Mantra (OM), a layer-1 (L1) blockchain that supports real-world asset (RWA) tokenization, has seen a nearly 40% price increase over the last seven days. DefiLlama data also shows that Mantra’s total value locked (TVL) has increased by approximately 25.72% since the beginning of June, reaching $52.4 million.

This increase follows months of stagnation since mid-April. Analysts credit this rise to new partnerships and technological advancements in the Mantra ecosystem.

New Partnerships Fuel Mantra’s Growth

On June 5, Mantra announced a memorandum of understanding (MoU) with Zand Bank PJSC, a digital bank licensed by the Central Bank of the United Arab Emirates (UAE). The partnership aims to establish frameworks for real-world asset tokenization under the Virtual Asset Regulatory Authority of Dubai (VARA) standards. This strategic move also intends to enhance regulatory compliance, investor protection, and trust in RWA tokenization in the UAE.

Read more: What Are Tokenized Real-World Assets (RWA)?

“This collaboration represents a step forward in our journey to amalgamate blockchain technology with our robust financial offerings to give our clients greater control over their investments, enhanced security, and more clarity into the lifecycle of their transactions,” Michael Chan, CEO of Zand, stated.

Mantra’s technological advancements have also played a key role in its recent growth. Last week, Mantra announced plans to feature Ondo’s flagship interest-bearing tokenized note, USDY, as a genesis asset when its blockchain debuts later this year. USDY exposes holders to short-term US Treasury yield while maintaining stablecoin utility.

The collaboration between Ondo Foundation and Mantra aims to incentivize a multi-chain vault, allowing users to contribute USDC and receive high-quality yields. Upon the mainnet launch, this initiative will provide participants with ONDO tokens and OM coins, further boosting Mantra’s ecosystem.

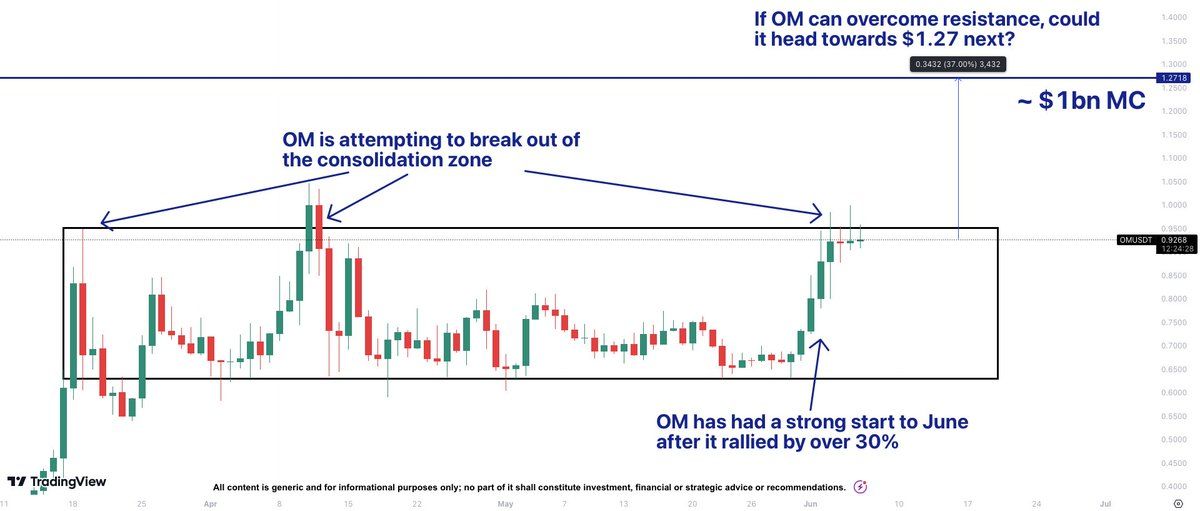

A technical analysis by CryptoSavingExpert highlights OM’s potential to break out of its consolidation zone. The analysis indicates that OM could reach $1.27 if it overcomes current resistance levels. This insight aligns with the broader trends in the crypto market, emphasizing the increasing focus on real-world asset tokenization.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

The CoinGecko RWA Report 2024 highlights the rise of real-world asset tokenization in crypto, particularly USD-pegged stablecoins and commodity-backed tokens like gold. The report also notes a 782% surge in tokenized treasury products in 2023.

These trends align with Mantra’s strategic moves. As the project continues to innovate and grow, it stands poised for further success in the real-world asset tokenization industry.