A new player is operating at the intersection of artificial intelligence and web3. Introducing AgentLayer, an autonomous AI Agent network. The completely decentralized ecosystem facilitates the coordination and collaboration of AI agents. This AgentLayer review explains everything there is to know about this blockchain-powered innovation in 2025.

To be clear, AgentLayer doesn’t host Siri, Autopilot, or any other centralized AI agents. Instead, it acts more like a one-stop shop, helping users customize, deploy, and subscribe to a proprietary AI workforce. From a long list of star-studded VC backers to its non-GPT approach, there is much to understand about this AI enigma. Let’s dive in.

- Unpacking AgentLayer

- What are the key benefits of AgentLayer?

- The AgentLayer team

- Top brands and investors connected with AgentLayer

- Diving into the AgentLayer infrastructure

- What is AgentFi, AgentLayer’s financial element?

- The utility of the AGENT token

- Other key components of the AgentLayer ecosystem

- How AgentLayer handles governance and community-based interactions

- How does the AgentLayer community work?

- AgentLayer review: APGN as the premium governance feature

- The aelf partnership

- Top projects leveraging AgentLayer’s innovation

- AgentLayer roadmap: How users can reap benefits

- Can AgentLayer be a game-changing AI innovation?

- Frequently asked questions

Unpacking AgentLayer

In brief: AgentLayer is a decentralized, intricate AI network.

AgentLayer hosts and lets developers create autonomous agents while harnessing the capabilities of a decentralized network. The idea is to create a transparent, secure, and efficient arena where AI agents can collaborate and perform tasks from the mundane to the highly advanced. This is achieved with the help of smart contracts and blockchain technology.

AgentLayer simplified

Here’s how this complex project works in simple terms. Think of AgentLayer as a group of smart robots who do their own thing. The robots can interact and work among themselves without much human help. Do note that unlike some of the other agents available on the market, like Replika and Copy.ai — which use the ChatGPT API — this project does things differently. This means that robots operating within the ecosystem have a different kind of brain altogether.

What’s unique about AgentLayer’s brain?

