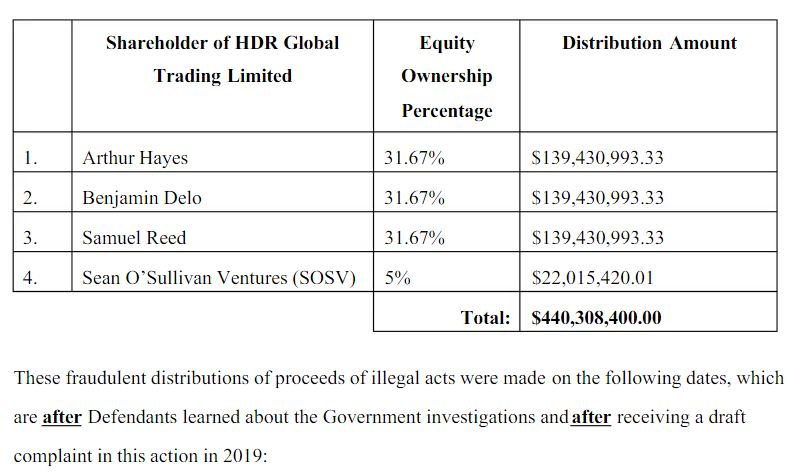

A civil lawsuit alleges that BitMEX’s co-founders directed roughly $440 million away from the exchange despite knowledge of investigations. It also suggests that the funds were moved to limit seizure by authorities.

A civil lawsuit dated Oct. 30 alleges that BitMEX executives engaged in market manipulation and unregistered trading. Furthermore, it claims that BitMEX’s co-founders sought to move approximately $440 million out of BitMEX, knowing that civil and criminal charges were unfolding.

The complaint was filed by traders Yaroslav Kolchin and Vitaly Dubinin against the founders of BitMEX parent company HDR Global Trading Limited. Among other serious accusations, it refers to BitMEX co-founders Arthur Hayes, Benjamin Delo, and Samuel Reed as “notorious fraudsters.” The lawsuit uses the indictments by the Department of Justice and the U.S. Commodity Futures Trading Commission (CFTC) as exhibits.

Regulators Ramping Up Investigations

BitMEX first faced this legal case in May, with the plaintiff BMA LLC accusing it of money laundering, wire fraud, and civil conspiracy. Claims in the suit included exacerbating price fluctuations and causing the most liquidations. Shortly after the initial announcement of the indictments, CEO Arthur Hayes stepped down as CEO.The newest development is a serious escalation of the circumstances of BitMEX, which saw an exodus of users following the indictments. Investors withdrew over 37,000 BTC while open interest dropped by 16%, according to Arcane Research. SEC Commissioner Hester Peirce, who supports digital currencies, said that the BitMEX arrests are a sign of increasing regulatory scrutiny. Speaking on the Unconfirmed podcast, Commissioner Peirce said that unregistered securities via ICOs and celebrity promotions are under examination.Update:

— K33 Research (@K33Research) October 2, 2020

The open interest on the BitMEX Bitcoin perp has fell further throughout the night, and reached 45,112 BTC at 07:00 (GMT+2).

The open interest (measured in BTC) is currently down 16% since the CFTC announcement. pic.twitter.com/GTnI291Enu

Binance Faces Accusations

Binance, the world’s largest cryptocurrency exchange, is also facing problems. Forbes released a report on Oct. 29 pointing to a leaked document alleging that Binance was looking to circumvent U.S. regulations. It claimed that a “Tai Chi entity” was used to execute a bait and switch and funnel profits towards Binance. The exchange firmly denied these accusations, also stating that the report had inaccuracies. https://twitter.com/cz_binance/status/1321887211084603392 Binance officials said that the document was merely a strategy document that “anyone can produce.” Binance U.S. CEO Catherine Coley has also responded to the allegations, saying that the U.S.-arm has made no payments to Binance.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored