The value of MATIC, the native token that powers leading Layer-2 (L2) solutions provider Polygon, has experienced a large drop in the last week. During Monday’s general market decline, the altcoin’s value plummeted to a two-year low of $0.34.

While it has regained by over 10%, MATIC trades at a price level last observed in June 2022.

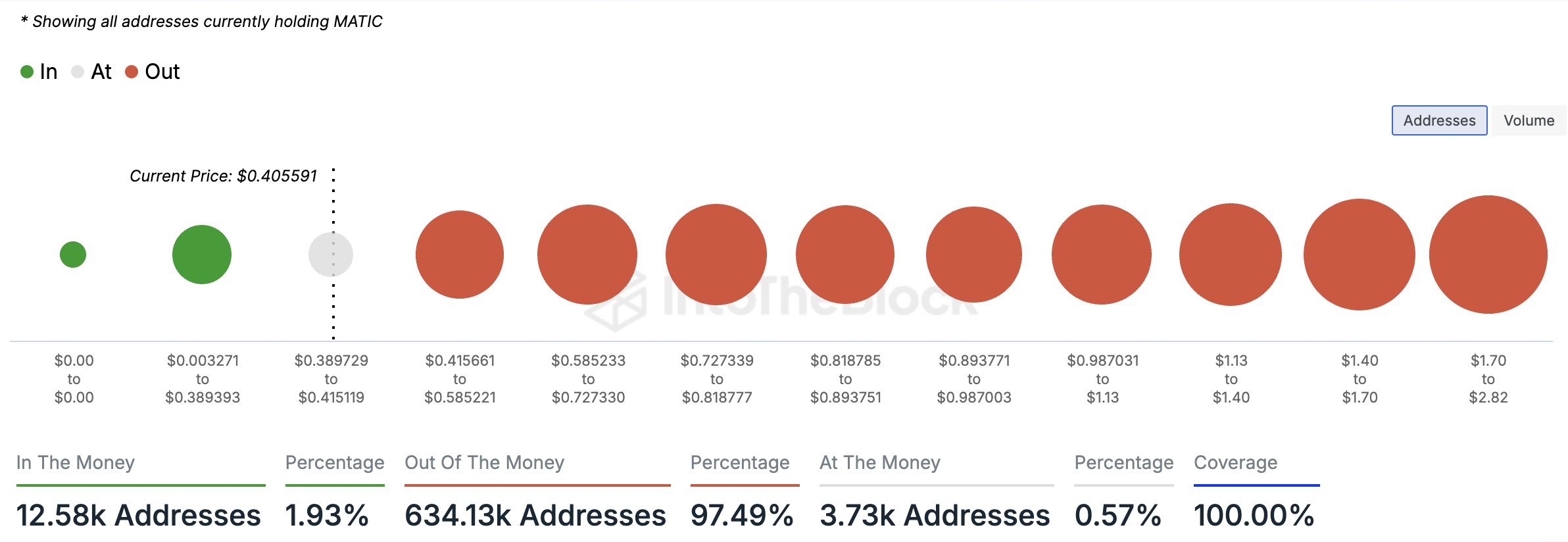

Only 2% of Polygon Holders Are “In the Money”

Due to MATIC’s price troubles, many of its holders sit on unrealized losses. An assessment of the token’s financial statistics reveals that only 13,000 addresses, comprising 2% of the altcoin’s total holders, are “in the money.”

According to on-chain data provider IntoTheBlock, a wallet address is considered “in the money” when the current price of the asset held is higher than its average purchase price. If such an address decides to sell, it may record a profit.

Conversely, 643,130 addresses, representing over 97% of its total holders, are “out of the money.” An address is considered out of the money if an asset’s current market price is lower than the average cost at which the address purchased the tokens it currently holds.

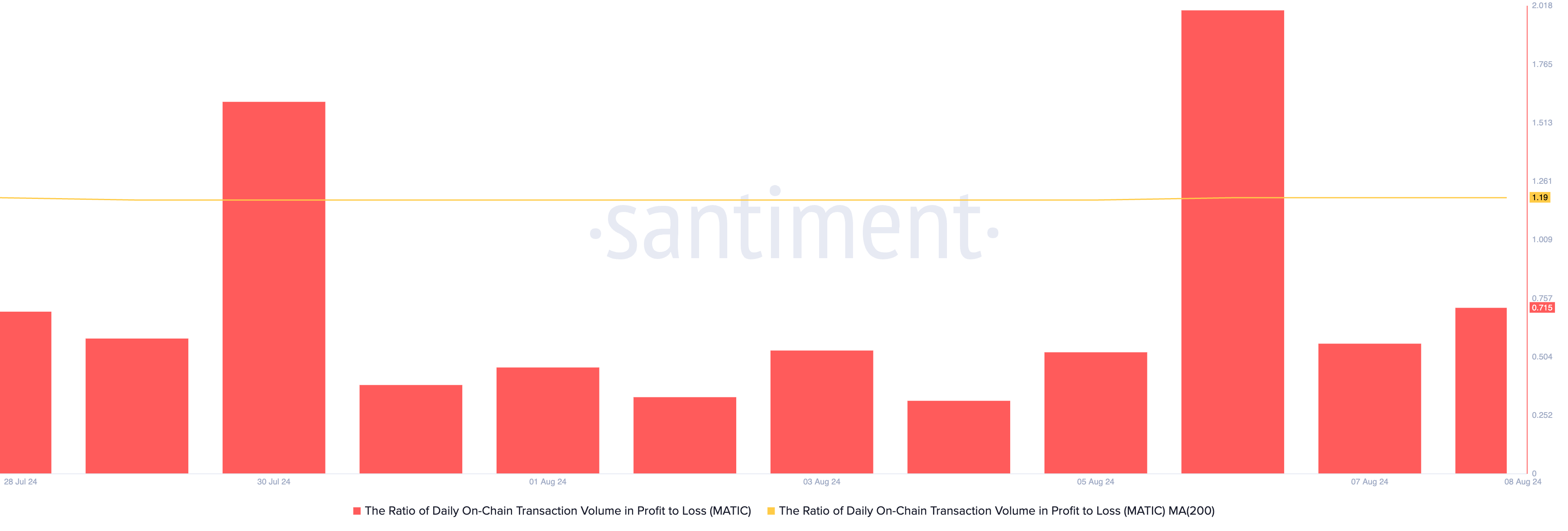

Since MATIC peaked at a year-to-date high of $1.52 on February 17, its value has fallen by 74%. Interestingly, despite this decline, daily transactions have returned more profits than losses.

An assessment of the token’s daily ratio of on-chain transaction volume in profit to loss (over a 200-day moving average) shows that traders have consistently recorded profits.

Read more: 15 Best Polygon (MATIC) Wallets in 2024

Per Santiment, the metric’s value is 1.19, suggesting that for every transaction that returned a loss in the past 200 trading days, 1.19 transactions ended in a profit.

MATIC Price Prediction: Buying Pressure Leans as Token Trades Below Moving Averages

At its current value, MATIC trades below its 20-day exponential moving average (EMA) and its 50-day small moving average (SMA). An asset’s 20-day EMA measures its average closing price over the past 20 days, while the 50-day SMA tracks the average closing price over the past 50 days.

When an asset’s price falls below these key moving averages, it indicates low demand. Traders see this as a signal that the price will likely continue to decline if bearish sentiment persists.

Read more: Polygon (MATIC) Price Prediction 2024/2025/2030

If the broader market rally encounters a roadblock, MATIC’s price risks returning to Monday’s low of $0.34. Conversely, if new demand for MATIC enters the market, its price could rise to $0.55.