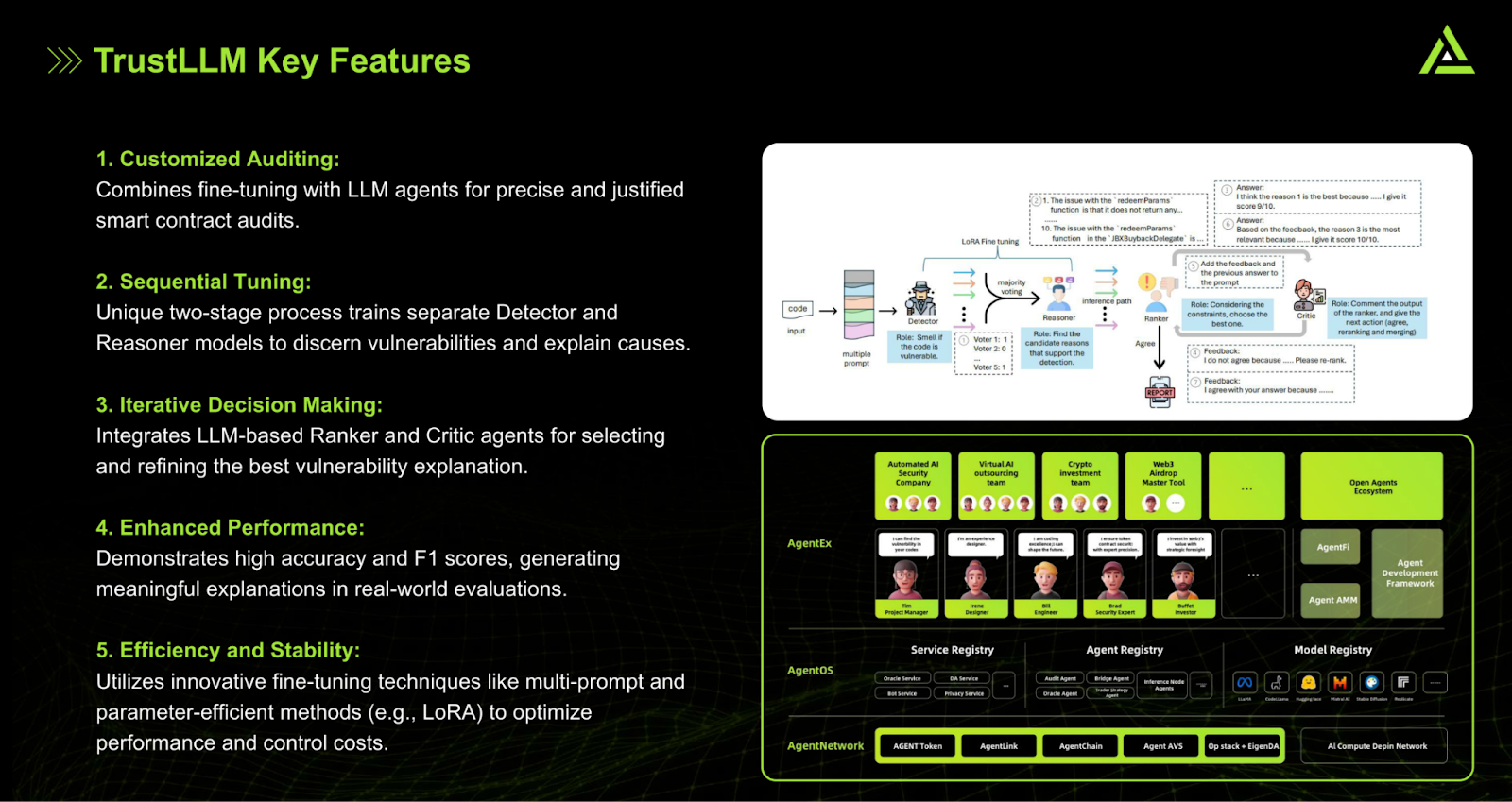

AgentLayer utilizes a unique open-source large language model, TrustLLM. The model was developed by AgentLayer’s team and adheres to top-of-the-line performance and security standards.

What are the key benefits of AgentLayer?

AgentLayer might first appear to be a form of aggregator for AI and autonomous agents. Indeed, that is one element of this ecosystem. But there is a lot more to it. Here are some aspects you need to know of from an end-user perspective.

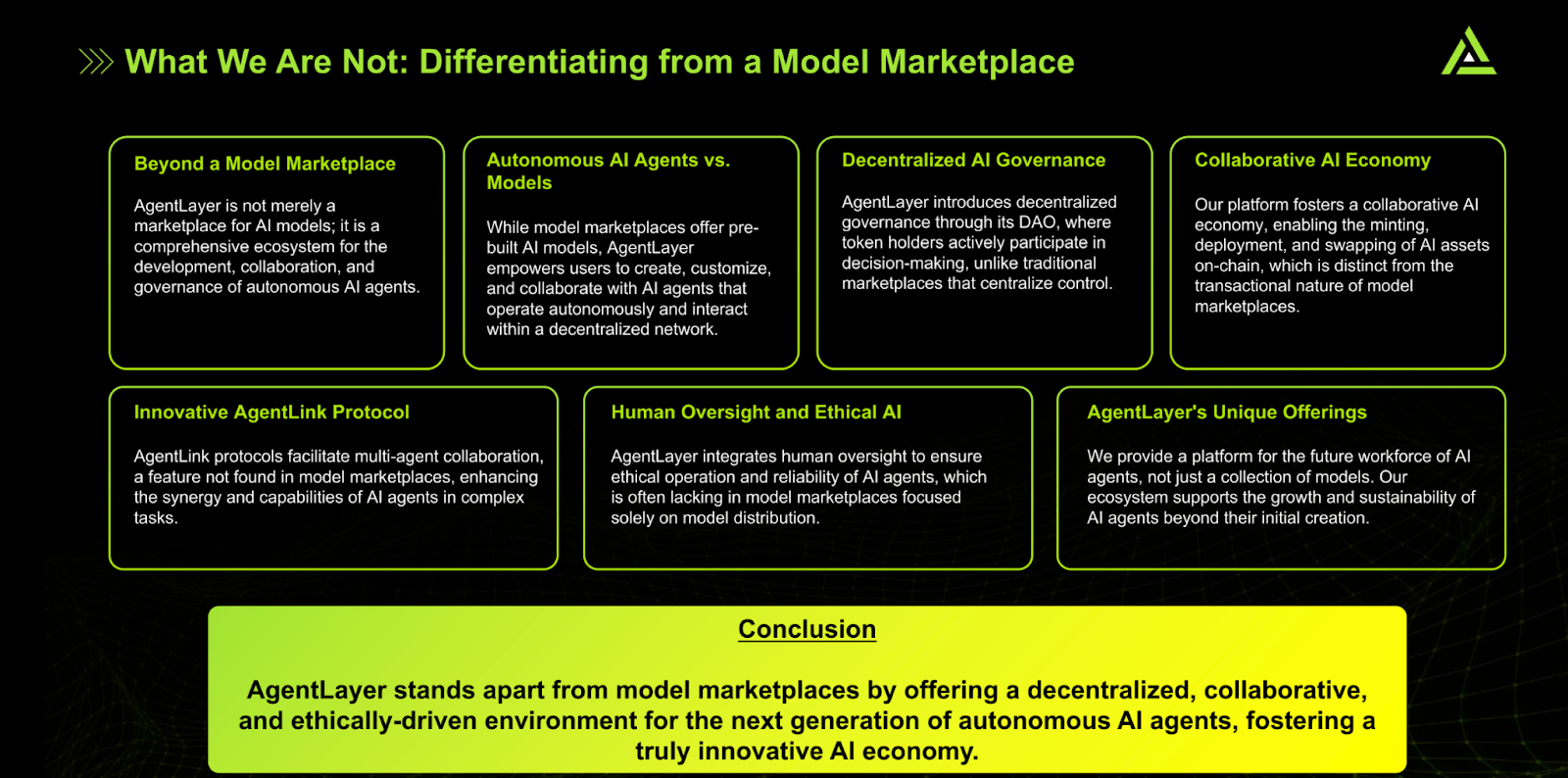

Not just a model marketplace

While model marketplaces are all about listing pre-built tools, AgentLayer goes one step further by facilitating autonomous AI agents’ collaboration and governance. While there are still pre-built AI models, much more is happening within this decentralized network.

