Solana projects are taking over the crypto market. Solana (SOL) is a fast-growing smart-contract blockchain that enables fast, cheap transactions and high throughput. It ticks all the boxes for developers looking to launch a scalable DApp. We cover some of the top Solana projects with high potential here.

An ideal ecosystem for DApp development

Solana is a programmable blockchain that uses the proof-of-stake consensus and proof-of-history, a cryptographic clock to order the on-chain events.

Solana provides Dapp developers with an ecosystem for developing applications at a cost-efficient rate. Anyone can build on this open-source blockchain, on which hundreds of Solana projects exist.

Security and scalability are two key features that have driven its design. To that end, Solana’s blockchain can handle 50,000 transactions per second (tps). Furthermore, when the maximum number of validators join the network, it can scale up to 710,000 tps.

Currently, the transaction fees on Solana are fractions of a cent, and the network speed increases with the number of validators.

Overall, the decentralized finance (DeFi) space has a Total Value Locked (TVL) of about $86 billion as of April 2024, according to DeFi Llama. Solana has one of the most prominent DeFi ecosystems, amounting to about 4% of the total TVL at $3.05 billion today.

The top 6 Solana projects

Solana has helped bring to life hundreds of projects, but we will focus on the top 6 Solana projects here. Most of these projects focus on the hottest niches in the market, including DeFi, blockchain games, and NFTs.

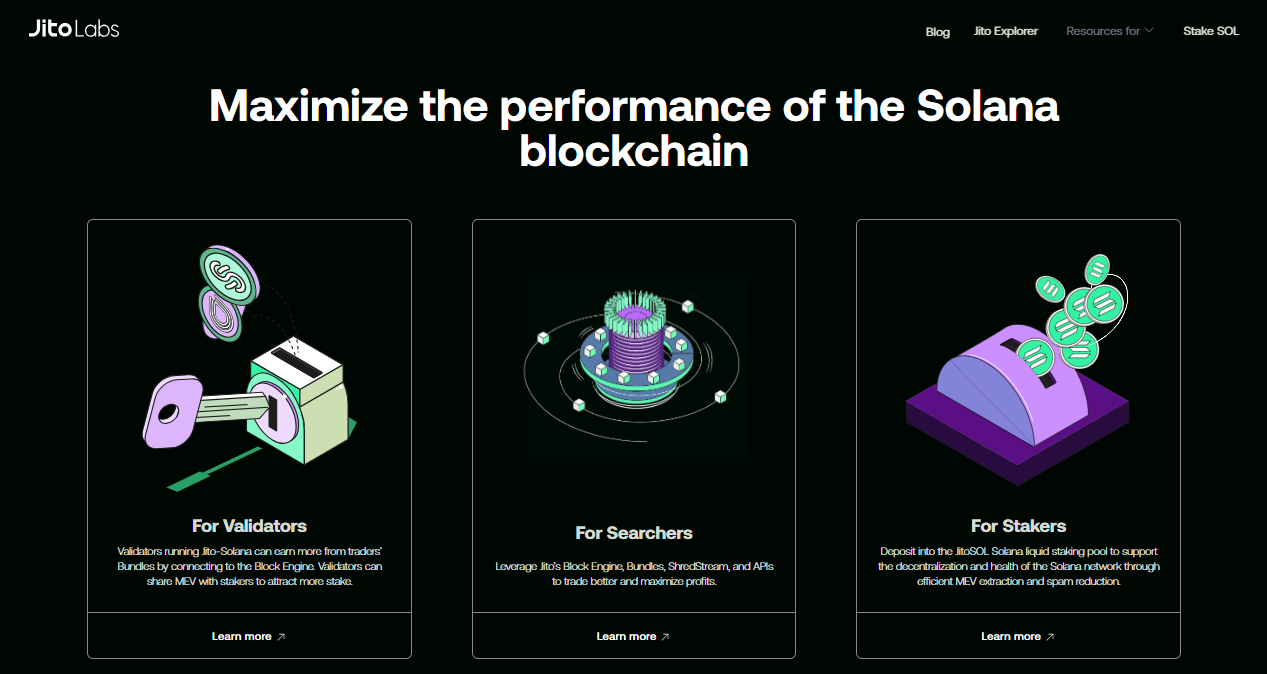

1. Jito (JTO)

As a relatively new project, Jito levels the playing field between Solana validators by democratizing earnings from maximal extractable value (MEV) through order flow auctions. This system utilizes specialized software to auction off block space to searchers.

