A new liquid staking platform called Diva is trying to ‘vampire attack’ industry-dominant Lido by offering better incentives for stakers. Meanwhile, Lido governance votes to sunset the protocol on Solana.

On October 16, the crypto community shared data showing that the Diva liquid staking protocol is trying to ‘vampire attack’ Lido. This is achieved by offering DIVA token rewards to stakers to lock up their ETH and stETH for divETH.

Diva Vampire Attack

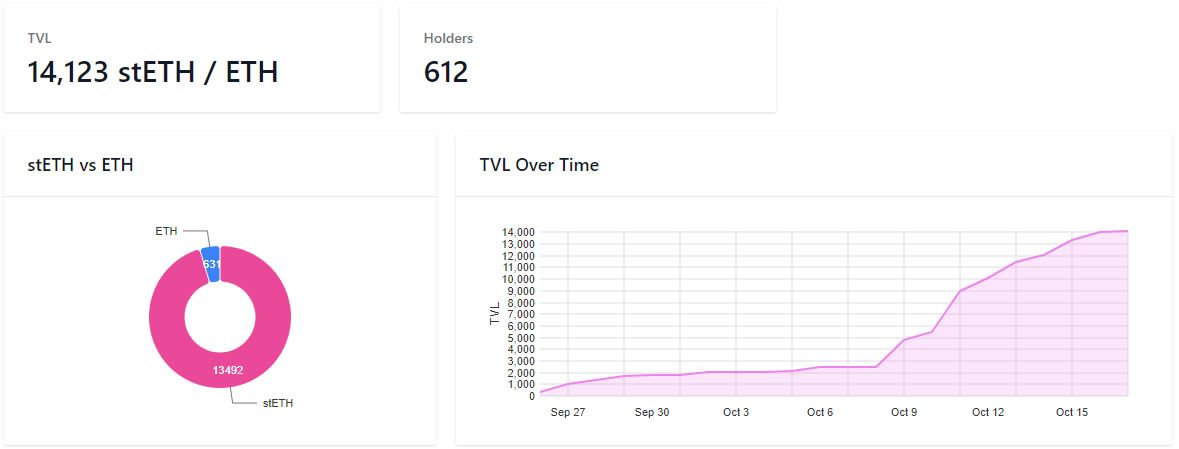

The ‘attack’ appears to be showing early signs of success, as its total value locked surged almost 600% over the past two weeks.

Divascan reports that TVL currently has 14,123 Lido staked ETH (stETH) valued at around $22.4 million at present prices.