With AgentLayer it is possible to mint, deploy, and trade AI assets on-chain. Here, registries that deal with off-chain or real-world fees can help.

Human oversight

Unlike other AI networks that try to eliminate human intervention completely, AgentLayer uses a multi-sig wallet to override anything that might challenge ethical operations and AI agent reliability.

With the recent surge in AI development and a bull run in the AI crypto space, a project like AgentLayer is highly relevant in 2024. While there are many marketplaces in existence, a network that allows for advanced collaboration between AI agents — courtesy of a multi-agent system — stands out from the crowd.

The AgentLayer team

There have been AI blockchain projects before AgentLayer, and there will be many after. However, this project is unique in the strength of its associations and backing. Let’s take a look.

Did you know? MetaTrust Labs contributes to AgentLayer’s development arc. Leading figures like Daniel Tan (Security Researcher) and Andy Deng (Product Lead) hold positions at AgentLayer and MetaLabs, paving the way for shared expertise.

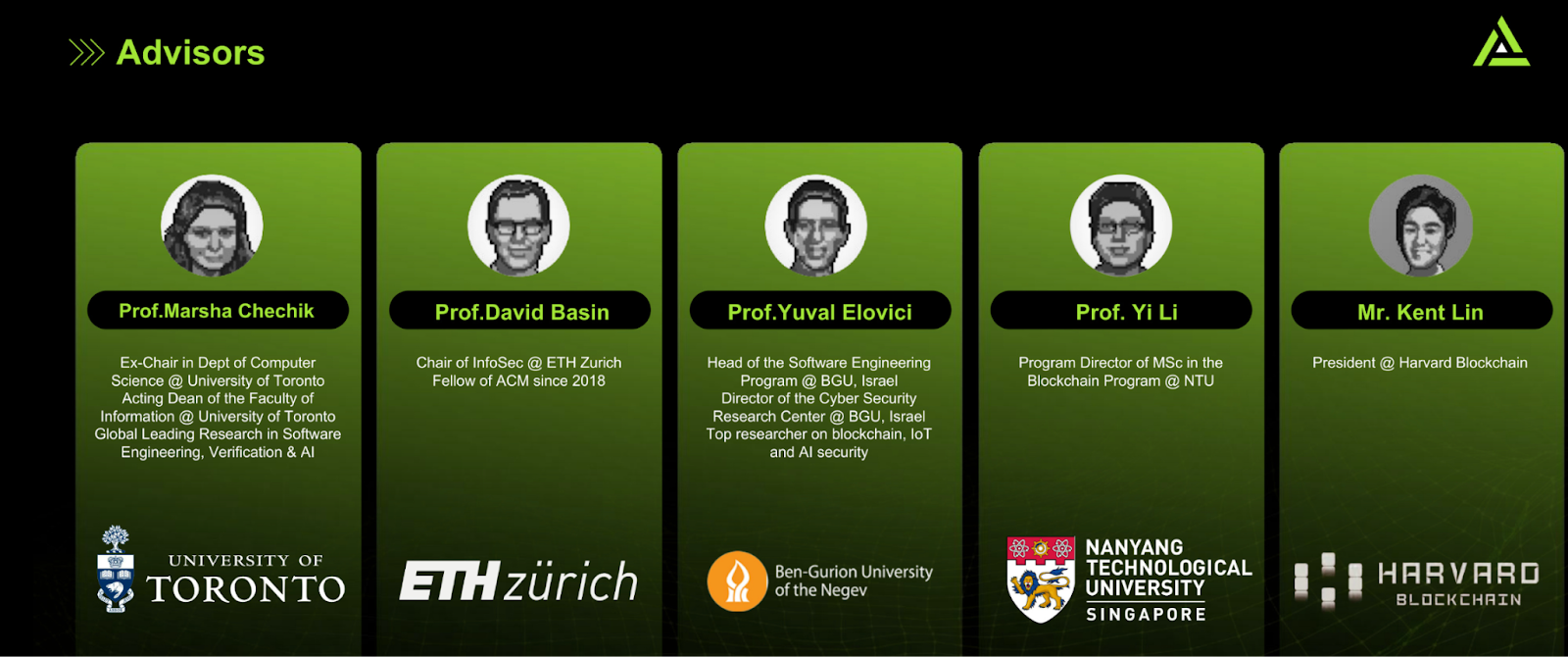

Team of advisors

AgentLayer’s team of advisors includes Prof. Marsha Chechik, Prof. David Basin, Mr. Kent Lin, and others. The team spans blockchain and IoT experts, information security stalwarts, and more.

Top brands and investors connected with AgentLayer

AgentLayer is backed by a wealth of credible brands and partners. The project is associated with a number of big names including aelf and EigenLayer.

