Litecoin (LTC), Dogecoin (DOGE), and Ripple (XRP are three cryptocurrencies that have existed longer than many altcoins in the market. While LTC and XRP were created in 2011, Dogecoin appeared two years later.

As such, it is not out of place to say these trio are peers in terms of longevity. Despite a small age difference, Litecoin has gained more market trust than the others. But how?

Litecoin Holders Remain Its Backbone

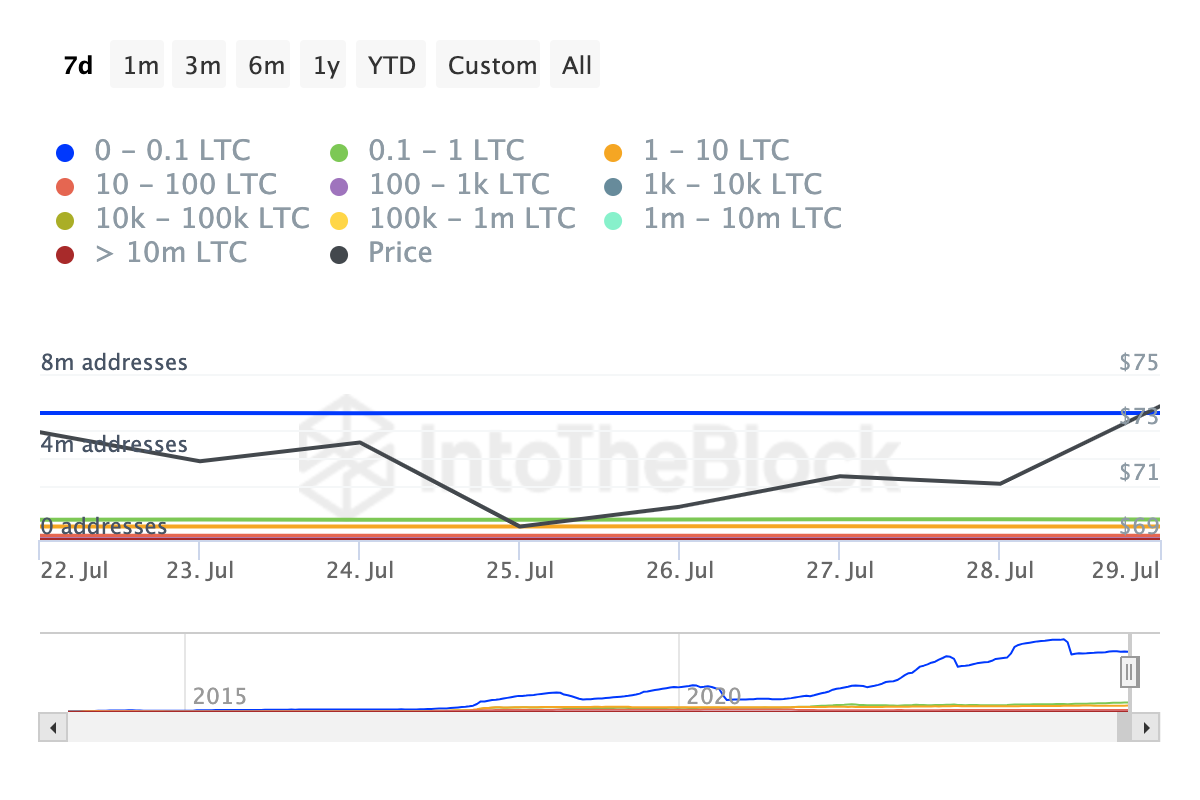

One way to know if the broader market is confident in a cryptocurrency’s potential is to look at its number of holders. Over the last few days, Litecoin’s number of holders has seen a notable decrease.

At press time, there are over 8 million LTC holders. XRP and DOGE, on the other hand, have seen these figures increase. Despite that jump, Litecoin still has more holders than Dogecoin and Ripple, which have 6.70 million and 5.26 million, respectively.

A higher number of holders indicates trust in crypto regardless of the current price action. This conviction could be based on Litecoin’s supply. The coin’s maximum supply is 84 million, which is much lower than the other two. However, the coin’s performance also plays a part.

Read More: Litecoin vs. Ethereum: What’s the Difference?

This year, Litecoin’s price has not performed better than DOGE and XRP, suggesting that its holders are not focused on short-term returns.

In addition, there has also been an increase in the number of addresses holding a ton of LTC. According to IntoTheBlock, the number of addresses holding 1 million to 10 million has increased by 33% within the last month.

This indicates rising demand for the coin, suggesting that market participants are capitalizing on the dip and buying at discount prices. If this continues, LTC’s price may experience respite and climb.

Vincent Maliepaard, Marketing Director at IntoTheBlock, spoke to BeInCrypto about Litecoin. According to him, the coin has been registering several milestones recently, especially in terms of volume.

“Litecoin’s transaction volume has steadily risen over the past three months, now averaging 49 million LTC daily. This represents an impressive 66% of its current market cap. (For perspective, this is quite high compared to many other similar-sized coins, such as AVAX at 2.9% and LINK at 0.77%.)” Maliepaard says.

An increase in volume indicates rising interest in a cryptocurrency. If sustained, this could help LTC’s price bounce off the correction it has recently had.

LTC Price Prediction: Recovery Over Another Correction

At press time, LTC trades at $71.91. However, data obtained from the In/Out of Money Around Price (IOMAP) suggests that the price could be higher soon.

The IOMAP gauges resistance and support by looking at the addresses in profit or loss around a certain price range. If a large number of addresses are in the money, the price can act as support. But if the concentration is out of the money, it will be a resistance zone.

According to IntoTheBlock, 295,350 addresses are profitable and purchased LTC for around $70.60. Conversely, 286,450 accumulated the coin at a weighted price of $72.88, are in loss. With more holders in the money, LTC could have strong support between $69.67 and $71.54.

If validated, this could lead the price to an uptrend, possibly breaking past $72.88 and hitting $74.52 or $77.08.

Read More: How To Buy Litecoin (LTC) in 4 Easy Steps

However, this prediction may be invalidated if the number of LTC holders decreases. If this happens, it could signal a no-confidence vote in the cryptocurrency, and the price could drop to $68.23/