As countless DeFi tokens flood the market, identifying those that offer genuine value for holders can be a difficult task. Many lack real utility and unique properties. The Nereus token (NRS) breaks this pattern, striking an attractive balance between utility and user rewards.

Built to facilitate secure, transparent, and user-friendly trading, Nereus combines high leverage and real-yield rewards. This guide covers everything you need to know about the native token of the Nereus ecosystem in 2025.

KEY TAKEAWAYS

➤ Nereus token (NRS) powers a DeFi ecosystem with staking rewards, governance, and real-yield incentives, ensuring active community engagement.

➤ Partnerships, such as with Wirex, allow Nereus to combine CEX-like usability with DeFi transparency, offering unique advantages for traders.

➤ NRS tokenomics include structured vesting and lock-up schedules, supporting long-term stability and sustainability in the platform’s growth.

What is Nereus token?

The Nereus token (NRS) serves as the lifeblood of the Nereus Finance ecosystem, facilitating unique benefits and a smooth trading experience.

NRS is specifically designed to fuel Nereus Finance’s decentralized finance (DeFi) offerings, from high-leverage trading to staking rewards.

Through staking and governance features, the Nereus token directly connects users to the platform, allowing them to earn rewards and have a voice in decision-making.

Understanding the Nereus Finance ecosystem

Nereus Finance is a Polygon blockchain-based ecosystem that looks to bridge the gap between centralized exchanges (CEX) and decentralized finance (DeFi).

At its core, Nereus provides a suite of financial tools and products that deliver the transparency of DeFi with the ease and user experience of CEX. Here’s a breakdown of the key pillars that make the platform tick.

CEX-like user experience

Imagine moving across the DeFi space as easily as using your favorite social media app. That’s the Nereus approach to user experience.

By incorporating features like social logins and gasless transactions, Nereus removes the complexities of DeFi while keeping it decentralized. Features include:

- 1-click trading: Just like shopping with a single tap, you can initiate trades in an instant, saving time and avoiding missed opportunities.

- Gasless transactions: Nereus eliminates gas fees on transactions, letting you focus on trading rather than worrying about additional costs.

- Social logins: Start trading without extra setup; connect using social accounts, making it quick and hassle-free.

Diverse trading opportunities

Nereus acts as a global marketplace with sections for everything you might need — from crypto to commodities. The platform’s wide range of assets makes it versatile enough to suit all types of traders. Here’s what stands out:

- Up to 70x leverage: Unlike most platforms, which max out at 50x, Nereus allows you to supercharge your trades with up to 70x leverage.

- Multiple asset types: From crypto and forex to commodities and prediction markets, Nereus lets you diversify your portfolio within a single platform.

- Instant execution with low fees: Avoid the slowdowns and price impacts typical of other platforms. Nereus ensures near-instant trade execution with minimal fees.

Transparency and security

Trading transparency is like seeing the ingredients on a food label — you know exactly what you’re getting. Nereus puts transparency at the forefront by recording every transaction on-chain, which means every trade is visible and verifiable. Here’s how the platform prioritizes safety without sacrificing speed:

- On-chain settlements: Every transaction goes on the blockchain, ensuring full transparency and security.

- ZK-powered layer-2 scalability: Built on Polygon’s layer-2 technology, Nereus reduces transaction costs and enhances scalability for a seamless trading experience.

Did you know? Nereus Finance uses the Polygon Chain Development Kit (CDK) as part of its infrastructure. This integration brings in the power of zero-knowledge (ZK) technology, allowing faster transactions, reduced fees, and enhanced scalability. By using Polygon CDK, Nereus ensures that every trade is securely settled on-chain, combining the efficiency of a CEX-like experience with the transparency of DeFi.

- Enhanced data privacy: Zero-knowledge proofs ensure that while transactions are recorded, sensitive details remain secure.

“Nereus isn’t just about offering more trading options; it’s about redefining what users should expect in terms of transparency and security in the DeFi space. Our mission is to set new standards that combine DeFi’s transparency with the user experience of traditional CEX platforms.”

Yves Renno (Nereus advisor)

At the heart of the ecosystem lies the Nereus token (NRS) — the enabler that ties everything together. Whether it’s empowering governance decisions, fueling staking rewards, or providing real-yield benefits, NRS ensures that every element of the Nereus experience runs smoothly.

