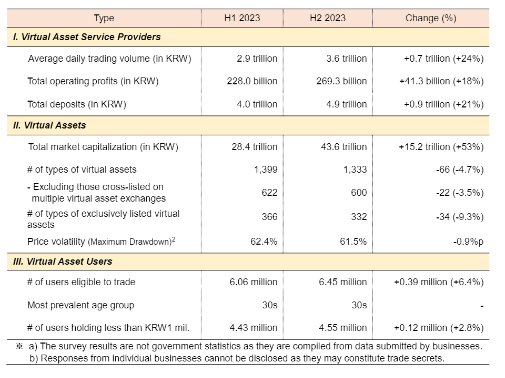

The Korea Financial Intelligence Unit (KOFIU), a South Korean financial regulatory agency, recently published a report on the crypto business in the region during the second half of 2023. The report indicates a significant increase of 390,000 users, bringing the total to 6.45 million by the end of 2023.

This growth reflects a 6% rise from the figures reported at the end of June 2023. This figure also shows the country’s expanding interest and participation in the crypto market.

Inside the Surge: Korea’s Crypto Investor Profiles

The KOFIU report sheds light on investor profiles. About 80,500 investors hold accounts valued at over 100 million Korean won (~$74,280) on domestic exchanges. In contrast, around 65% of investors have less than 500,000 Korean won (~$371.40) in their accounts.

Additionally, about 2,500 people have investments worth more than 1 billion Korean won (~$742,815) in their accounts. Of those users, representing more than 10% of the country’s total population, 99% identified as “individual” investors. This distribution indicates a broad spectrum of investment sizes, reflecting varying levels of engagement and risk appetite among South Korean crypto investors.

KOFIU’s report also shows that the average daily trading volume of 22 virtual asset exchanges in Korea in the second half last year was approximately 3.6 trillion Korean won ($2.6 billion). This is a 24% increase compared to the year’s first half. Moreover, the total value of the crypto held by registered exchanges surged 53% to 43.6 trillion Korean won ($32.36 billion).

Read more: Top 10 Cheapest Cryptocurrencies to Invest in May 2024

“Total volume of deposits in [Korean won] KRW was up 21%, as virtual asset prices increased and investment sentiment recovered,” KOFIU added.

The report also notes a unique trading pattern in Korea compared to global exchanges. For instance, Bitcoin’s trading percentage on global exchanges is 49.87%. In Korea, it was much smaller, at 27.5%.

Altcoin investment patterns also stand out. Ripple (XRP) holds the second-largest share of domestic transactions at 15.4%. Ethereum ranks third, with an 8.4% share.

Dogecoin (DOGE) and Ethereum Classic (ETC) follow in the fourth and fifth positions. They have shares of 2.9% and 2.8%, respectively.

Korea ranks as a top country in active crypto trading relative to its population size. The Korean won recently overtook the US dollar in trading volume among fiat currencies.

Read more: 11 Best Altcoin Exchanges for Crypto Trading in May 2024

Crypto remains a hot topic in Korea. This is clear in political campaigns from both major parties. They use crypto-related promises to win votes. In April, the People Power Party, backing President Yoon Suk Yeol, vowed to delay a digital asset tax. Meanwhile, the Democratic Party pledged to lift curbs on spot exchange-traded funds (ETFs), including US Bitcoin products.