These associations and partnerships aim to enhance AgentLayer’s scaling capabilities, the credibility of the network’s smart contracts, the quality of its infrastructure, and other operational efficiencies.

AgentLayer is backed by 21 strong VCs, including:

- Bing Ventures

- MEXC Global

- Zephyrus Capital

- Web3.com Ventures

- Redpoint Ventures

Now we have covered AgentLayer’s strong, fundamental spread, it is time to focus on the technical aspects of the network.

Diving into the AgentLayer infrastructure

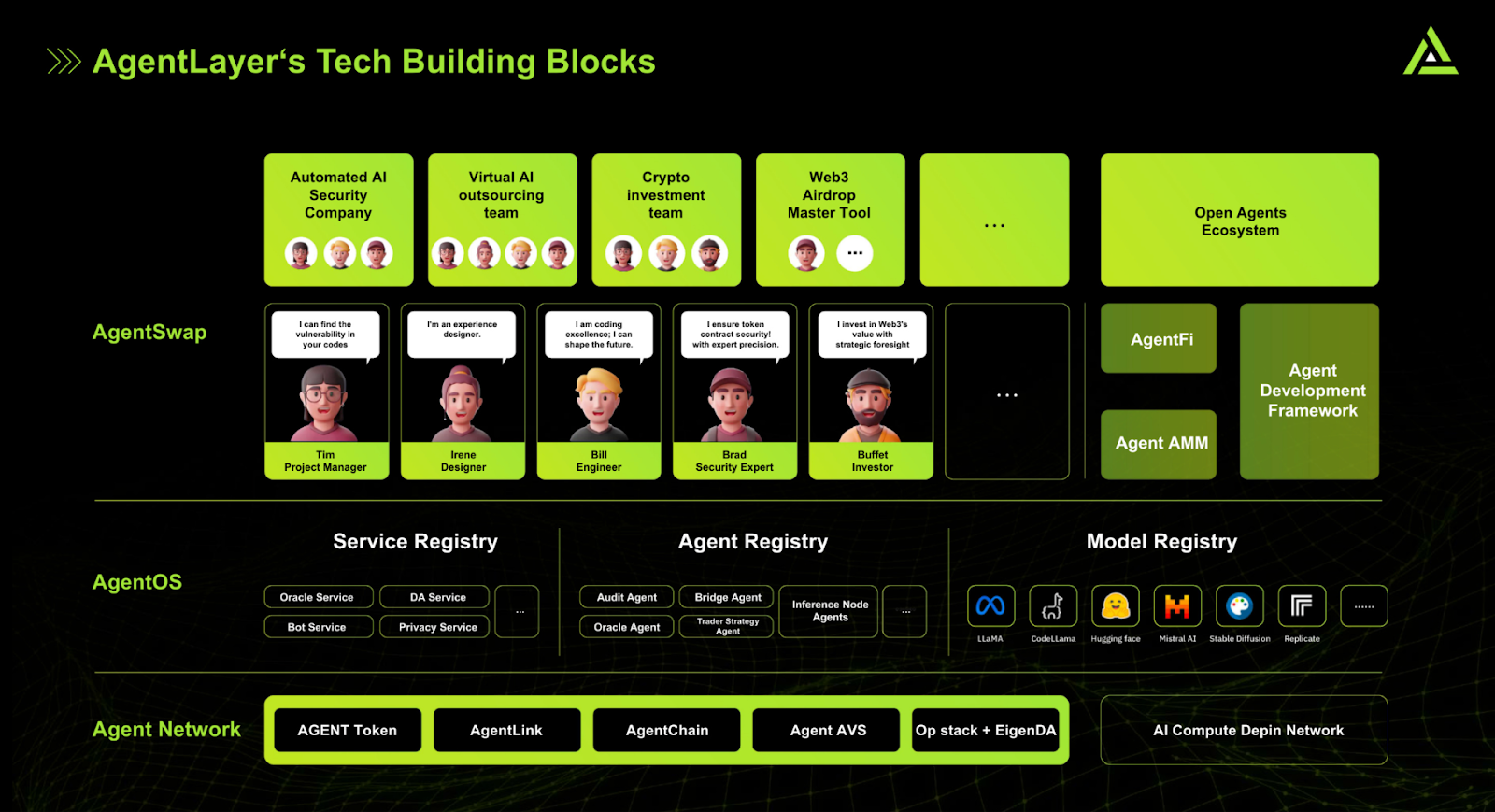

The layered AgentLayer ecosystem comprises several elements. Here’s how each element works and interconnects.

Development and deployment modules

AgentOS: Provides the environment and tools for developers to build AI agents. Developers rely on the AgentOS software development kit to create AI agents.

AgentNetwork: Hosts these agents while closely pairing up with the AgentOS.

AgentLink: A part of the AgentNetwork that enables AI agents to communicate, helping them coordinate and work together.

Integration and operational layer

DePIN layer: This is an advanced infrastructure layer that integrates AgentLayer’s ecosystem with decentralized physical assets. It enhances the capabilities of the AI agents.