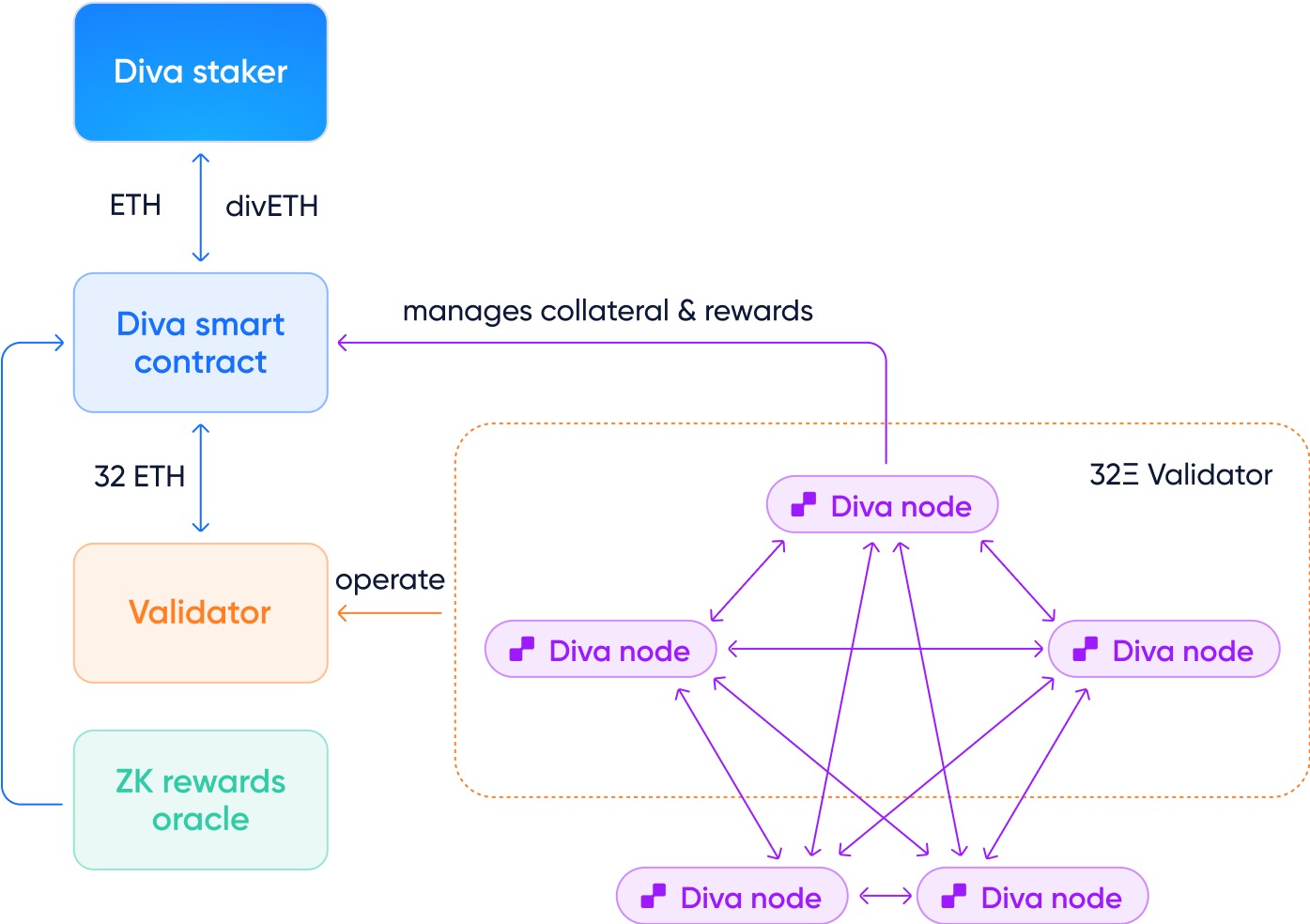

Diva is Ethereum’s first liquid staking solution powered by Distributed Validator Technology (DVT).

The platform provides a liquid staking token, divETH, and claims that potentially thousands of resilient, permissionless Operators credibly back it.

Furthermore, Diva provides node operator access for just 1 ETH rather than the 32 ETH required to stake directly and become a full node validator.

“The Diva Smart Contract receives ETH deposits from Liquid Stakers. Every time there are 32 ETH available, it deposits them to the Ethereum Consensus Layer to form a new validator, which is operated by 16 unique Key Shares to generate Staking Rewards.”

The move has been largely welcomed by the Ethereum community, which has been growing concerned about Lido’s dominance.

David Hoffman from Bankless (which is a Diva partner) explained the mechanisms of the “vampire attack:”

“It’s a bootstrapping mechanism that leverages token incentives to steal TVL and users from a large incumbent player.”

He added that this was good because Lido is “threatening to break the 33% threshold of ETH stake.” It would be “crossing a critical line and violating values of decentralization and credible neutrality held by Ethereum.”

If you want to learn more about the best liquid staking platforms to watch in 2023, check out our guide here!

Ethereum developers such as Danny Ryan have also warned about the dangers of staking “cartelization” by the likes of Lido.

Furthermore, Lido’s staking share is currently 31.6% of the total staked, according to Dune Analytics.

Lido to Sunset Solana

In related news, Lido governance token holders have voted to discontinue Lido on Solana.

An October 16 announcement stated that it would be discontinuing stSOL rewards. It also urged users to unstake SOL until February 4, 2024.

It added that,

“This decision does not reflect the belief of Lido contributors on the potential and longevity of the Solana ecosystem as a whole.”

Moreover, Lido DAO (LDO) token prices dropped 2.7% on the day in a fall to $1.59 at the time of writing.