The shopping experience’s gamification has been in the works for a long time. Every supermarket chain now has a shopping points system on mobile websites to reward customer loyalty with cheaper prices. Assemble Protocol (ASM) aims to evolve this pre-digital tradition, in which these points can be tokenized and used as a payment method. This detailed guide will help you find out if ASM is the next big blockchain project with valuable utility.

KEY TAKEAWAYS

➤ Assemble Protocol unifies fragmented reward points into a single asset and enables their use as digital payments.

➤ Assemble Protocol supports point exchange, a marketplace, and data insights to optimize loyalty programs.

➤ ASM tokens can be converted, staked, or used for value transfer.

➤ $ASM can be bought on major exchanges like Coinbase, Uniswap, and Gate.io for easy access.

Assemble Protocol: An overview

Assemble Protocol is a South Korean blockchain project leveraging the expertise of STA1.COM and ClubPass.

Together, these companies identified that a significant portion of the Korean rewards points market was underutilized.

Since the inception of the Korean Point Reward system for airline mileage points, it has spread to all major industries. The bulk of these points have accumulated within the credit card ecosystem.

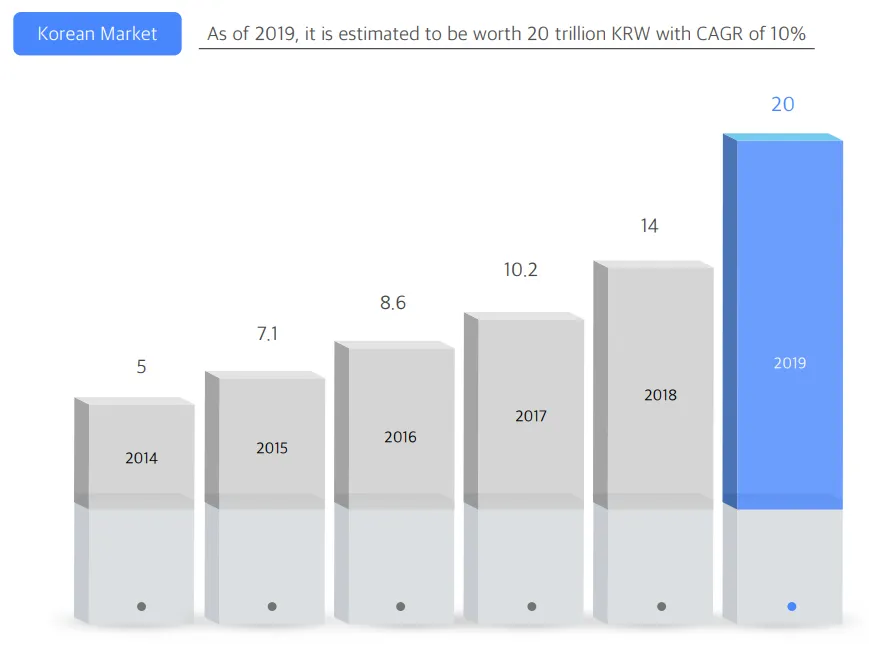

As you can see from the image below, the Korean e-commerce points system reached 20 trillion won (KRW) in 2019. However, according to the Japanese Yano Research Group, this is ten times smaller than the Global Point Market, estimated at 200 trillion won.

The question was how could one earn these points?

For instance, Hab Korea, a notable Korean tour company, rewards points for several interactions. This includes daily visits, website comments, magazine subscriptions, and engaging in the comment sections under articles. In the payments industry, cashback rewards are a regular occurrence at department stores and gas stations.

These are just some of the hundreds of examples that you must have experienced yourself. Reward points have become a staple for e-commerce to increase consumer loyalty and give them a way to manage their budgets. However, they are all inefficiently dispersed across these ecosystems.

The goal of the Assemble Protocol is to unify these reward points onto a single blockchain platform via ASM tokens, which can then be used for monetization.

