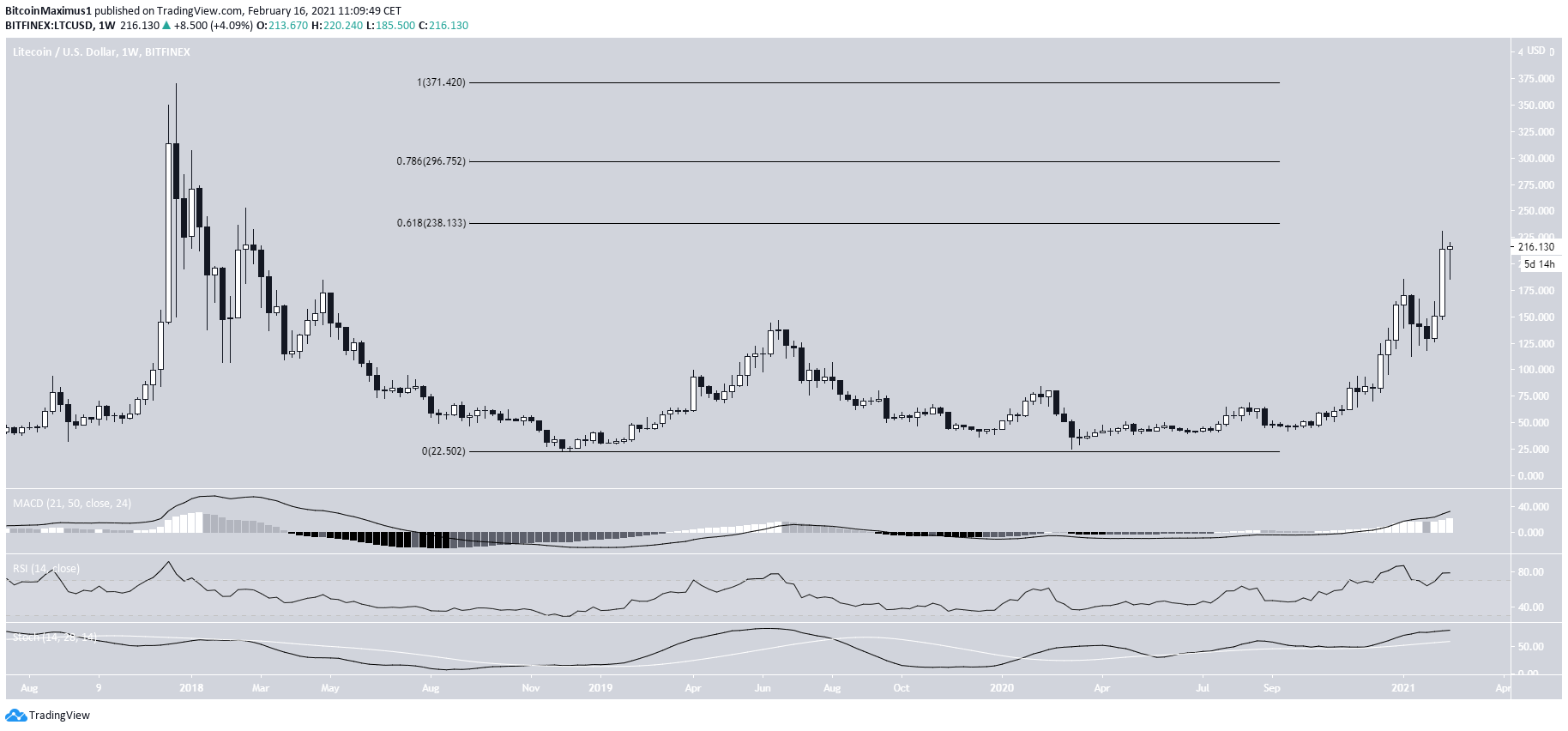

Litecoin (LTC) has decreased slightly since falling short of the $238 long-term resistance level last week.

Despite the rejection, the Litecoin trend still looks bullish. The price is expected to make another breakout attempt in the near future.

Long-Term Litecoin Resistance Levels

Litecoin increased considerably over the past week, creating a bullish candlestick to reach a high of $230.

The high was just below the $238 resistance area, created by the 0.618 Fib retracement level. LTC has not traded above this level since February 2018.

If successful in reclaiming it, the next resistance would likely be found at $296 (0.786 Fib retracement). And above that, the all-time high price of $371 as its final resistance.

Despite a potential bearish divergence in the weekly RSI, the RSI, MACD, and Stochastic oscillator are increasing. This indicates that the trend is likely still bullish.

