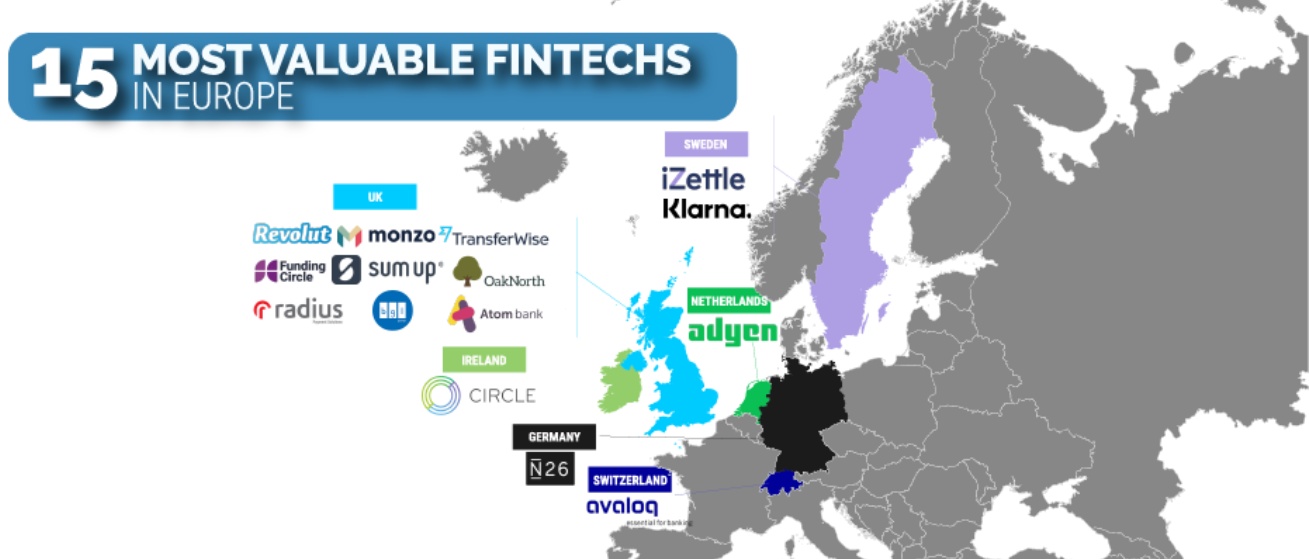

Inside the European Union or not, the United Kingdom continues to hold its enviable ranking as the most developed fintech hub in the world, reflected by the cryptocurrency sector as well.

Drawing from Deloitte data and its previous reports, the UK attracts cutting-edge innovations and talent pools all across the world.

Fintech Sector in the United Kingdom

As far as the UK’s fintech sector goes, it would be more accurate to s

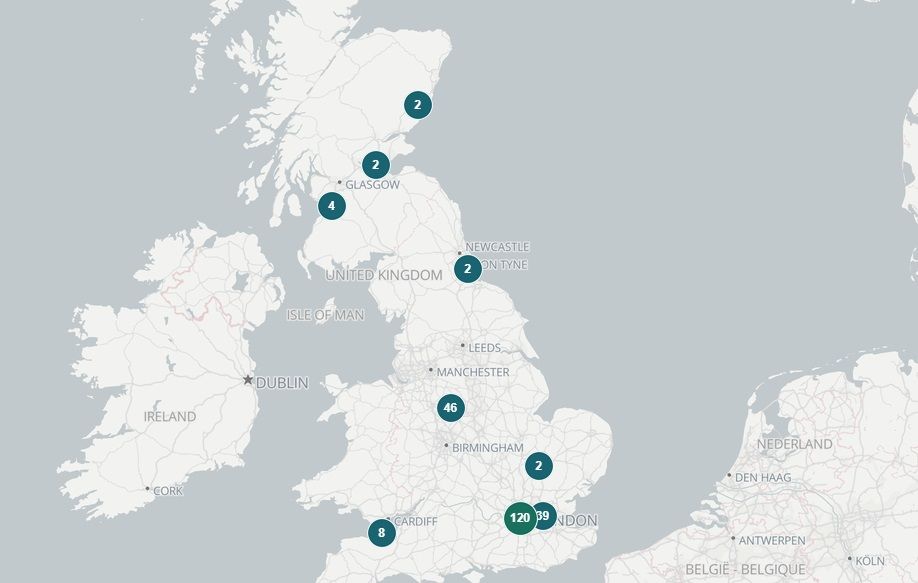

ay that London represents this surge in financial adoption and innovation. The city hosts over 90,000 firms within the fintech ecosystem, including the supporting businesses. Out of the top 50 fintech companies, 37 of them are headquartered in London.