What makes the Nereus token unique?

The Nereus Token (NRS) is carefully structured to offer real utility, encourage active participation, and align closely with Nereus Finance’s user-first vision. Let’s explore what makes NRS stand out and how it adds value to users across the ecosystem.

Dual rewards mechanism for stakers

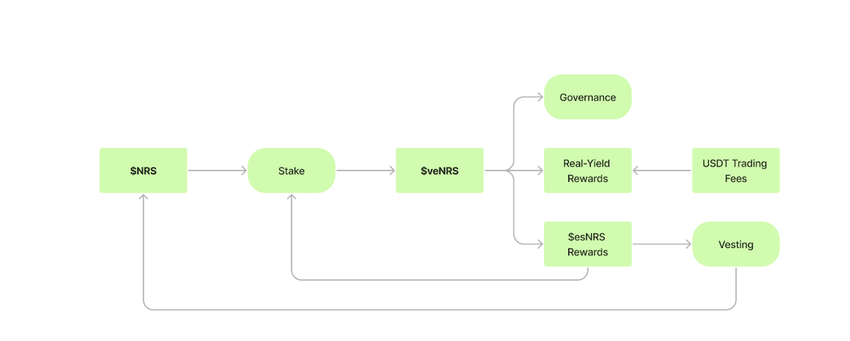

One of the most appealing aspects of the Nereus token is its dual rewards system, which gives stakers a choice and adds layers to their rewards.

- Real-yield rewards in USDT: Stakers of NRS earn a portion of the platform’s trading fees, which are paid out in USDT. This is no ordinary yield; it’s directly tied to the platform’s trading volume. Essentially, the more the platform thrives, the more stakers benefit. To put numbers into perspective, 80% of the platform’s daily trading fees are redistributed to veNRS token holders. That’s a solid passive income stream that scales as Nereus grows.

- Escrowed NRS (esNRS) rewards: In addition to real-yield USDT rewards, stakers can also earn in esNRS, a token that’s designed to reinforce the ecosystem. This dual approach encourages users to hold onto their earnings for long-term value while keeping the token economy balanced and sustainable.

The escrow model used for esNRS helps maintain token stability by preventing sudden market saturation. This means your rewards grow, while the value of the ecosystem remains strong.

Flexibility with staking periods and augmentations

The ecosystem’s staking structure is particularly flexible, catering to both long-term holders and short-term participants.

- Customizable staking periods: Users can lock their NRS for periods ranging from 1 to 104 weeks. The longer you stake, the more veNRS you receive, amplifying your earning potential.

- Mid-period augmentation: If you decide to add more NRS midway through your staking period, your veNRS count is adjusted based on the remaining lock duration. This approach accommodates evolving strategies and provides more control over staking outcomes.

Governance with quadratic voting

In many DeFi projects, governance often favors large token holders. However, Nereus Finance uses a quadratic voting model to ensure fairer participation in the governance process.

- Unlike traditional voting, where power scales directly with the number of tokens held, the quadratic model grows at a slower pace. In other words, holding twice as many tokens doesn’t give you twice the voting power. This setup prevents “whales” from monopolizing decisions and encourages a more democratic community-led governance.

Did you know? Quadratic voting is like giving everyone a voice, not just the loudest in the room. This voting model helps distribute decision-making power across the community, making governance more inclusive.

APR cap mechanism

To prevent hyperinflationary pressures that might devalue NRS, Nereus Finance has introduced an APR cap mechanism.

- APR limit of 50%: Stakers can earn rewards up to a maximum of 50% APR. By capping the APR, Nereus ensures that returns remain sustainable and the token economy doesn’t become oversaturated with rewards. This mechanism protects the long-term value of NRS, keeping incentives meaningful without compromising stability.

Staking and vesting flexibility

The $NRS token also offers flexible staking options and early vesting exits.

- Early vesting exit option: Need your staked tokens earlier than anticipated? Nereus offers an early exit option. While there’s a financial penalty, this feature ensures that users have an option for liquidity without being completely locked out.

Strong utility and ecosystem integration

The $NRS token is not just a tool for staking or governance. It serves as the glue that binds the entire Nereus ecosystem.