“Jito Labs builds infrastructure to efficiently extract MEV on Solana. There’s a lot of spam and arbitrage transactions that are failing on Solana and we kind of predicted this would happen back in 2021, and wanted to work on solving it.”

Lucas Bruder, Jito CEO: YouTube

By implementing Jito’s system, Solana validators have a new avenue to increase their income. This setup not only boosts a validator’s profits from transactions but also allows them to share MEV incentives with their stakers, thereby attracting even more revenue.

Stakers in this system can commit their SOL and receive JitoSOL (a token representing their stake) to provide liquidity to various DeFi protocols and earn boosted rewards. This system enables them to benefit from both staking rewards and MEV profits.

JTO, not to be confused with JitoSOL, serves as the governance token, giving holders a say in Jito’s future governance decisions. As of today, Jito has reached many milestones, these include:

- 9,796,611 SOL TVL in the pool ($1.28 billion as of April 16, 2024)

- 93,031 stakers

- 129 validators

2. Render (RENDER)

The Render Network marries the world of blockchain with the demand for graphical processing power, also known as DePIN (physical network infrastructure). This enables users to monetize their unused GPU capacity by providing animation and visual effects rendering services.

Node operators earn Render tokens (RNDR), the network’s utility token, as payment for their services. The RNDR token was initially launched on Ethereum. RNDR (Ethereum) Holders can now bridge their assets to Solana through a wormhole to receive RENDER (Solana).

The Render Network promotes a shift towards cloud-based rendering solutions by connecting node operators with excess GPU capacity with creators requiring powerful rendering for 3D projects.

3. Solarians

Solarians are a collection of 10,000 fully randomized, generative NFTs robots minted on the Solana blockchain. Each of the Solarians is an NFT, with their entire history stored on the Solana blockchain.

To ensure the uniqueness of each Solarian, there are 1800 body parts drawn by the team’s artist. Each Solarian is different from the others, and some of these NFTs have Easter eggs that were specifically drawn by the artist.

The NFT marketplace for Solarians is available on Magic Eden, where you can also see the rarity level of each Solarian NFT. These NFTs trade for Solana’s native token, SOL, and prices vary from 1.754 to 6,450 SOL.

4. SolFarm (Tulip)

Tulip Protocol or Tulip Garden, formerly SolFarm, is a crypto yield aggregator offering auto-compounding vault strategies.

SolFarm’s (TULIP) main features are:

- Low fees

- High-speed transactions

- Additional profits from high APYs

- Supported vaults on Saber, Raydium, and Orca

- Leveraged yield farming

SolFarm was launched in the spring of 2021 by an anonymous team, and the members go under the nicknames “Momo,” “senx,” “therealssj,” and “post.” They wish to keep their identity anonymous to preserve their privacy.

SolFarm (Tulip) raised $5 million during a private token sale funding round led by Jump Capital and Alameda Research and with the participation of Amber Group, Cadenza Ventures, CMS Holdings, FinTech Collective, and others.

In June 2021, SolFarm won the Solana Season Hackathon, establishing itself as one of the top Solana projects.

SolFarm protocol (Tulip Garden) has a total value locked (TVL) over $700 million. The platform’s native token, TULIP, is designed to grant holders on-chain governance. TULIP offers governance over the platform, and holders will be able to vote on matters such as:

- Platform fees

- Treasury usage

- Protocol improvements

- Pool reward weighting

SolFarm (TULIP) has a total market cap of $819,573. The current circulating supply is 815,206 TULIP. The maximum supply is 10 million TULIP.