Some interesting facts related to fintech and the UK:

- As of 2019, fintech accounted for £3.06 billion of investments in the UK.

- While the global average of fintech adoption rate is 64%, the country leads the way with 71%.

- The UK’s current fintech workforce numbers at around 80,000, with a projected growth to over 105,000 by 2030. Out of that workforce, 42% of workers come from overseas.

- London alone hosts over 350,000 software developers, surpassing all other cities within the EU.

- Annually, the fintech sector infuses £7 billion into the UK economy.

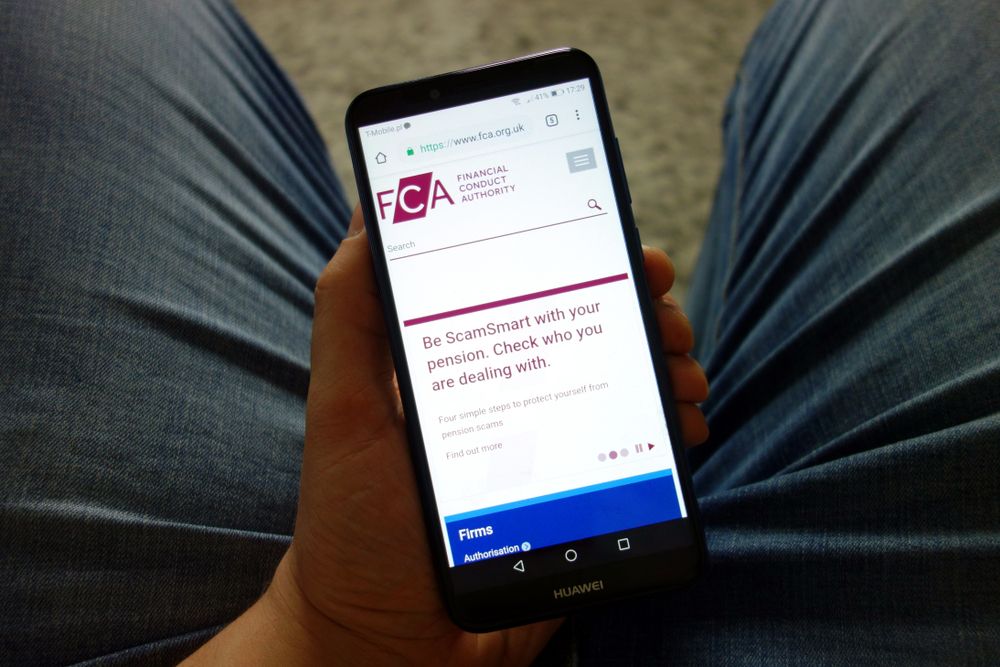

In short, the UK has been nurturing the growth of massive intellectual infrastructure. Much of that expansion can be owed to the UK’s Financial Conduct Authority (FCA). This governmental agency pioneered a novel approach to regulation.

Instead of requiring financial platforms and products to be fully completed and tested before they are registered, the FCA implemented a Regulatory Sandbox.

This regulatory innovation allowed fintech companies to test their products under real market conditions and with real customers, but still within controlled parameters.