- Platform fee redistribution: With 80% of daily trading fees flowing back to veNRS holders, NRS holders benefit directly from the platform’s success.

- Seamless ecosystem engagement: Nereus has made NRS integral to platform activities, allowing users to engage in multiple facets like governance, staking, and rewards.

Tokenomics designed for long-term growth

Nereus has carefully structured NRS’s tokenomics to support its long-term growth and sustainability.

- Vesting and lock-up periods: The token allocation and vesting schedules are designed to incentivize both early adopters and long-term investors. For example, team tokens have a vesting period of 12 months with a cliff, which aligns the team’s interests with the platform’s health and longevity.

- Liquidity and incentive programs: A portion of NRS tokens is reserved for liquidity and incentives, ensuring that the ecosystem remains active and appealing to new users.

Did you know? The vesting periods and carefully balanced token allocation create a stable foundation for NRS, making it less vulnerable to speculative swings and more focused on long-term sustainability.

Tokenomics and distribution of NRS

While we’ve explored the many NRS utilities within the Nereus Finance ecosystem, let’s examine the numbers that make it all work in more detail. It’s not just about staking and governance — it all boils down to how the tokenomics are designed for traders, early adopters, and the Nereus team alike.

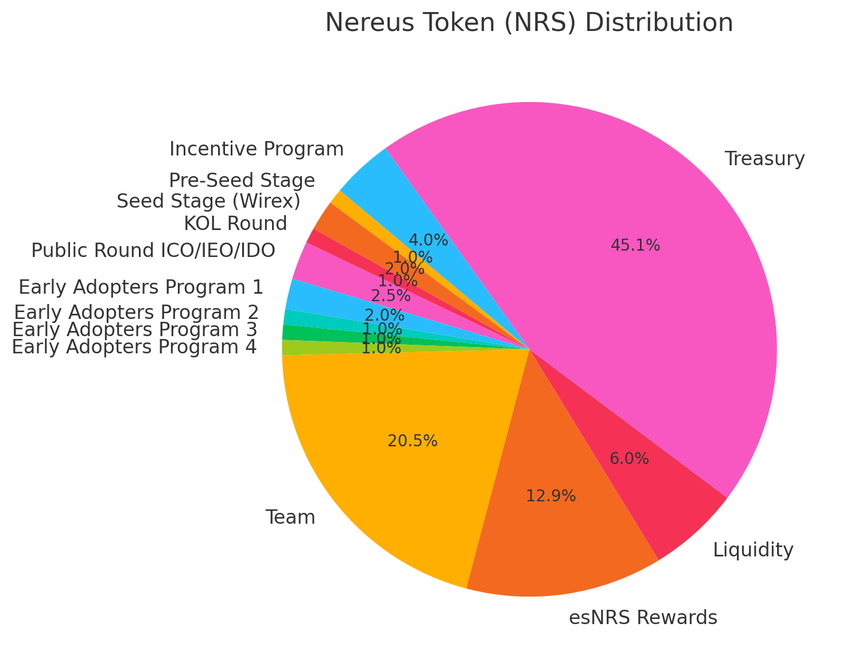

Token allocation

The NRS token is spread out in a way that balances growth, rewards, and stability. Here’s how it all stacks up:

- Pre-seed stage: 1% of the total supply (10 million tokens) was set aside for the earliest believers.

- Seed stage (Wirex): Another 2% (20 million tokens) to back Nereus with a solid foundation supported by Wirex.

- KOL round: 1% (10 million tokens) is allocated to key opinion leaders who are spreading the word.

- Public round ICO/IEO/IDO: For the public, 2.5% (25 million tokens) is up for grabs.

- Early adopters programs: Spread across multiple phases, 4% in total for those who joined the Nereus mission early on.

- Team allocation: A significant 20.5%, acknowledging the team’s dedication to building and growing this ecosystem.

- Rewards and incentives: 4% goes toward esNRS rewards, 6% for liquidity, and a hefty 45.14% is reserved for the treasury.

Vesting and lock-up periods

Nereus has crafted a well-thought-out release strategy for NRS, ensuring tokens don’t instantly flood the market but rather trickle out at a sustainable pace. Here’s the lowdown:

Early-stage allocations

- Pre-seed stage: Tokens have a three-month lock-up followed by a six-month daily linear vesting. They are slowly released to ensure excitement steadily grows.

