Bitcoin miner MARA, formerly Marathon Digital, revealed a $100 million BTC purchase and declared commitment to the “HODL” strategy.

Bitcoin’s price has investors on the edge of their seats as it struggles to hold above $60,000. Late in July, it provided late bulls multiple buy opportunities, slipping to depths as low as $53,485.

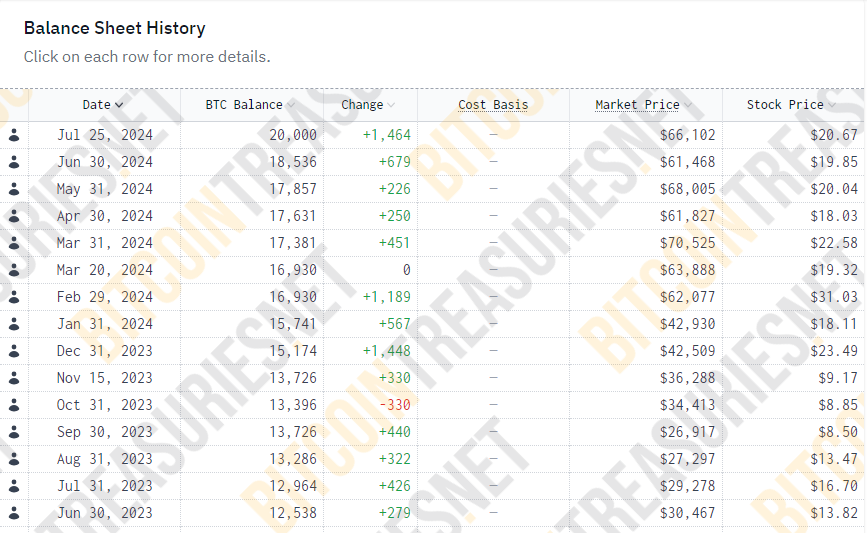

MARA Grows Bitcoin Portfolio Past 20,000 BTC

The Bitcoin miner’s portfolio now exceeds 20,000 BTC, valued at approximately $1.275 billion at current market rates. This amount represents about 0.0952% of the total 21 million Bitcoin supply. The company reportedly took advantage of “favorable market conditions,” likely referring to a recent correction, to make this acquisition.

While details of the purchase remain unknown, MARA’s balance sheet holdings as of June 30 show only up to 18,536 BTC. This means the firm bought at least 1,464 BTC tokens within the month, capitalizing on Bitcoin’s retraction to the $53,400 to $68,000 range.

Read more: Is Crypto Mining Profitable in 2024?

Operating as a digital asset technology company that mines cryptocurrencies, MARA focuses on the blockchain ecosystem and the generation of digital assets in the US. Despite its buying spree, including a $150 million purchase in 2021, most of the firm’s Bitcoin portfolio draws from its mining activities.

With over 20,000 BTC in its portfolio, MARA commits to a HODL treasury policy. This signals plans to retain all the Bitcoin it mines alongside other potential acquisitions in the future.

“Adopting a full HODL strategy reflects our confidence in the long-term value of Bitcoin,” said Fred Thiel, MARA’s chair and CEO, in the press release.

Read more: Bitcoin Mining From Home: Is It Possible in 2024?

As part of this strategy, the Bitcoin miner has already reduced the amount of BTC it sells relative to production. According to a Bernstein report on Wednesday, MARA is selling 25% less BTC than it previously sold. Its peers, CleanSpark (CLSK) and Riot Platforms (RIOT), slashed their sale proportions by 61% and 84%, respectively.

This resolve comes as MARA sees Bitcoin’s potential, which enjoys tailwinds from institutional support and an improving macro environment. Indeed, spot ETFs and changing tides in US economic data inspire hope for crypto markets.

With this vision, the firm is already looking outwards, diversifying its operations amidst rising Bitcoin mining difficulty. It signed a multi-million dollar agreement with Kenya’s Ministry of Energy and Petroleum as it looks to tap the country’s renewable energy.