Mastercard introduces a new tool that uses artificial intelligence (AI) to detect unauthorized flows through bank accounts, even as shiny new real-time payments systems threaten its dominance.

The new “Consumer Fraud Risk solution” will roll out to nine banks in the UK to detect scam funds’ movement through so-called “mule” accounts.

Mastercard AI Tool Enters Fraught CeFi and DeFi Risk Landscape

Mastercard trained the AI tool through data gleaned from joint investigations with UK banks into the movement of stolen funds. The model assimilated account names, payment values, and parties at both ends of fraudulent transfers.

Initially available in the UK, the new Mastercard service will be available to Lloyds Bank, Halifax, Bank of Scotland, NatWest, Monzo, and TSB customers.

Financial services, including those in traditional finance and blockchain, face growing threats caused and solved by AI.

In TradFi, Mastercard’s AI tools have stopped over $35 billion in losses in the last year.

In DeFi, Google’s Bard and ChatGPT AI assistants can generate or manipulate smart contract code to steal funds. Services ripe for attack include smart contracts that bridge tokens between blockchains. Other loopholes can be more subtle and are often identified only after an exploit.

Cybersecurity firm AnChain.ai uses AI to spot loopholes in smart contracts in decentralized finance applications, while rival Cyver.ai studies on-chain transaction patterns with AI to identify unusual behavior.

Read here about on-chain analysis tools.

Can Mastercard Fit Into Wholesale Settlement Future?

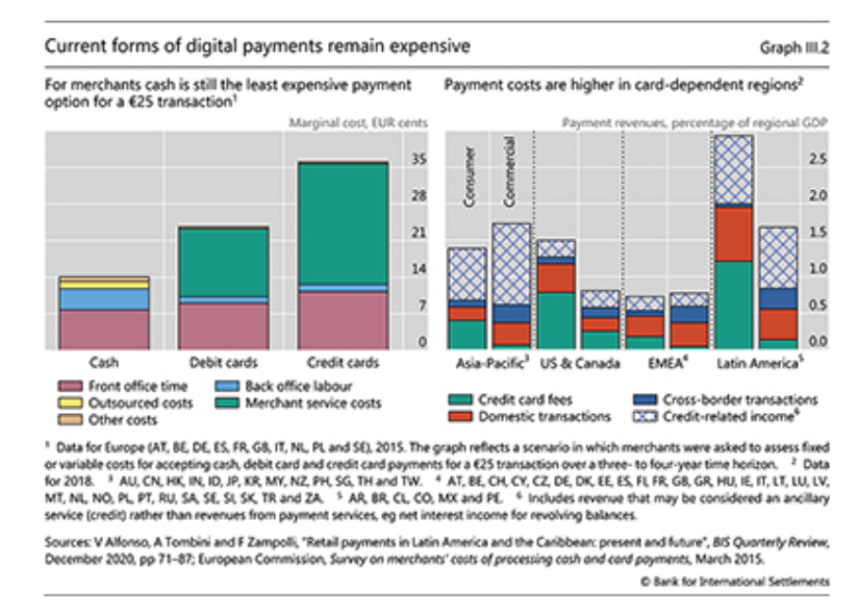

New private blockchain networks may change the roles of traditional payment providers like Mastercard and Visa. In the last year, several banks and governments have launched or trialed wholesale settlement services to improve business banking.

Yesterday, DBS Singapore confirmed a new service to allow clients to settle merchant accounts in China’s central bank digital currency, the e-CNY. Meanwhile, JPMorgan allows dollar and euro-based client-merchant settlements through its JPM Coin over a private network.

Today, the New York Fed announced a successful trial of a dollar-based wholesale settlement system called a “regulated liability network.”

Launched last year, the project tested domestic and international dollar settlements’ programmability, privacy, and interoperability in partnership with large banks, including Citigroup BNY Mellon, HSBC, and Wells Fargo. Mastercard also took part, suggesting it is not waiting to get left behind in the race for more efficient networks. However, its role in the future of real-time retail payments is less certain.

The US Federal Reserve will roll out its new FedNow system this month. The Bank of England recently tested a Real-Time settlement system it intends to roll out to commercial banks next year.

Got something to say about Mastercard’s AI tool or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.