Assemble Protocol’s core features

To unify global reward points across e-commerce systems, Assemble Protocol uses a blockchain protocol. This runs on Ethereum and connects to the three pillars of e-commerce:

- Point Providers (enterprises previously mentioned)

- Point Consumers (customers serviced by enterprises)

- Retailers (both individuals and enterprises to use for their sales channels and advertising tools)

Effectively, the Assemble Protocol is a highway for these, tokenizing these into a single asset, the Ethereum-based ASM token. This way, the protocol creates a valuable, single-point resource without time constraints and other limitations imposed by the currently dispersed Korean Point Market (TAM).

Aside from this core feature, Assemble Protocol gives point providers an infrastructure to build data management systems, which encompasses developing advertising strategies. Additionally, enterprises can use the protocol to create customer inflow channels.

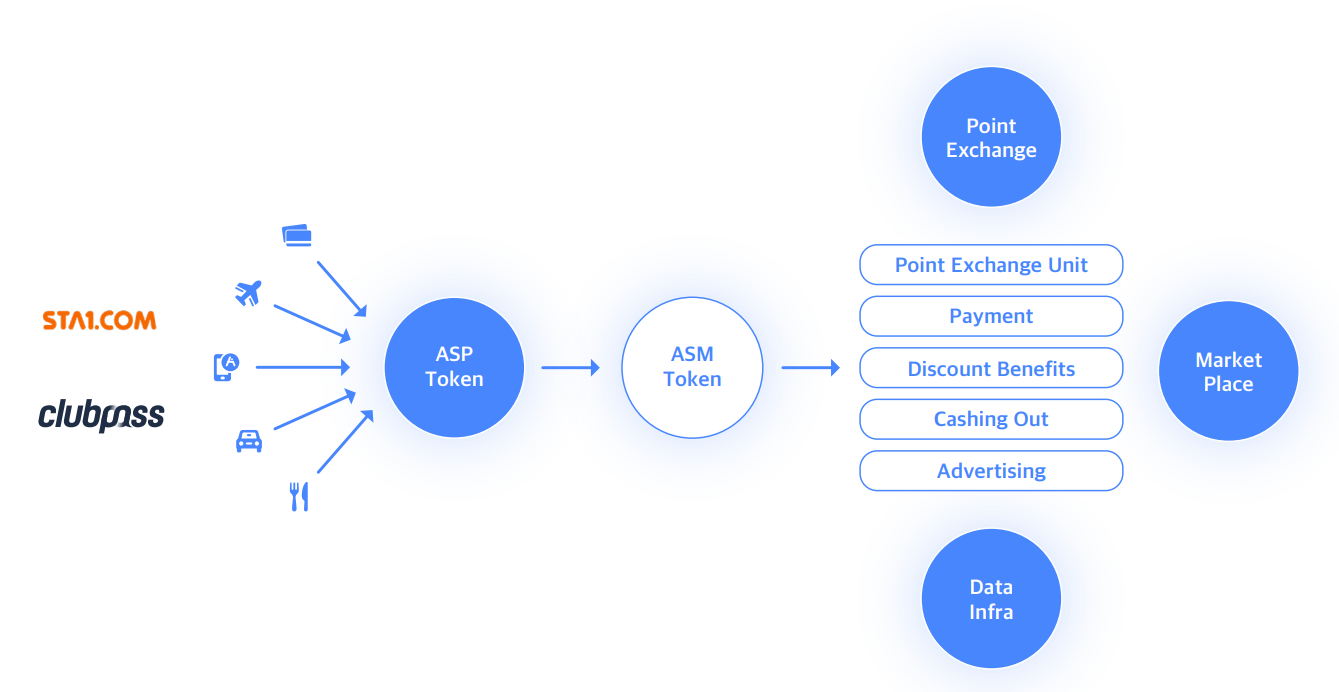

At the same time, customers can, at any time, convert their rewards into ASM tokens. Accordingly, Assemble Protocol consists of the following key elements:

- Point Exchange (XP) — Integration and exchange of reward points into ASP (Assemble Point). ASP represents the unification and tokenization of all the incoming reward points. In turn, they can then be converted into ASM tokens.