AgentFi: This element determines the ecosystem’s revenue model and concerns itself with the native token AGENT, the service fees associated with Agent usage, and more. This section requires a little more detail as AgentFi is the breeding ground for several other elements within the space.

What is AgentFi, AgentLayer’s financial element?

Even the AgentLayer ecosystem needs to take care of its financial operations. This is made possible with AgentFi, which subtly integrates decentralized finance (DeFi) capabilities with advanced AI tools. Here are the involved elements and aspects that AgentFi touches upon:

- Protocol-owned transaction costs

AgentFi ensures that users who deploy AgentNetwork services, like storage and data transfer, can pay using the native AGENT token. Per the tokenomics, a portion of revenue is added to the treasury funds, while another portion is moved to the protocol for additional development.

As for the services, everything that utilizes smart contracts and blockchain technology within the space, including Oracle usage and data security, qualifies for protocol fees. Do note that these charges are not associated with using AI agents.

- Sequencer revenue

AgentLayer also generates revenue by selling blockspace on Ethereum. By selling this critical blockchain resource, AgentLayer can help services ramp up their transaction processing capabilities. The AGENT token is again used as the primary currency here.

- Agents revenue

Besides protocol-owned costs and sequencer revenue, the AgentFi layer of AgentLayer also accrues agent services fees. The concept is simple — these are the fees associated with AI agent usage. This represents AgentLayer’s most productive and consistent revenue stream.

Users can also create custom tokens with the space. If new AI tokens are created, fees are levied, adding another layer of financial complexity to the AgentLayer ecosystem.

Besides its revenue-generating elements, AgentFi boasts a solid set of fully developed services/products for users. These involve the following.

AgentSwap

Any decentralized platform would be incomplete without a built-in decentralized exchange (DEX). AgentSwap is the DEX native to the AgentLayer ecosystem and facilitates automated trading of the AgentLayer token and other assets. As you might expect, it ditches the traditional order book method and uses automated market-making (AMM) algorithms to facilitate trades and liquidity provisioning.

AgentList

This is a launchpad designed to aid the growth of other decentralized AI projects. It also supports community engagement, token staking, and fundraising. Participating projects can stake their tokens for credibility and visibility, showcasing their long-term commitment. As for community support, collaborative parties can interact on project visions, participate in governance, and foster a sense of synergy.

Per the roadmap, AgentList is expected to go live somewhere between Q4 2024 and early 2025.

IAO

IAO is AgentLayer’s novel financing tool, intended for on-chain asset issuance and project-specific fundraising. Using AgentLayer’s IAO, projects can issue tokens directly, which investors can purchase to fund the projects. The IAO opens up access to capital without the need for TradFi capital infusion.

The utility of the AGENT token

The AGENT token is at the heart of the AgentLayer ecosystem. It can be used for transaction fees, node incentives, agent purchases and transactions, governance elements, and user incentives. Notably, the native token can also be used for staking and liquidity mining.

Here is a quick rundown of the AGENT benefits for your quick reference:

- Economic incentives

- Innovation and growth

- Scalability and efficiency

- Governance and efficiency

Other key components of the AgentLayer ecosystem

Here is some key context regarding the necessity of EigenLayer integration within the AgentLayer ecosystem. The AGENT token was always envisaged as an OmniToken, courtesy of the ERC-6358 standard. The actual need was to synchronize the token state across chains — Optimism, Polygon, and Ethereum — without using bridges to move everything around.

EigenLayer’s AVS, or agent verification system, made this possible. In other words, this integration ensures the AGENT token is interoperable across chains.

Besides EigenLayer AVS integration, other elements exist. These include the following.

AgentStore: A marketplace where devs can list AI agents for subscription or sale.

AgentKey: Facilitates secure control and access over AI agents.

AgentChain: A specialized layer-2 chain built on Ethereum for AgentLayer to initiate optimized AI operations. Ensures low latency agent interactions.

How AgentLayer handles governance and community-based interactions

The AgentLayer ecosystem’s governance model is highly decentralized. The TAGDAO or the AgentLayer Governance DAO, run using the veAGENT tokens, handles most of the governance initiatives.

veAGENT token holders can vote on aspects like fund allocation, community rule-making, and feature development.

Note: When dealing with AI or autonomous agents, governance frameworks are crucial as they define how the layers should act across situations. For AgentLayer, here are the standard steps:

- Decision involvement

- Discussion and voting using veAGENT quantity analysis

- Proposal execution

- Emergency handling using multisig wallets in case there are major security vulnerabilities around

How does the AgentLayer community work?

The AgentLayer community is entirely unique. Its aim is to ensure supporters and contributors come together to shape decisions actively.

Notably, integrated community watchdog agents have the following responsibilities:

- Monitoring social media feedback

- Monitoring model data leaks, courtesy of TrustLLM

- Implementing new test features across agents

Other community-specific elements include:

- Availability of multiple engagement channels like X, Discord, and more.

- Regular workshops and bounty programs allow participants to earn AGENT tokens.