Future Movement

The daily chart shows that the decrease on Feb. 15 was a re-test of the $190 area, which left a long lower wick (green arrow). This is a bullish sign that suggests that LTC is heading higher.

Similar to the weekly time-frame, the MACD, Stoch, and RSI are moving upwards.

The re-test is even clearer in the six-hour time-frame and is also combined with a hidden bullish divergence in the RSI. This is commonly a strong sign of trend continuation.

If LTC breaks out from the potential descending resistance line (dashed), the rate of increase would be expected to accelerate.

Wave Count

The wave count suggests that LTC is in sub-wave five (orange) of wave three (white) of a bullish impulse that began in March 2020.

The most likely target for the top of this move is found at $259. This was found by using a Fib projection (orange) and the 4.16 external retracement (black).

The next most likely area for the top would be the $296 resistance outlined in the first section.

LTC/BTC

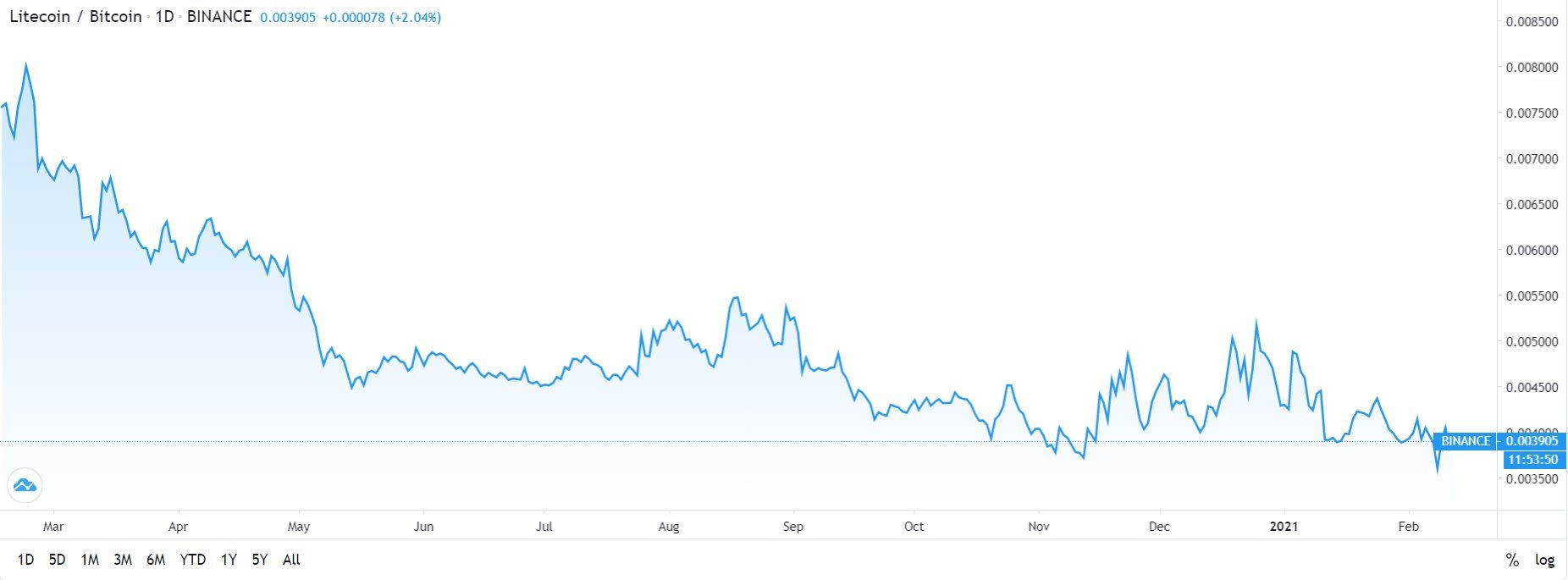

Cryptocurrency trader @Gem_Insider outlined an LTC/BTC chart, stating that the price is trading near its all-time low levels and should soon initiate a significant upward movement.

LTC/BTC is trading very close to its all-time low levels at ₿0.003, previously reached in 2017. Despite this, the weekly RSI has been generating a bullish divergence for nearly a year, a strong sign that a bullish reversal might be near. This is also supported by the fact that the Stochastic oscillator has made a bullish cross.

If LTC/BTC manages to clear the ₿0.0055 resistance area, it will likely head higher towards the next resistance area at ₿0.008.

Conclusion

LTC/USD is expected to break out above resistance and move towards the range of $250-300.

LTC/BTC is expected to increase towards ₿0.0055. If it’s successful in breaking out, a bullish trend would likely be confirmed.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.