- MarketPlace (MP) — Online market where ASP can be used to buy goods or services provided by Assembly Protocol’s partners.

- Data Infra (DI) — Assembly Protocol users can take advantage of DI’s modeling of consumer behavior, giving them access to databases.

In a nutshell, the Assembly Protocol prevents the loss of millions of rewards points every year. After tokenization into ERC-20 based ASM tokens, users can exchange these for cash. That is, after they have been first converted from external reward points into ASP (Assemble Point).

The role of the ASM and ASP tokens

The rewards points unification protocol has a maximum supply of 1.35 billion ASM tokens. Presently, about 680 million are in circulation, which is 50.37% of the total supply. The ASM token is both a utility and a staking token.

As is the case with other altcoins, ASM’s price is subject to free-market forces. ASM coin holders can stake them within the Assembly Protocol platform. In return, they gain discounts on various services provided by the platform’s partners.

When it comes to utility, ASM tokens have a wide use range:

- Point consumers can redeem ASM tokens for cash.

- Point providers can use them for staking to facilitate the Point Exchange (XP)

- Merchants and MP sellers can use AMS tokens to trade on the Marketplace.

- Point consumers can stake ASM tokens to increase their rating, in order to receive more benefits — events, discounts, gift cards, coupons, etc.

- Point providers and merchants can use ASM tokens to pay for ads on the Assemble Protocol platform.

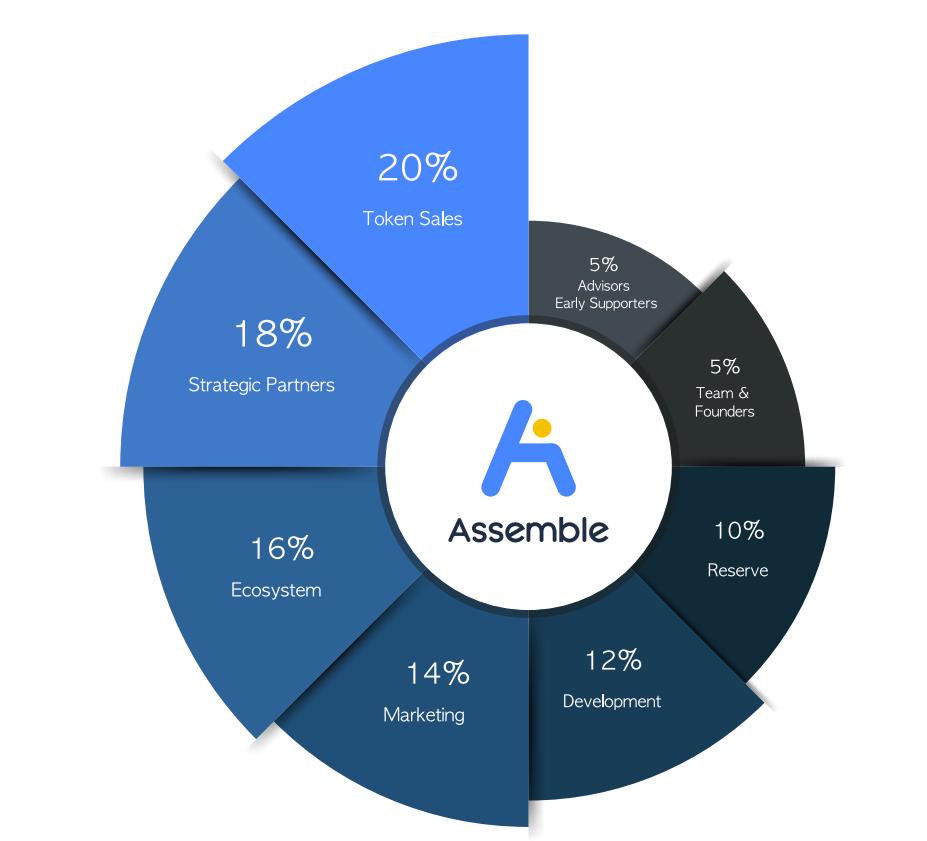

Alongside ASM tokens, ASP (Assemble Point Token) represents the first step, as the Unified Loyalty Point. 1 ASP has a fixed value of 1 KRW ($0.00085). Unlike the ASM token, ASP is only utilized within the Assemble Protocol platform. In chart form, this is how ASM tokenomics looks like:

As for the ASM token distribution, the other 50% of supply went into the following categories in order to fund the project:

Should you buy ASM?

