In a previous analysis, BeInCrypto published a bullish forecast for Kaspa (KAS) when the price was trading at $0.14.

Subsequently, it reached a new all-time high of $0.194. Now trading between $0.16 and $0.17, this analysis serves as an update to the previous price prediction.

Kaspa Price Analysis: Bullish Outlook

KAS has experienced a 14% drawdown following Bitcoin’s price correction from $70,000 to $66,000. This moderate decline saw KAS falling from $0.194 to $0.150 before stabilizing between $0.160 and $0.170.

The price has broken below the key support level of $0.171, which is now a critical resistance level to monitor closely. KAS has tested the baseline support (in red) at $0.151 and $0.155, reinforcing this line as a strong support level.

Despite the recent decline, the price outlook for KAS is not bearish. The price remains above the red baseline of the daily Ichimoku Cloud.

Read More: How To Buy KASPA And Everything You Need to Know

The Ichimoku Cloud is a technical analysis tool that displays support and resistance levels, trend direction, and momentum. It consists of multiple lines. The baseline represents the midpoint of the 26-day high and low prices. It is used to determine trend direction and potential support or resistance levels. All the support levels in the analysis are determined by the baseline.

The daily RSI (in violet) is around 60, which indicates the potential for a price drop if it starts to trend towards 50 or 40, underscoring a bearish trend.

An RSI below its 14-day average, shown in pink, could indicate potential for price appreciation. This could happen if KAS breaks above the $0.171 resistance level, potentially reaching new all-time highs.

Short-Term Holders HODLing: $0.20 Target Within Reach

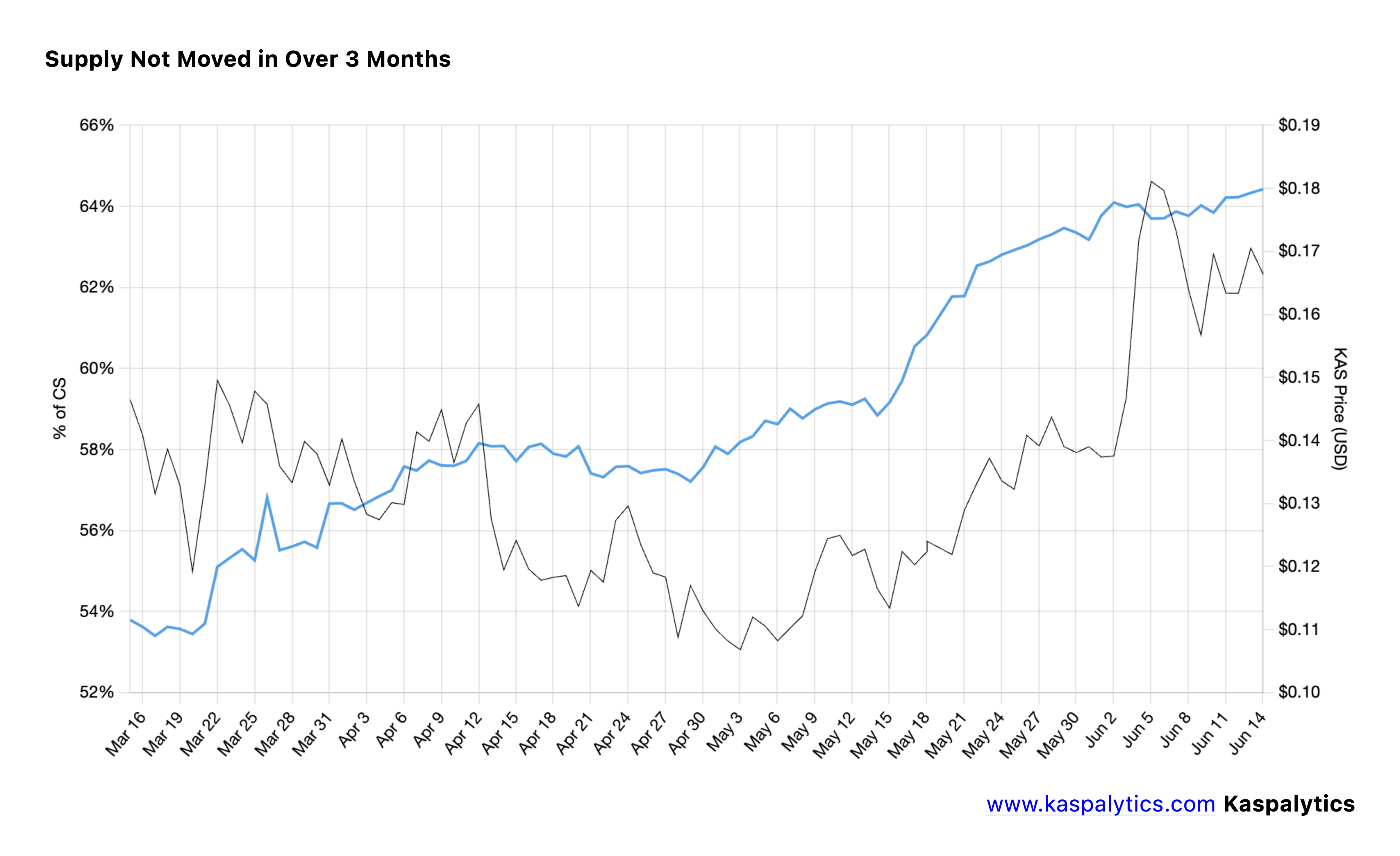

This indicator segments the total circulating supply of Kaspa based on detention time, tracking the behavior of both short-term and long-term holders.