Before and After Brexit

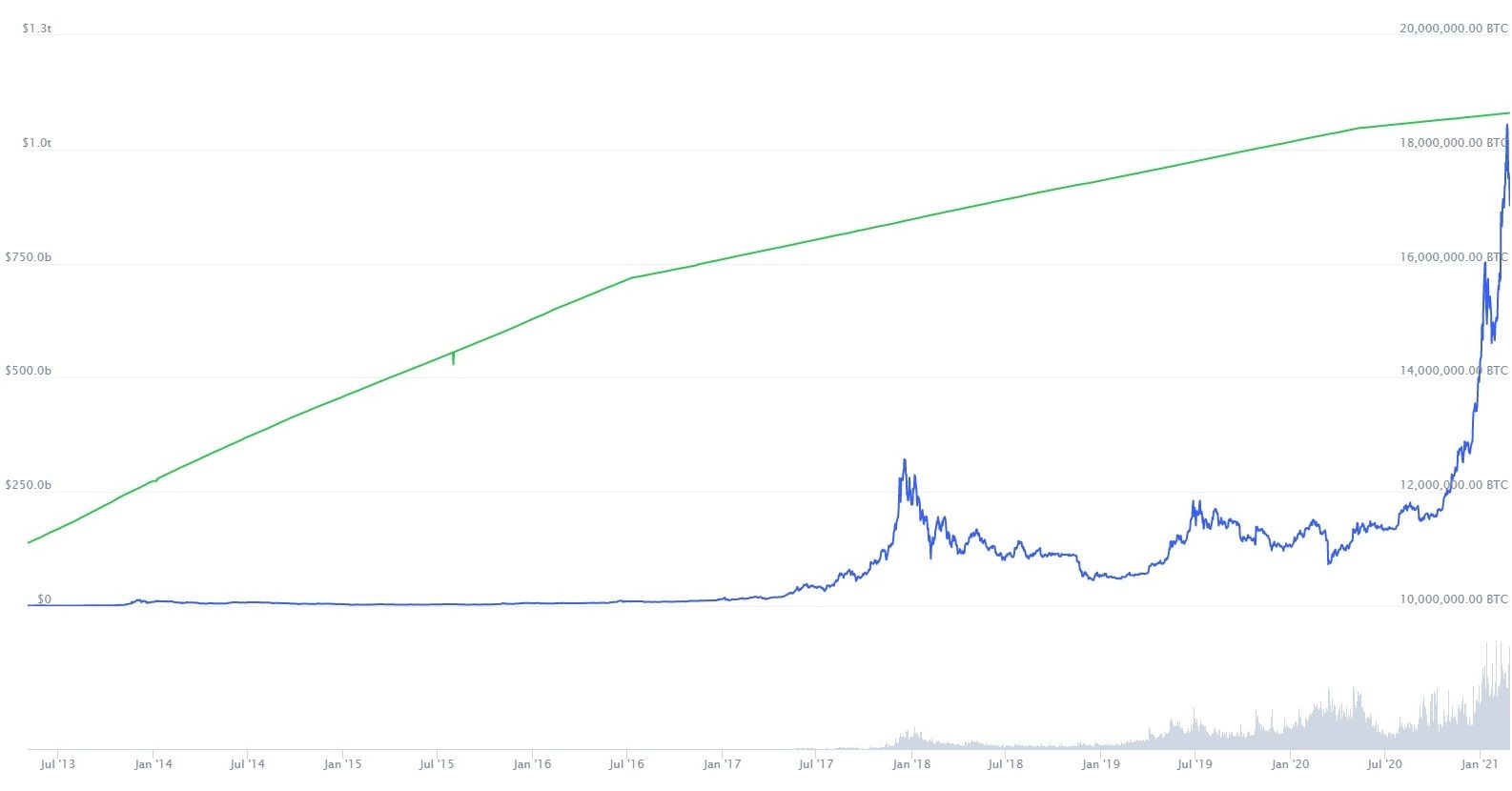

Five years after the launch of bitcoin (BTC) — just as the second-largest cryptocurrency ethereum (ETH) emerged on the scene — the UK began to tackle crypto regulation, in 2014.

During that time, bitcoin’s market cap oscillated between $5 billion and $8 billion, which is less than one percent of BTC’s current market cap of $1 trillion.

Accordingly, the Bank of England refused to acknowledge the cryptocurrencies as money-like. This is where the term “cryptoassets” emerged, so that even the term “cryptocurrency” could not be mistaken for money. In October 2018, this was officiated by the Cryptoassets Taskforce.

This group was formed to streamline the efforts of relevant institutional bodies — Her Majesty (HM) Treasury, the Bank of England, and the FCA — to form a long-term strategy for tackling cryptoassets.