- Seed stage (Wirex): Wirex-backed tokens get a six-month lock-up, then vest over the next 12 months.

- KOL round: Influencers have their tokens locked up, with vesting details still under wraps but coming soon.

Public round distribution

For the public, here’s how the numbers shake out:

- Public sale allocation: 2.5% of the total NRS supply, with tokens priced at $0.03 each.

- Initial market cap: NRS hits the ground running with a $300,000 market cap at TGE, excluding liquidity.

- Vesting schedule: 40% of these tokens unlock at TGE, with the rest trickling out daily over a three-month period. There are no sudden dumps here — just a steady flow.

Treasury and incentive allocation

A huge chunk of NRS is tucked away for long-term goals and rewards:

- Treasury: A whopping 45.14% is held for treasury purposes, fueling future growth and development.

- Incentive programs: 4% is reserved to keep users engaged and excited — whether through rewards or community incentives.

Benefits of holding and staking Nereus token

Holding and staking Nereus token (NRS) isn’t just about token accumulation; it’s about accessing an entire suite of perks and financial benefits within the Nereus Finance ecosystem. Here’s why NRS holders could potentially stand to gain both short-term rewards and long-term value.

Real Yield Rewards in stablecoins (USDT)

Staking NRS unlocks Real Yield rewards. These are directly tied to Nereus Finance’s trading fees. Here’s how it works:

- 80% of daily trading fees are redistributed back to holders in USDT, creating a steady income stream based on platform performance.

- As Nereus grows and trading volume increases, so do the potential rewards, making this an attractive, performance-based incentive for stakers.

esNRS rewards for increased ecosystem value

Beyond stablecoin rewards, stakers also receive yields in esNRS, an escrowed version of NRS:

- esNRS reinforces ecosystem circulation, contributing to token stability by keeping a portion of rewards locked.

- With an APR cap mechanism that maxes out at 50%, inflationary risks are mitigated, preserving long-term value and preventing excessive market saturation.

Flexibility with staking and vesting

Nereus provides stakers with a range of options that accommodate both short-term and long-term holders:

- Flexible staking periods: From one week to 104 weeks, users can select their preferred lock-up period.

- Mid-period adjustments: Need to add more NRS midway? No problem. You can increase your stake at any point, with veNRS calculations dynamically adjusting to the remaining lock duration.

- Early exit option: An option for early vesting withdrawal lets users access vested rewards before the term ends, with a small penalty, offering liquidity flexibility.

Long-term value and stability through DAO governance

Holding and staking NRS isn’t only about financial rewards; it also gives users voting rights within the ecosystem:

- The quadratic voting model ensures that a few large holders don’t monopolize governance. This empowers the broader community to make impactful decisions.

- NRS holders will shape Nereus’s development and strategic direction, adding intrinsic value and making it a genuinely user-driven ecosystem.

Strategic benefits and sustainability

By syncing the rewards model with platform performance, Nereus ensures sustainable tokenomics:

- Performance-based incentives like Real Yield Rewards tie earnings to actual platform success, fostering a cycle of user growth and rewards.

The escrow model helps maintain token value and prevents volatility, creating a stable environment for long-term holders.

Did you know? Nereus’s staking model, which allows mid-period adjustments and early exits, was crafted specifically to balance flexibility with sustainability — a rare feature in DeFi staking models.

Where to purchase Nereus token (NRS)?

Understanding where and when the Nereus Token (NRS) will be listed is crucial for potential investors. As of Nov. 11, 2024, Nereus Finance is available to trade on MEXC. The token will soon be available on several more exchanges.

Is the Nereus token a solid choice?

With its attractive staking rewards, transparent governance, and strategic partnerships (like Wirex), the Nereus token aims to provide long-term value for holders. The platform’s emphasis on transparency, supported by on-chain settlements and security features, makes it a compelling option. However, note that this is a new token in a demonstrably volatile and unpredictable market. Profits are never guaranteed, so you should never invest more than you can afford to lose.

If armed with this knowledge, you’re still eyeing the Nereus token, make sure to consider its ecosystem benefits, real-yield rewards, and future growth potential when making a decision. Remember, it’s all about weighing the value Nereus brings to the table.

Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Proceed with caution when investing in any cryptocurrency.