Centralized crypto exchange Kraken retaliated against the US Securities and Exchange Commission (SEC) by challenging its securities label on digital assets.

The regulator claimed Kraken violated federal securities laws when it offered certain digital assets, which qualify as unregistered securities.

Kraken Disputes SEC Allegations Against Digital Assets

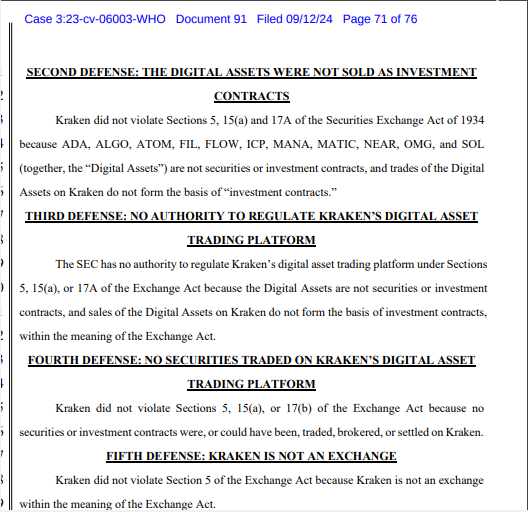

Kraken said ADA, ALGO, SOL, and other assets do not meet the legal definition of securities under US law. The exchange also slammed the SEC for the lack of clarity, calling it out for regulatory overreach.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

In its defense, Kraken cites the Howey ruling, a milestone Supreme Court case that serves as a reference point to determine what constitutes an investment contract. With this reference, the exchange challenges that the SEC failed to demonstrate that the named tokens meet the criteria outlined in the Howey framework and, thereby, do not fall under the SEC’s jurisdiction.

“The SEC has no authority to regulate Kraken’s digital asset trading platform […] because the Digital Assets are not securities or investment contracts,” the filing read.

Kraken is, therefore, pushing for a jury trial, saying the SEC is blocking its efforts to register or cooperate. It argues that the regulator consistently “stonewalls” it using inconsistent rulings and guidance.

Some community members have criticized the Howey test, arguing that it’s too broad and doesn’t account for the complexities of modern investment structures or technologies. As a result, the test may not always accurately classify certain types of transactions in today’s increasingly complex financial landscape.

“The problem is really that the Howey test is far too generic. The truth is that many cryptocurrencies do not pass that specific test. But that doesn’t take in the nuance of what securities were meant to be,” one X user commented.

This isn’t the first time the SEC has faced criticism for labeling digital assets as securities. In June 2023, the regulator alleged that several crypto assets traded on Binance, Coinbase, and Robinhood qualified as securities, a claim that was quickly challenged by crypto executives.

Read More: Who Is Gary Gensler? Everything To Know About the SEC Chairman

Recently, the SEC revised its position by amending its complaint related to “Third Party Crypto Asset Securities.” The regulator clarified that the term refers to contracts tied to the sale of crypto assets, not the assets themselves. This update came from the wording used in Footnote 6 of its amended complaint against Binance.