Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read how corporate players are rewriting the Bitcoin (BTC) playbook in real time. As traditional finance (TradFi) norms unravel, bold strategies are emerging to reshape corporate balance sheets and redefine what it means to go all in on digital assets, regardless of risk or reward.

Crypto News of the Day: Strategy Rips Up Rulebook on Path to 1 Million Bitcoin, Says Max Keiser

Strategy, now MicroStrategy, recently revealed a new offering called STRC, or “Stretch.” Marketed as a perpetual preferred stock with an initial 9% dividend, the product is explicitly designed to support the company’s goal of accumulating more Bitcoin.

Michael Saylor, executive chairman of Strategy, announced the IPO via X (Twitter), calling it a new lever for Bitcoin accumulation.

Strategy’s post echoed the same language, reaffirming that net proceeds will go toward general corporate purposes, including acquiring Bitcoin.

That mission, however, was punctuated more dramatically in an exclusive comment to BeInCrypto by Bitcoin evangelist Max Keiser.

“Strategy is committed to 1 million Bitcoin by any means necessary. They’re tearing up the corporate finance rule book and charging hell-bent for leather to the 1 million Bitcoin promised land,” Keiser told BeInCrypto.

Morgan Stanley, Barclays, Moelis & Co., and TD Securities are joint bookrunners, signaling strong institutional coordination.

However, Keiser’s comment cuts through the finance speak, articulating that MicroStrategy does not want more Bitcoin. Rather, it wants all the Bitcoin.

This aggressive tone is consistent with Strategy’s decade-long shift from an enterprise software firm to a Bitcoin holding company.

Meanwhile, even as the firm progressively pivots to BTC, analysts say the firm could trigger a Bitcoin cascade worse than Mt. Gox or Three Arrows Capital.

MARA Raises $850 Million to Double Down on Bitcoin

MARA Holdings, the world’s largest public Bitcoin miner, is joining the Bitcoin accumulation wave. The firm revealed a $850 million private offering of convertible senior notes due in 2032.

The move signals continued strategic conviction in Bitcoin as a treasury reserve and a core asset in the company’s business model. The offering consists of 0.00% convertible senior notes, with an option for initial purchasers to buy an additional $150 million.

Redemption terms kick in from January 2030, and the company has embedded multiple mechanisms to manage dilution.

MARA intends to use the bulk of the proceeds to buy additional Bitcoin and fund general corporate purposes. This raise highlights MARA’s role as a miner and digital asset treasury operator.

Like Strategy, MARA is positioning itself to amass more Bitcoin while fortifying its balance sheet against future market disruptions.

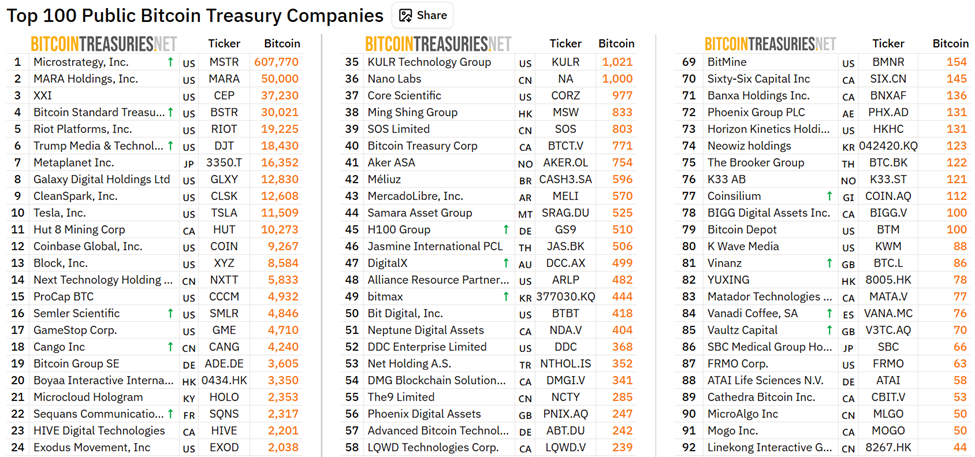

Data on Bitcoin Treasuries shows MARA is a distant second among public corporate holders of BTC, holding 50,000 tokens.

Meanwhile, as of this writing, MicroStrategy is the largest holder, with a 607,770 portfolio valued at $71.80 billion.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Tether expands beyond stablecoins as profit fuels 120+ investments.

- 21Shares seeks SEC nod to launch Ondo ETF.

- Bitwise sees a $20 billion institutional surge ahead for Ethereum.

- Solana rises 20% in a week, but an analyst warns of a LUNA-like breakdown ahead.

- Wall Street is set to benefit as in-kind crypto ETF redemptions gain momentum.

- Coinbase teases 3 new altcoin listings, market reacts with price jumps.

- Public companies’ Bitcoin bet: Can they weather the bear market storm?

- BNB price hits new all-time high; 2021 pattern signals altcoin season is imminent.

- Should investors buy low-cap altcoins in Q3 2025? Analysts weigh in.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 22 | Pre-Market Overview |

| Strategy (MSTR) | $426.40 | $425.74 (-0.15%) |

| Coinbase Global (COIN) | $404.44 | $405.50 (+0.26%) |

| Galaxy Digital Holdings (GLXY) | $29.11 | $29.90 (+2.71%) |

| MARA Holdings (MARA) | $19.88 | $18.86 (-5.33%) |

| Riot Platforms (RIOT) | $14.27 | $14.13 (-0.98%) |

| Core Scientific (CORZ) | $13.48 | $13.60 (+0.89%) |