Litecoin (LTC) price has been one of the worst hit by the recent downturn in the crypto markets. Despite a 12% decline already in May 2023, investors are positioned for further bullish LTC price predictions.

A deep dive into the on-chain data shows bearish action from Whale investors and Litecoin miners could be a major driving factor for the price downswing.

Litecoin Whales Are Making Fewer Bets

This week, Litecoin whales appear to have reduced their trading activity considerably. LTC transactions exceeding $1 million have dropped from 511 transactions recorded on May 5 to a lowly 14 on May 9.

Seemingly, institutional investors are taking a hawkish position as they wait for the bearish trend to blow over. But, typically, whale transactions provide much-needed liquidity to the market.

Hence, this decline could trigger a downward spiral, where LTC traders have to lower prices to get their orders filled.

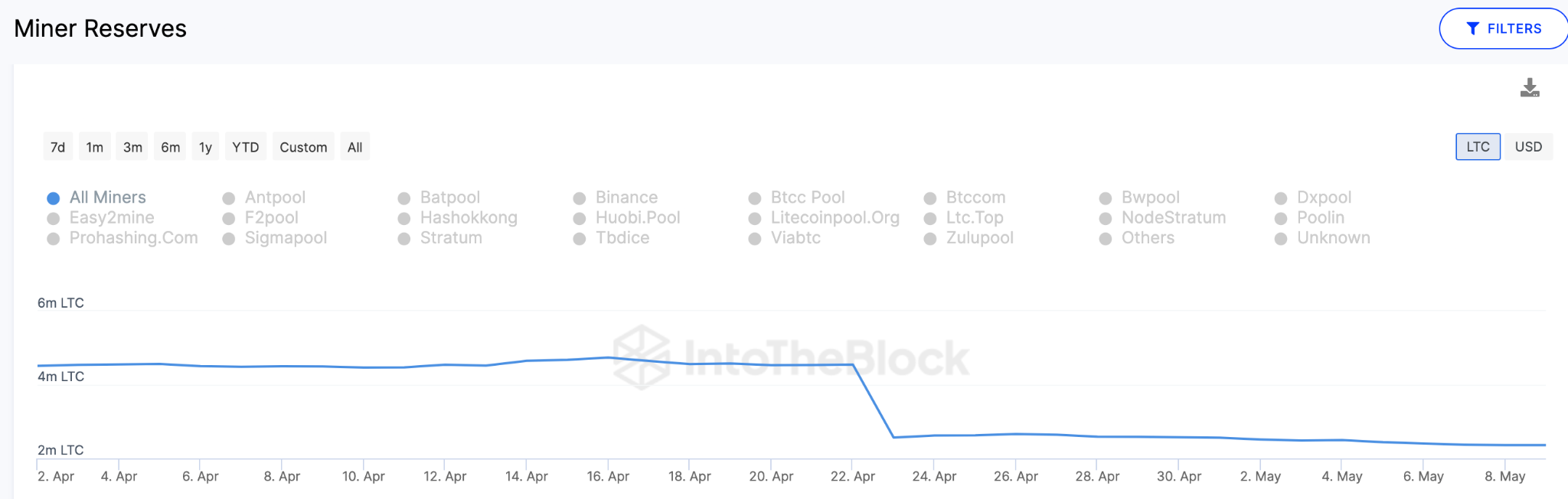

Miners Offloaded 2 Million Coins Recently

Moreso, Litecoin Miners appear to be selling off their block rewards, signaling their bearish sentiments. The chart below shows how LTC Miners sold a total of the miners have sold over 2.16 million coins between April 22 and May 10.

Notably, with the current market value of $79, the coins sold in April are worth over $170 million.

The sudden increase in market supply caused by a drastic reduction in miners’ reserves appears to be a major driver behind the recent Litecoin price retracement.

Furthermore, selling pressure among the miners will likely cause other strategic investors to become bearish themselves over the coming days.

LTC Price Prediction: Another Drop Below $70?

Litecoin could drop below $70 for the first time since March 2023 if the current bearish LTC price predictions play out.

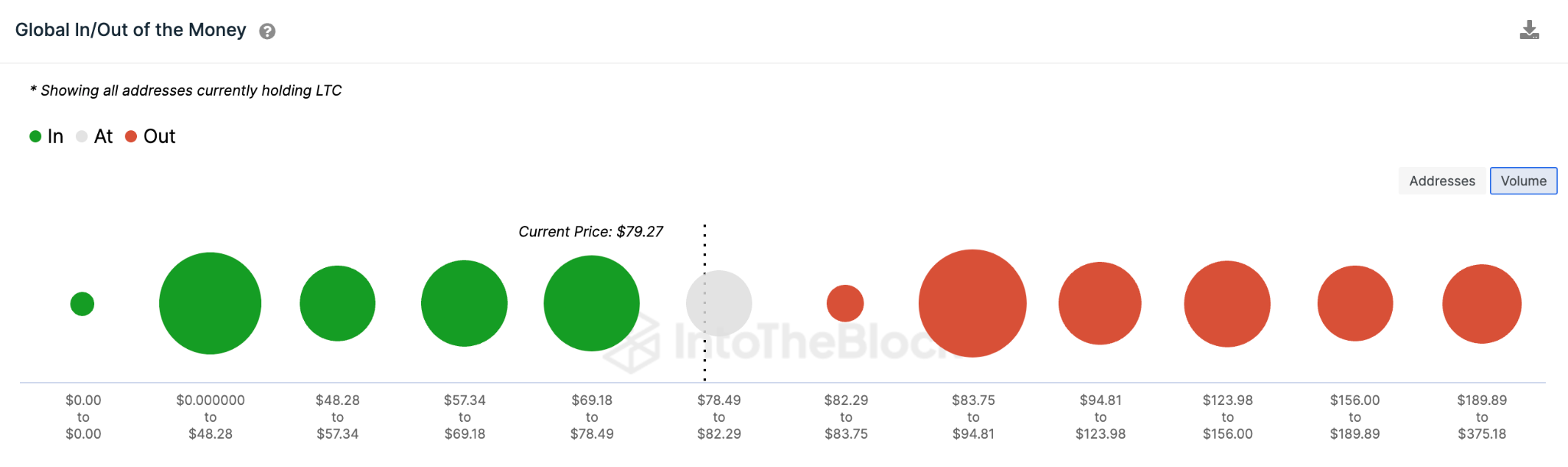

But, Global In/Out of the Money data below shows that the bears will first have to breach the initial support level at $74. Around that zone, the 476,000 addresses holding 9.2 million coins could offer bullish support.

But if that cannot hold, then LTC price will likely drop toward $62, which is the average price that 920,000 investors had bought 7 million coins.

Yet, the bulls could negate the bearish Litecoin price prediction if LTC breaks above $83. But the initial sell-wall mounted by 30,000 addresses that 886,000 coins for a maximum of $83 can trigger another downswing.

But if bulls manage to push above $83, LTC price could rise as high as $88 before hitting another significant resistance.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.