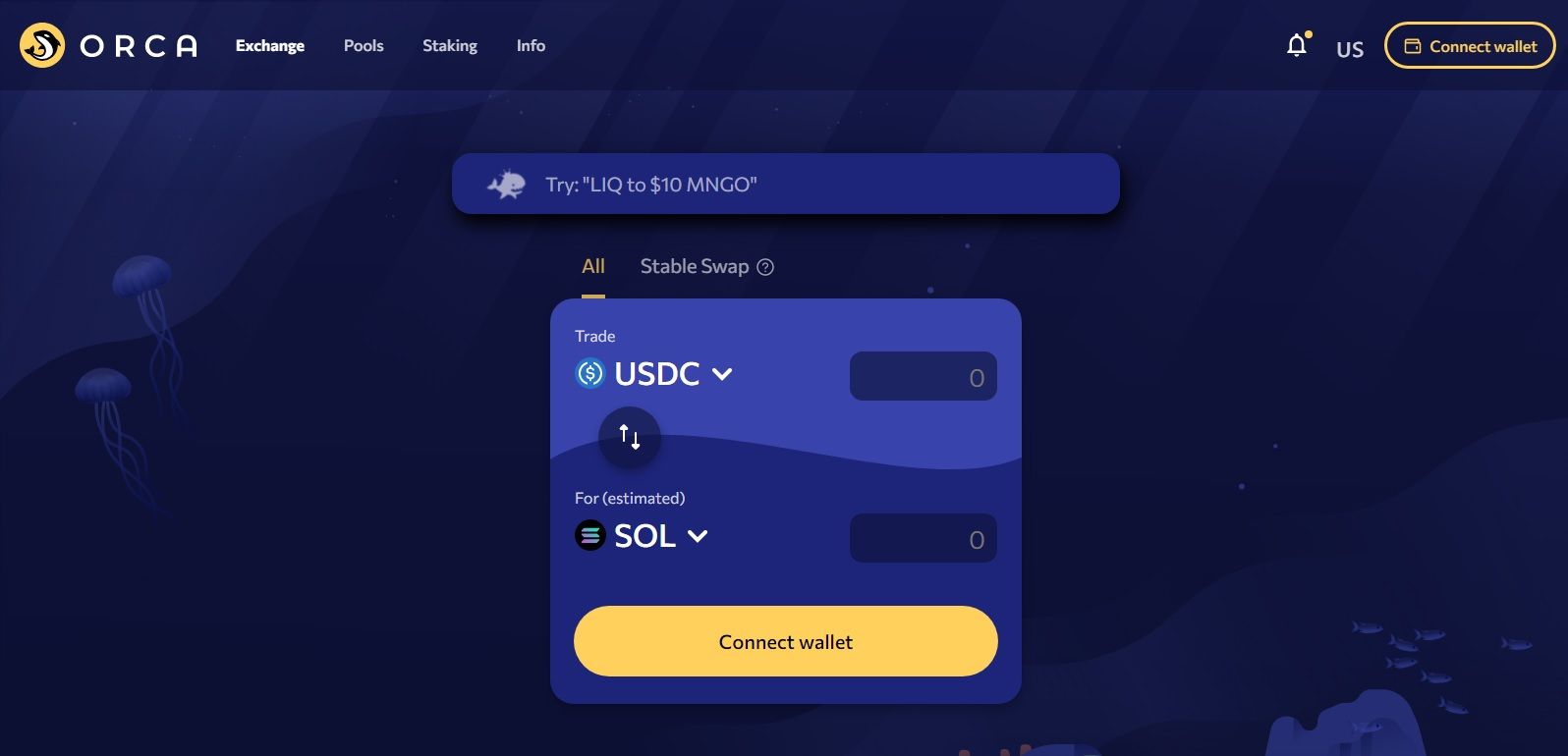

5. ORCA

ORCA is an automated market maker (AMM) decentralized exchange (DEX) with its own liquidity pool. Traders can use Orca to swap tokens, and crypto enthusiasts and project supporters can create their own Orca liquidity pools. The exchange has easily become one of the top DEXs in all of crypto.

Orca is one of the top Solana projects and takes advantage of the inherent benefits of the network. The exchange allows fast trades that take less than one second, and the gas fees are around a fraction of a cent. To incentivize liquidity providers (LPs), the exchange rewards 0.3% of the trading fee to the liquidity pool.