AgentLayer review: APGN as the premium governance feature

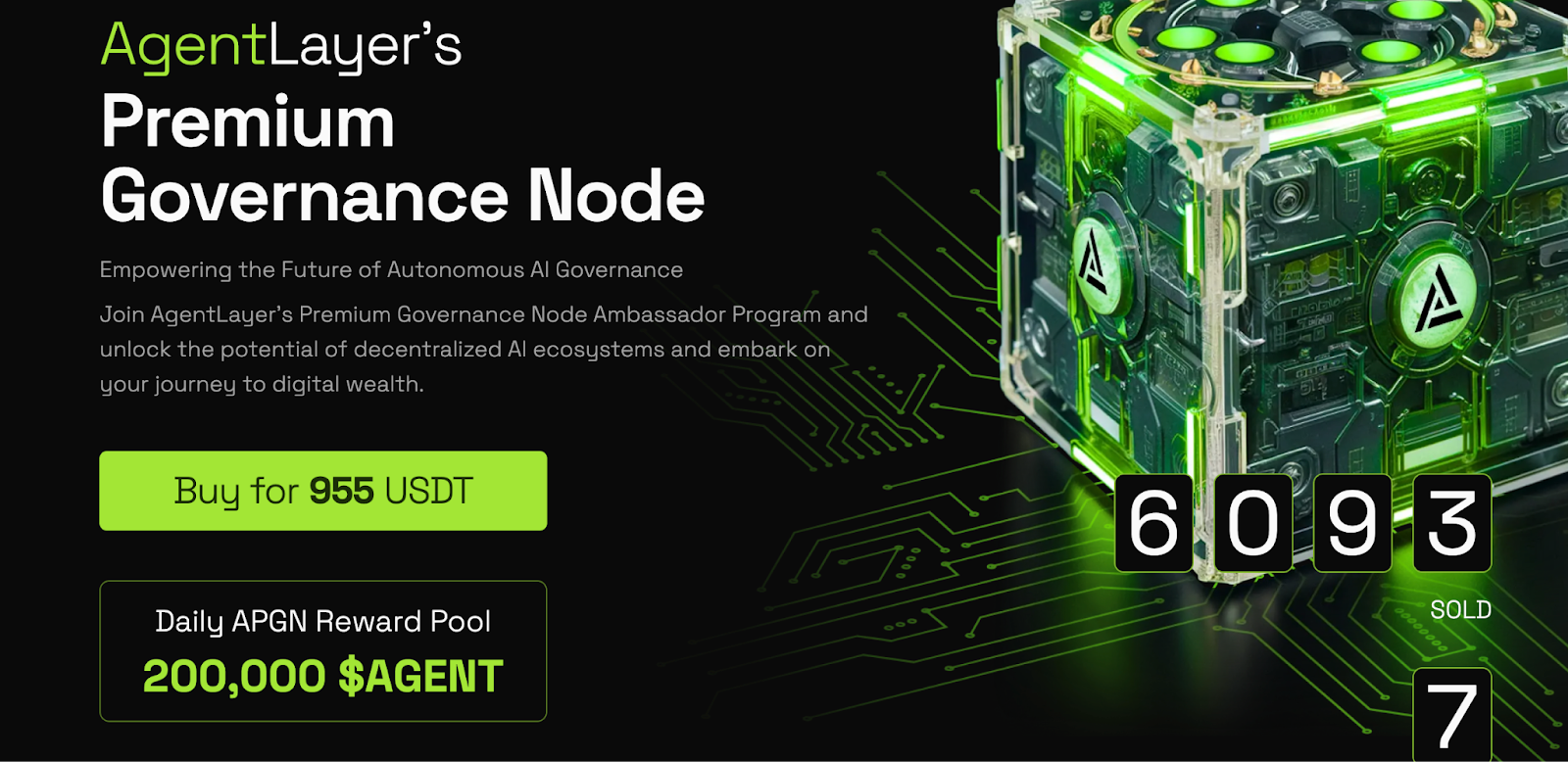

Even though holding veAGENT tokens offers governance rights — which users gain by locking their AGENT tokens — AgentLayer also offers a premium governance tier, courtesy of AgentLayer Premium Governance Nodes.

The APGNs represent an elite network participation tier and offer enhanced rights, exclusive service access, and a revenue stream.