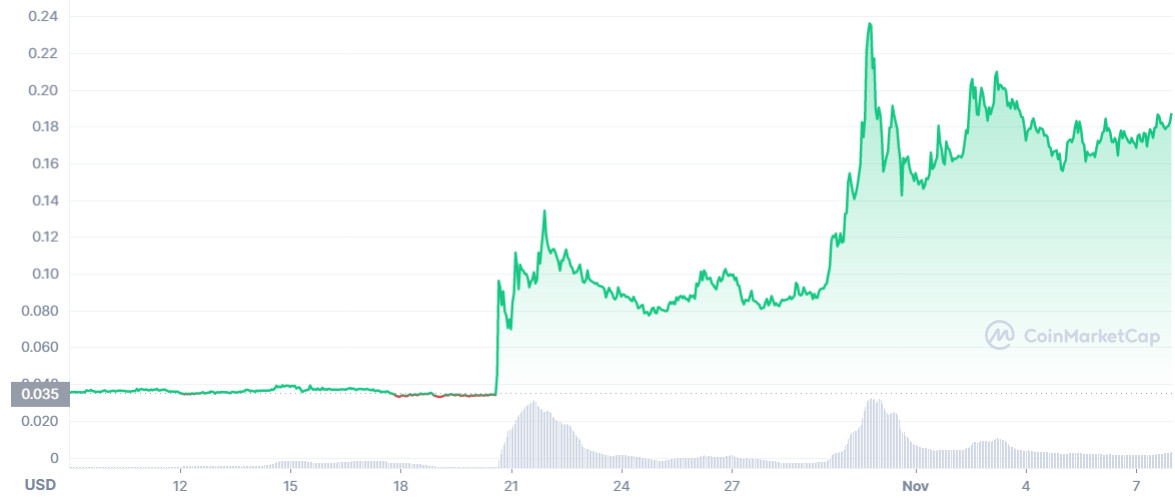

Since the ASM token’s launch on October 20th, it has seen a steady rise, with its ATH price hitting $0.2361 on October 30, which was a 145% increase. Presently, it stabilized at around $0.1872.

The project’s success depends on how many partners it can bring into its points unification ecosystem. So far, this list is impressive, starring well-known blockchain Venture Capitalist (VC) firms such as Blockchain Ventures and AKG Ventures. Likewise, Oracle is one of the industry leaders in cloud computing and data management, with a market cap of nearly $260 billion.

If the team continues to link up with such formidable partners, ASM should see a steady rise. No doubt, the core concept is sound.

Assembly Protocol is a natural evolution of the rewards point system, transforming the points into a permanent and tradeable asset. Likewise, such an asset unification platform saves businesses money, as it takes a lot of effort to create an in-house reward points system.

Where to buy ASM tokens?

ASM coins are presently available on Coinbase, the largest US crypto exchange. Additionally, you can buy them on Uniswap, Ethereum’s largest decentralized exchange (DEX), Gate.io, Coinone, and Bithumb.

Following a Binance listing, one could reasonably expect ASM price to spike, as is tradition when altcoins get listed.

When it comes to asset storage, the most convenient way would be the MetaMask wallet. MetaMask seamlessly integrates into your web browser as an extension. Then, you can connect it to Uniswap to swap them for a number of altcoins, from ETH to stablecoins.

Blockchain is ready to upend the rewards points market

The rewards points ecosystem has been around for many years. But with blockchain technology, it has the potential to reach and engage with customers like never before. It is only a matter of time before the whole ecosystem becomes tokenized, and it seems like Assemble Protocol wants to lead the way.

Frequently asked questions

What is ASM?

What is ASP?

What is Assembly Protocol’s main draw?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.