The end result was the formulation of “Guidance on Cryptoassets,” in 2019. This framework doesn’t explicitly regulate cryptocurrencies.

Instead, the regulatory guidelines identify the types of tokens, how they are to be traded, and consumer protections. With all these institutions working together, cryptoassets were finally defined as:

“cryptographically secured digital representation of value or contractual rights that uses some type of DLT and can be transferred, stored or traded electronically.”

After leaving the EU, the UK finds itself in a delicate position to balance the act of forging its own path while maintaining access to the EU market. Simon Briskman of the Fieldfisher FinTech law firm, emphasizes this approach:

“Brexit presents the possibility of a twin-track regulatory regime allowing new entrants from outside of Europe and UK start-ups some leeway on the heavy regulatory responsibility that financial companies face.”

In the meantime, both British and EU customers are still able to use SEPA bank payments, accounting for the bulk of deposits from Europe. This is good news for the continued cryptocurrency adoption in the UK.

If you recall, in 2019, the FCA conducted a survey reporting that only 3% of surveyed owned crypto assets. In 2020, this shifted to 20%, signifying a dramatic upward crypto trend shift.

This aligns with another survey, from Paxful, which found that 42% of adults don’t trust the UK banking infrastructure to work in their interests. Similarly, 31% of surveyed adults blame the banks for the post-pandemic recession.

The Current State of Crypto Assets in the UK

Thanks to the FCA’s pioneering Regulatory Sandbox (RS), the UK became one of the first nations to regulate Distributed Ledger Technology (DLT) and crypto assets.

The RS did not only cut costs on financial product and services rollouts, but it exposed policy gaps that needed to be patched in order to not stifle innovation.

The UK’s current cryptocurrency ecosystem, in which cryptocurrencies are not classified as legal tender but as “crypto assets,” can take multiple forms:

- As e-money under the Electronic Money Regulations (EMRs). E-money is a digital representation of fiat money.

- As utility tokens – for purchasing access to blockchain-powered servicesю

- As security tokens – equivalent to tokenized financial securities in the form of equity or debt-financing products. They are governed by the Regulated Activities Order (RAO). Under these guidelines, only these tokens can be transferable securities.

- As exchange tokens – this includes cryptocurrencies as we know it.

Both utility and exchange tokens fall under the category of unregulated coins. If one were to quantify the UK’s crypto ecosystem, it could be defined by eight market actors:

- Crypto asset developers

- Miners

- Liquidity providers (market makers)

- Crypto asset investors, both retail and institutional

- Payment processors that plug in crypto assets for customers to use for payments

- Financial intermediaries (brokers)

- Crypto asset exchanges

- Wallet and custody providers for crypto assets

Overall, it is easy to buy and sell cryptocurrencies in the UK if all parties involved follow regulations.

The baseline of such harmonious relationships comes from the understanding that cryptocurrencies are not legal tender. Likewise, all crypto assets must be registered with the FCA.

Because the FCA concluded that the underlying value of crypto assets cannot be reliably benchmarked to calculate it, one cannot trade in crypto derivatives in the UK.

The same agency is also responsible for all eight market actors to implement the anti-money laundering (AML), Know-Your-Customer), and combating the financing of terrorism (CFT) protocols.

Lastly, virtual asset service providers (VASPs) must apply to the FCA for licensing, with the exception of e-money tokens.

As you can see, it all comes down to the Financial Conduct Authority. The FCA not only provides the legal framework for financial markets but can investigate or freeze suspicious activities and sanction business entities.

Likewise, given that the FCA classifies cryptocurrencies to exchange tokens, it is perfectly legal to trade with them through ATMs. Currently, there are over 220 bitcoin ATMs dispersed throughout the UK. This number is still higher than in any other EU nation.

Crypto Regulation in the British Isles

Isle of Man

Outside the UK and EU, but still a British Crown Dependency, the Isle of Man has grown its reputation as “Bitcoin Island,” thanks to its low-tax jurisdiction.

In 2015, cryptocurrencies were amended in its Proceeds of Crime Act to include virtual currencies as “designated businesses.”

This means that, under the auspices of the Financial Services Authority (FSA), cryptocurrency providers must employ AML and KYC protocols. In the Isle of Man, there are four types of virtual currencies:

- Digital currency – the same as the UK’s e-money, a digital representation of existing fiat currencies.