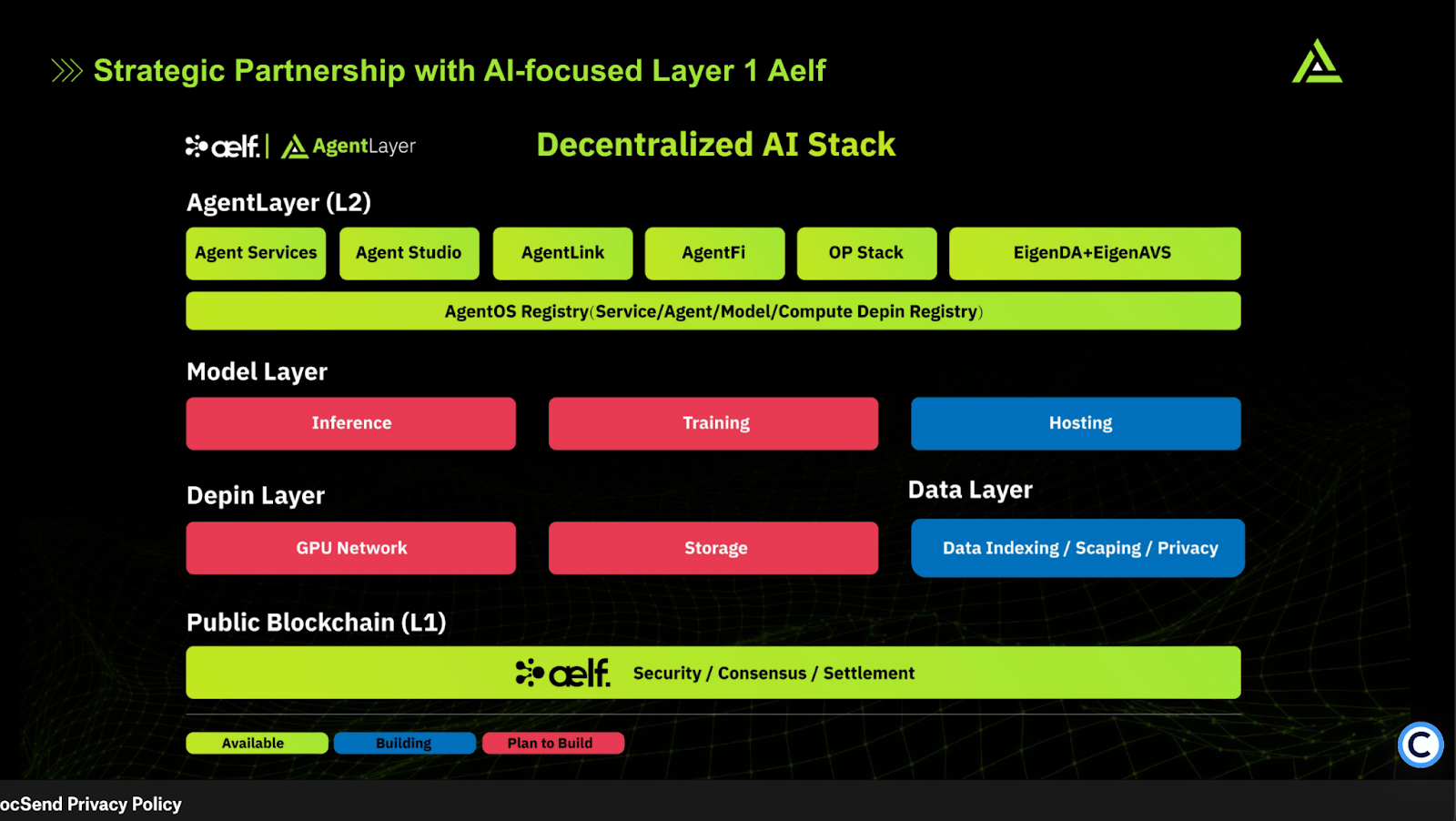

The aelf partnership

So how do the chain-specific elements work across AgentLayer? Here’s how everything works within the ecosystem.

AgentLayer leverages the Ethereum ecosystem’s layer-2 abilities. However, the partnership with aelf — a high-performance layer-1 chain — makes the ecosystem scalable and efficient, especially for DApp integration.

Here’s where aelf helps AgentLayer:

- With scalability, as aelf supports parallel processing and high throughput

- With efficiency, as it is one of the more cost-effective chains

- With interoperability, as aelf can closely work with other blockchains

With aelf, AgentLayer brings forth a modular architecture essential for the nature of AI development. Simply put, the ecosystem can scale whenever it wants. And with Ethereum being the parent layer, security is solid.

Top projects leveraging AgentLayer’s innovation

AgentLayer houses several AI agents. Many are slowly transforming into mature and impactful projects. Here are the top ones to know about:

1. Fortuna

- Lucky Blind Boxes: Offers randomized rewards, including BTC, ETH, and AGENT tokens.

- Engagement: Enhances user interaction using gamified rewards.

- Exclusive rewards: Provides unique and valuable prizes to economize participation.

2. AGIS

- GPT integration: Combines GPT with static analysis for smart contract security.

- Vulnerability detection: Identifies logic vulnerabilities in smart contracts.

- Enhanced security: Reduces risks by proactively finding and mitigating potential threats.

Reminder: As explained previously. AgentLayer native AI agents do not use ChatGPT API and instead rely on TrustLLM.

3. Sentinel

- Transaction monitoring: Watches on-chain transactions for suspicious activity.

- Threat alerts: Notifies users of potential security threats in real-time.

- Security layer: Adds an extra layer of security to blockchain interactions.

4. Proteus

- Predictive analytics: Uses AI to analyze market trends in DeFi.

- Forecasting: Helps investors make informed decisions by predicting market outcomes.

- Investment insights: Provides deep insights into market dynamics and potential risks.

5. Aegis

- Web3 security: Ensures the integrity and safety of digital assets.

- Continuous monitoring: Uses advanced AI for ongoing security checks.

- Threat detection: Identifies and handles security threats in real-time.