Orca has three main features for cryptocurrency investors and traders:

- Token Swaps: Users can use Orca to swap tokens using the DEX’s liquidity pools

- Liquidity Pools: LPs can contribute to the pools and receive a percentage of the trading fees generated by swaps

- Yield Farming (Aquafarm): Some of the liquidity pools on Orca will become Aquafarm, allowing LPs to earn trading fees and ORCA tokens. Other projects will be able to add their tokens in the future.

Orca’s native token, ORCA, is a utility token. This rewards LPs in the liquidity pools and grants governance voting rights. ORCA has a total market cap of $114 million. The current circulating supply is 49,990,353 ORCA.

6. Star Atlas

Star Atlas is a blockchain multiplayer exploration game built on the Solana ecosystem. This game aims to build a metaverse with an open economy, in which players can enjoy absolute freedom and earn ATLAS tokens while playing.

The game claims to provide “a universe of opportunities.” The game has a dual economy, relying on $ATLAS for the in-game currency and $POLIS for the governance of the Star Atlas DAO structure. Within the game, players are rewarded with ATLAS and NFTs.

The game is set in the future, in 2620, and the control is split between three fractions ━ : humans, androids, and aliens. What sets Star Atlas apart from other massively multiplayer online games is that it is based on blockchain, and you truly own what you get and earn in the game.

ATLAS is currently trading at $0.004867 and has a market cap of $76 million. The current circulating supply is 15 billion ATLAS. The maximum supply is 36 billion ATLAS. POLIS is trading at $0.27 and has a total market cap of $68 million. The current circulating supply is 248,789,502 POLIS, and the maximum supply is 360 million POLIS.

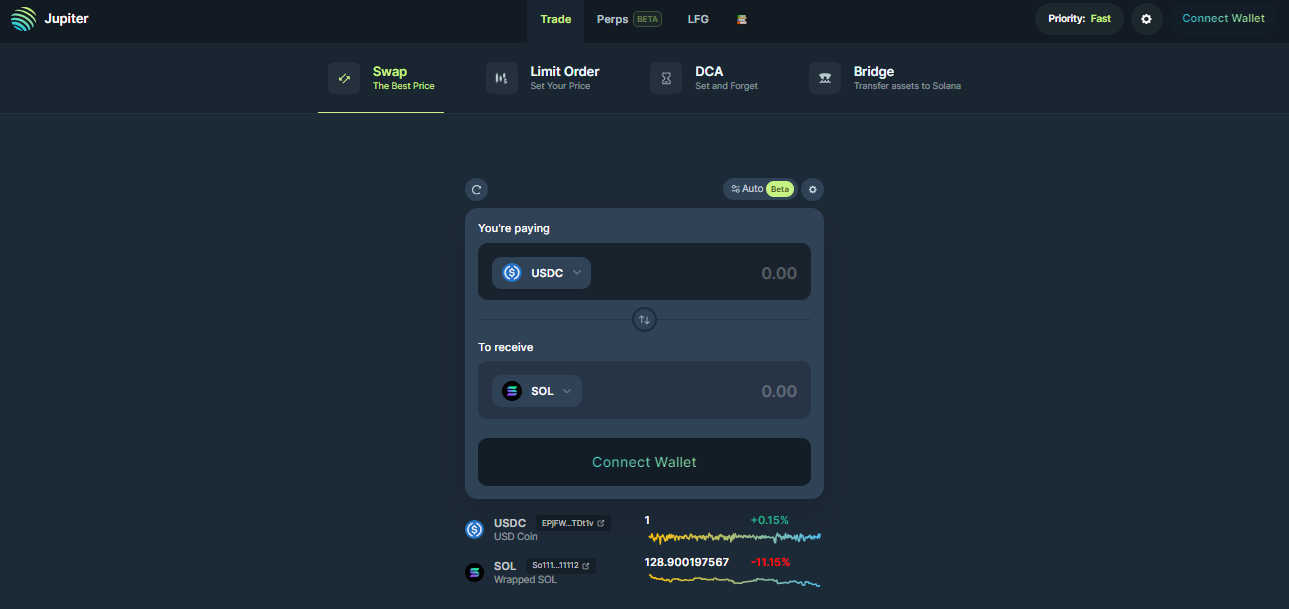

7. Jupiter (JUP)

The Jupiter exchange is a DEX aggregator that was developed by an individual or group known pseudonymously as Meow on X (formerly known as Twitter). The platform initially focused on sourcing favorable pricing across various DEXs. Over time, Jupiter’s functionalities have expanded.