- Virtual currency – convertible or non-convertible digital representation of value that doesn’t require a central authority.

- Convertible virtual currency – a stand-in for cryptocurrencies as we know them — BTC, ETH, LTC, and others — they only need for a market to exist without established value benchmarks.

- Non-convertible virtual currency — cannot be transferred to another person, or redeemed, once it is purchased.

As of 2016, the Isle of Man’s gambling platforms were given the go-ahead to accept virtual currencies. Interestingly, the island’s government was the first one to implement blockchain for a register of all designated businesses using virtual currencies and applying KYC/AML protocols.

Jersey

Unlike the UK, Jersey defined virtual currencies as currencies, instead of assets or commodities, in September 2016. This allowed the island to cover cryptocurrency under the existing regulation provided by the Financial Services Commission (FSC).

Therefore, Jersey’s definition is one that is most aligned with people’s perception of cryptocurrencies:

- Any currency that digitally represents value;

- Can be used as a unit of account;

- Acts as an exchange medium;

- Digitally exchangeable for other forms of money, which represents its fungibility.

Those businesses with over £150,000 annual turnover must comply with anti-terrorism, AML, and KYC rules for those customers who traded over €1,000 in cryptocurrencies.

Likewise, businesses who conduct one-off transactions exceeding in value of €15,000 must comply with the same FSC’s laws.

Guernsey

Guernsey has not implemented any cryptocurrency-specific laws and definitions. Instead, its government approves financial businesses involved with virtual currency on a case-by-case basis.

However, just as there are no pronouncements equalizing cryptocurrencies with fiat money, there are also no edicts making it illegal to trade in.

This makes sense as Guernsey doesn’t have a central bank. Nonetheless, if prospective businesses can satisfy their FSC, the innovation-focused agency is more likely to give a go-ahead than not.

How Much Taxes Should You Pay?

Depending on your legal status — individual or business — you are subject to pay different types of taxes. Individuals have to further note their crypto asset activity — mining, staking — to determine their total tax burden under capital gains.

On the other hand, alongside a capital gain tax, businesses have to take into account corporation, income, value-added, stamp duty, and national insurance contribution taxes.

The Future of UK’s Approach to Cryptocurrencies

The UK has now free hands to craft its future across a host of industries. In tCe immediate aftermath of the finalized Brexit deal, the HM Treasury called upon all relevant institutions and experts to reassess crypto assets.

In particular, stablecoins — cryptocurrency pegged to a real asset or fiat currency so that volatility is maximally reduced — are to be the priority for the next round of legislation.

The new framework will also focus on the usage of cryptocurrencies as investment vehicles, as well as using blockchain/DLT to enhance the security of the existing financial infrastructure. Given the skyrocketing rise of stablecoins, this is somewhat predictable.

As a type of low-volatility, bridge cryptocurrency in wide use inside the decentralized finance (DeFi) ecosystem, stablecoins allow users to convert their bitcoin funds into those tokens that are compatible for use on the Ethereum blockchain — ERC-20 tokens.

Crypto Assets to Serve as Safe haven for the Masses

Following the greatest recession in the last 300 years, the UK is facing difficult challenges ahead. As BeInCrypto previously reported, central bank digital currencies (CBDCs), alongside stablecoins, will likely become the next big trend to keep an eye on.

They represent the process of complete tokenization of the economy toward a cashless society.

This not only entails total recall of all transactions occurring between all entities, but a frictionless flow of money.

One that forgoes security guards and transportation, but emphasizes encryption instead. Within that ecosystem, cryptocurrencies still have their place. As deflationary currencies with a finite pool of tokens, they mimic precious metals like gold.

If the worst comes to be — hyperinflation — due to all the debt incurred and crippled economic activity during the pandemic, people can resort to bitcoin as a form of digital gold to safeguard their wealth. So far, neither the UK government nor the EU member states have signaled for one solution over the other — CBDCs over bitcoin.

More importantly, after exiting the EU, the British fintech sector will have a larger space to operate in. Nonetheless, compromises will still have to be made to not cut off access to the EU markets.

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.