6. Wallet Checker AI

- Real-time monitoring of transactions

- Anomaly detection focussing on irregular transaction patterns

- Availability of instant alerts

- Enhanced security checks with AI-driven analytics

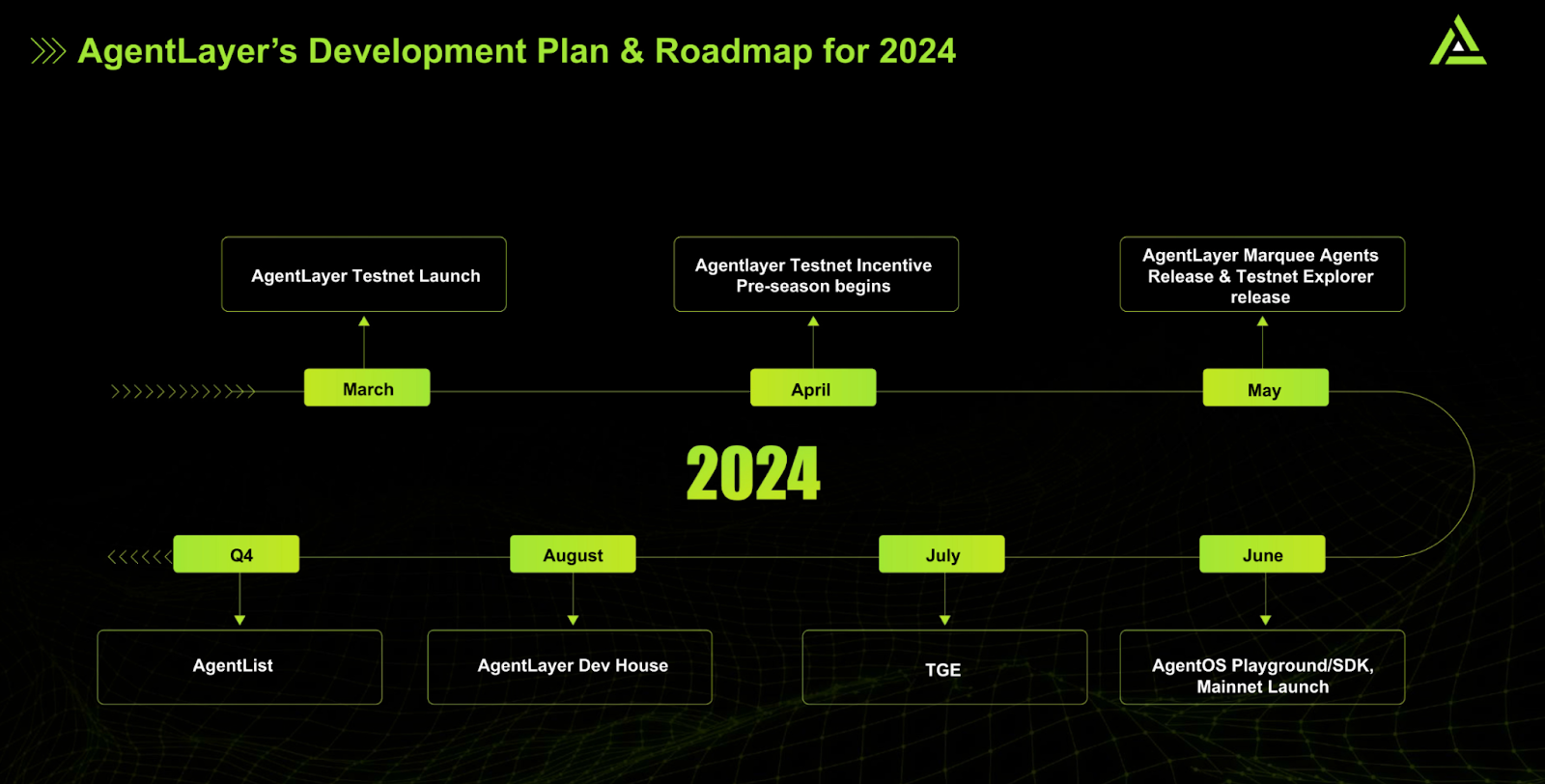

AgentLayer roadmap: How users can reap benefits

AgentLayer has plans to scale globally and even into regional hubs by 2025. Unsurprisingly, the project also anticipates 2024 to be packed with several exciting milestones.

July 2024: Developers are slowly getting access to the AgentOS SDK in order to build new AI agents. The AGENT Token Generation Event will give users access to the ecosystem’s economy. The token is already being given out and used across the AgentLayer ecosystem. In July, it will be usable across the internet.

August 2024: The AgentLayer dev house is set to launch with a dedicated team of developers to innovate and collaborate across projects.

Can AgentLayer be a game-changing AI innovation?

This AgentLayer review has shown how this decentralized AI network can potentially change the way we think about AI agents and models. With collaborative AI agent interactions, unique governance, and a versatile financial model — all thanks to AgentFi — without relying on ChatGPT, AgentLayer covers it all. While the immediate benefits are demonstrable, it looks like a project that may outlive others, with the potential for continued growth and long-term sustainability in 2024 and beyond.