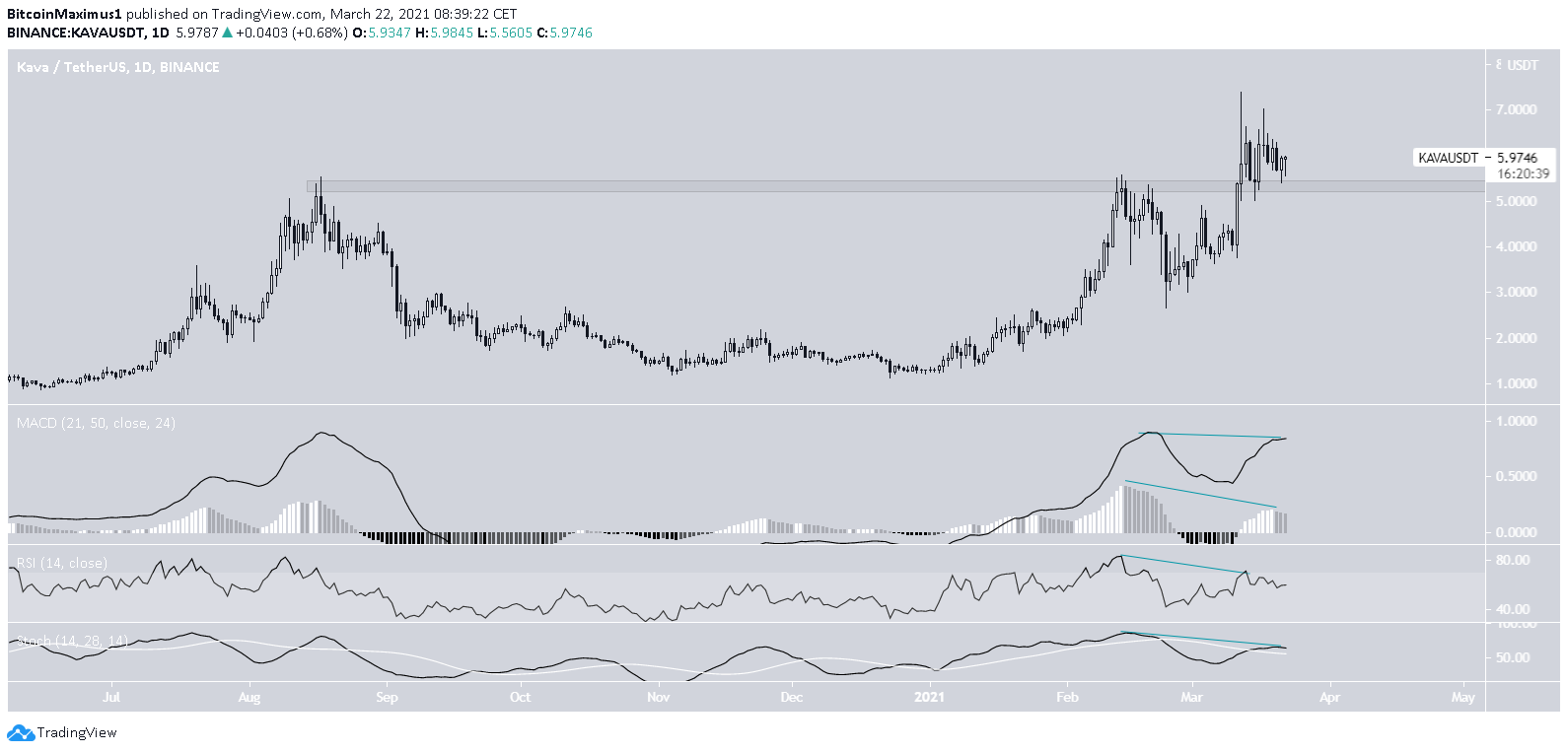

The Kava.io (KAVA) price reached an all-time high of $7.40 on March 14.

However, KAVA has retested its previous all-time high, validating it as support.

It’s expected to continue moving upwards, possibly reaching an eventual high near $12.

KAVA Retests All-Time High

KAVA has been decreasing since reaching a new all-time high price of $7.40 on March 13.

While the token price has been decreasing since the drop served to validate the previous all-time high resistance at $5.90 as support.

Technical indicators provide a slightly unusual outlook.

The MACD, RSI, and Stochastic oscillator are bullish. The MACD is positive, the RSI is above 50, and the Stochastic oscillator has made a bullish cross. All three are increasing.

However, all three have also generated considerable bearish divergences.

Nevertheless, since a drop has already occurred as a result of the divergence, it’s possible that the occurrence played out and the trend is now bullish.

Short-Term Triangle

The two-hour chart shows a symmetrical triangle. This is normally considered a neutral pattern.

However, it is transpiring after an upward movement, thus a breakout would be more likely.

This possibility is also supported by the MACD, which has given a bullish reversal signal.

Wave Count For KAVA

Cryptocurrency trader @Mesawine1 outlined a KAVA chart, stating that the price could go all the way to $25 in a few months.

The wave count suggests that the token is in an extended wave three (white). A potential target for the top of the move is found near $12.90.

This is found by using an external Fib retracement on wave two.

The sub-wave count is shown in orange.

An even closer look shows another extended minor sub-wave three (black).

An intermediate target would be found between $9.88-$10.40. If it continues past this range, the price could move toward the previously given $12.90 level.

Conclusion

KAVA is expected to continue increasing as long as it is trading above the previous all-time high resistance at $5.40.

A potential intermediate target for the top of the movement is found near $10, while a longer-term target could possibly reach $12.90.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.