Analyzing the percentage of supply that has remained inactive for more than 3 months is crucial for understanding holding patterns and market sentiment among different holder groups.

The inactive supply metric for more than three months serves as a barometer for short-term holders’ market sentiment when compared to the inactive supply (%) that has been held for more than one year or two years.

A drop in this metric could signal increased risk, while a rise indicates growing demand from new investors.

From May to the present, KAS Supply, which has been inactive for more than three months, has increased from 57.18% to 64.43% of the total circulating supply, signifying strong holding behavior from short-term holders.

This strengthens our bullish forecast for Kaspa. We anticipate the price breaking the all-time high and reaching the $0.20 – $0.30 range.

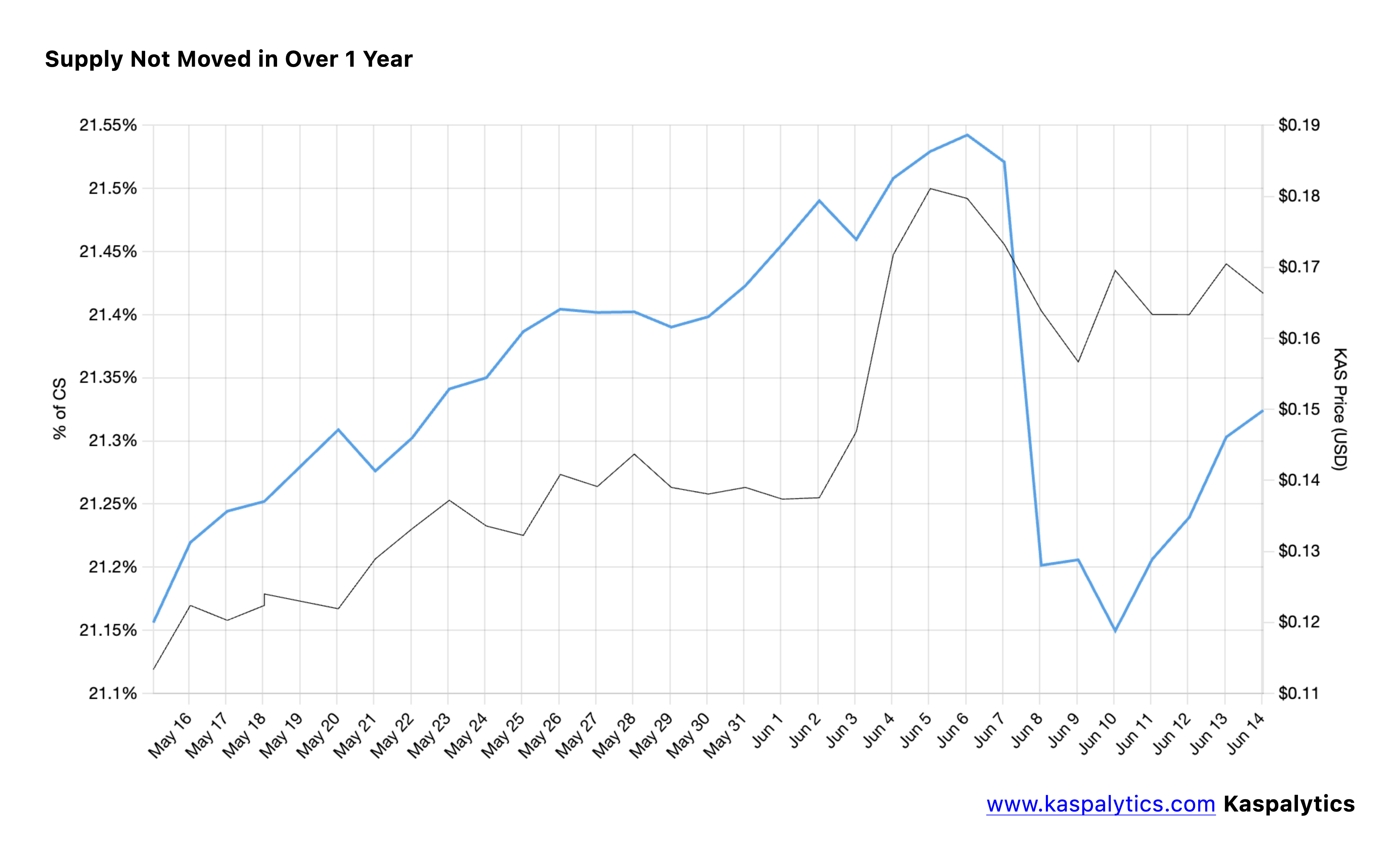

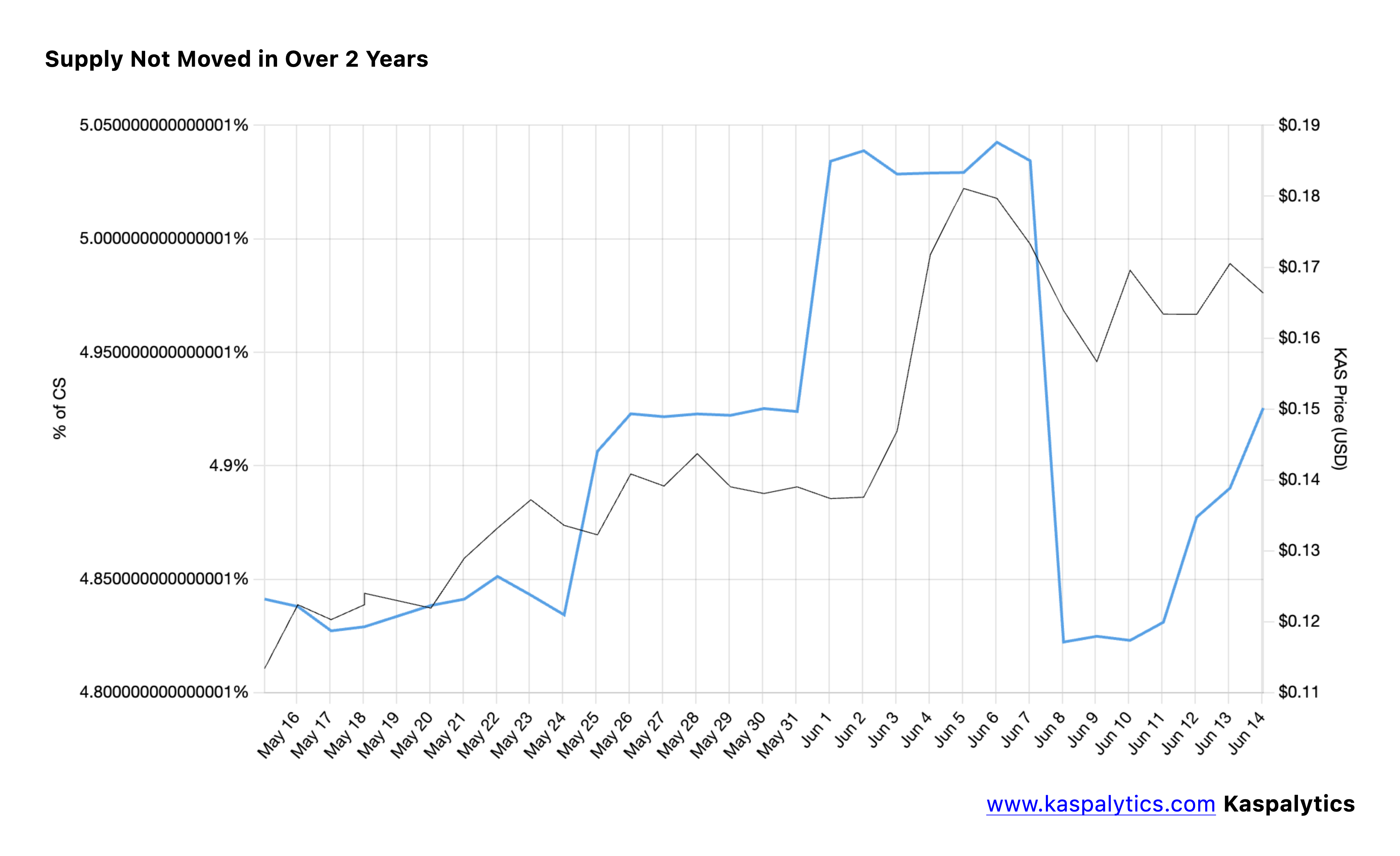

Analyzing the supply that has not been spent for more than one year and more than two years can provide a deeper understanding of Kaspa’s long-term holders’ behavior, especially in the context of recent price declines.

A slight drop from 21.5% to 21.2% of the total circulating supply. This minor decrease suggests some mid-term holders engage in profit-taking or risk management, but the overall holding pattern remains relatively stable.

KAS Price Prediction: $0.20 or $0.14 Next?

In addition to this, a similar slight drop was observed in the amount of Kaspa that had not been moved for more than two years, indicating profit-taking and risk-mitigation strategies by holders. Specifically, the supply held for over two years decreased from 5% to 4.8% of the total circulating supply, reflecting some level of selling activity among long-term holders.

Read More: Where To Buy Kaspa (KAS): 3 Best Platforms for 2024

The price of KAS has declined following the overall crypto market correction since June 7. Still, it remains resilient above the key support level, which is the Ichimoku baseline.

Should it sustain a break below this line, it could potentially reverse from a bullish to a bearish trend. In such a case, key support levels would be $0.143, $0.124.