The price of MATIC, the token powering Polygon, Ethereum’s leading Layer-2 scaling solution, has reached a 60-day high.

Over the past week, MATIC’s price surged 28% as investors anticipate the upcoming token migration from MATIC to POL.

Polygon Whales Leaves Nothing to Chance

As of this writing, MATIC trades at $0.52. Its double-digit price hike in the past seven days is partly due to a rise in whale activity during that period. Data from IntoTheBlock shows that the token’s large holders’ netflow has risen by 43% during that period.

Large holders refer to investors who hold more than 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins they buy and the amount they sell over time.

When an asset’s large holder netflow rises, it signals that whale addresses are accumulating more coins. This is considered a bullish indicator that often leads to a price rally. As retail investors observe large holders increasing their positions, their confidence typically grows, which drives additional buying and can sustain price momentum.

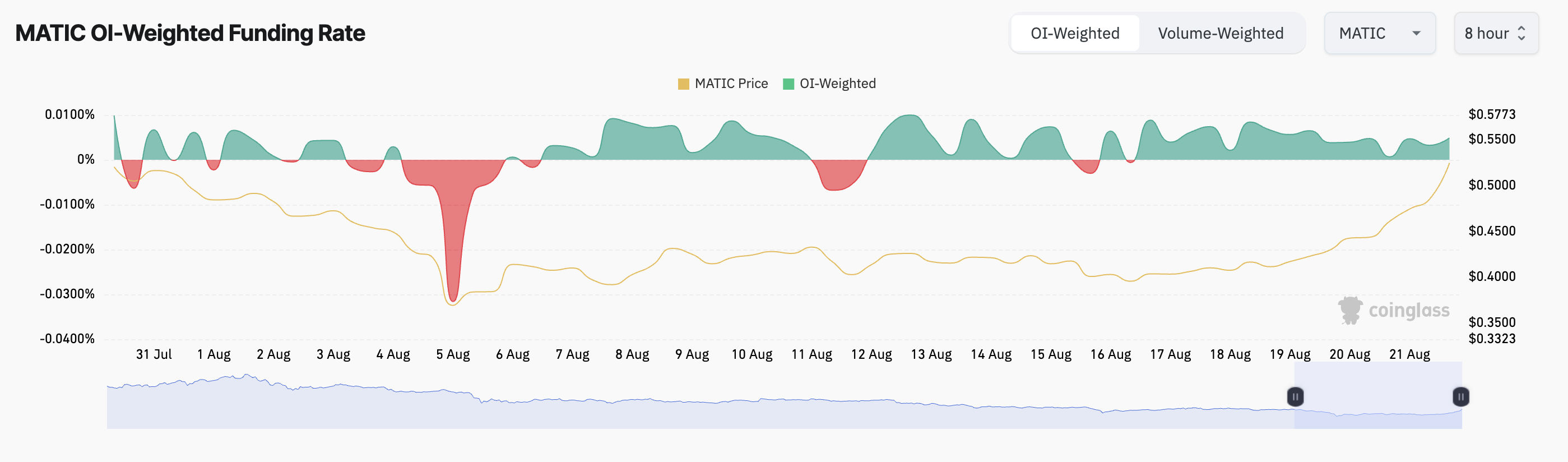

Furthermore, MATIC futures traders have consistently shown demand for long positions. This is reflected in the altcoin’s positive funding rate since August 17, indicating that traders are willing to pay a premium for maintaining bullish positions in the derivatives market.

Read more: 15 Best Polygon (MATIC) Wallets in 2024

When an asset’s funding rate is positive, there is more demand for long positions. It means that more traders are betting on a price rally than those anticipating a decline.

MATIC Price Prediction: Current Uptrend Is Strong

MATIC’s Average Directional Index (ADX) confirms that the current uptrend is strong. Assessed on a one-day chart, the indicator is in an uptrend at 48.17.

The ADX measures the strength of a trend regardless of its direction. At 48.17, MATIC’s ADX signals that its current trend is very strong.

MATIC’s Directional Movement Index setup shows that the trend is bullish. As of this writing, the token’s Positive Directional Indicator (+DI) rests above its Negative Directional Indicator (-DI). When the +DI is above the -DI, it suggests that the market trend is bullish and buying pressure is dominant.

Read more: Polygon (MATIC) Price Prediction 2024/2025/2030

Maintaining the current trend could push MATIC’s price to $0.55. However, profit-taking may exert downward pressure, potentially dropping the price to $0.33.