Users of the platform now have access to an array of services including trading perpetual contracts, scheduling dollar cost averaging (DCA) investments, placing limit orders, bridging assets over to Solana, and utilizing a fiat currency gateway.

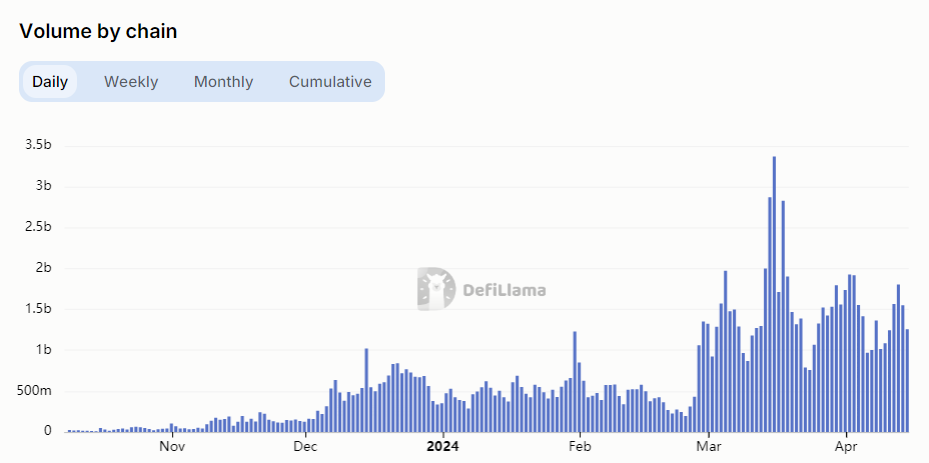

JUP is the utility and governance token of Jupiter. It allows holders to participate in the decision-making process, giving them a voice in the governance and direction of the platform’s future. JUP, launched on January 31, 2024. Since its launch, the aggregator has achieved a 24-hour volume of $1.25 billion as of April 16, 2024.

Solana projects are disrupting the crypto market

Since the launch of the network’s mainnet in March 2020, many interesting and viable Solana projects have been launched on the network. The hundreds of projects on Solana chose this platform because it is a scalable blockchain solution with cheap transaction fees.

The success of the Solana projects drove the price of SOL to a new all-time high price in November 2021. The cost-efficiency of Solana brings more Dapp developers to the network daily, widening its ecosystem and growing the overall Solana community. As such, Solana remains in competition with Ethereum, the market’s leading smart contract platform.

Frequently asked questions

The top Solana projects include DEXs, NFTs collections, DeFi applications, and blockchain games. The most popular projects built on Solana are Serum, Mango Markets, Solarians, SolFarm (Tulip), Orca, and Star Atlas.

Solana (SOL) powers the Solana blockchain, and it’s used as payment for the network’s services. SOL also serves a staking purpose to ensure the decentralization and validity of the blockchain and acts as a governance token.

Solana is one of the fastest smart-contract blockchains open for developers. The network can operate up to 400,000 transactions per second (TPS), according to the test on the beta mainnet.

The best projects on Solana depends on the particular sector. Render has the largest market cap for DePIN projects on Solana. WIF has the largest market cap for meme coins, whilw Raydium has the highest 24-hour trading volume for DEXs.

The best Solana token depends on your personal investment strategy and the token’s usage. The top projects on Solana by market cap are Tether, Solana, Chainlink, Render, and dogwifhat. However, Solana is the utility coin used to pay for transactions on the blockchain. Therefore, it will always have some level of demand.