced competitors like Moonshot, which rivaled Pump.fun.

Read more: 7 Hot Meme Coins and Altcoins that are Trending in 2024

However, the sector grapples with a persistent issue: rug pulls and scam tokens. These practices, where creators withdraw funds and abandon investors, continue to create unease, further eroding trust in the crypto industry.