After record inflows of $343 million for the week ending 22 July, CoinShares’ latest report highlights another set of strong inflow numbers for the month of July.

The report finds that the strongest set of monthly inflows this year have been in July, totaling $474 million, nearly making up for June’s total outflows of $481 million.

BTC short positions experience minor outflows

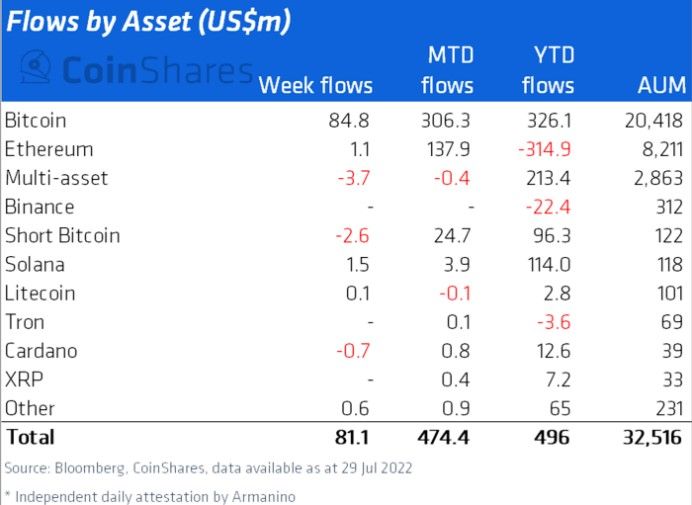

For the week ending July 29, investments in digital asset products marked the sixth positive week in a row, recording investments of $81 million.

That said, the week also saw minor outflows from short positions, with Bitcoin witnessing inflows of $85 million with short-Bitcoin outflows of $2.6 million. As per the report, this was the first week of outflows, following a five-week streak of inflows during the recent bear market. Even at the time of writing, BTC continues to trade to the north of $23,000, gaining around 4% in the last seven days on CoinGecko.

However, Craig Erlam, an analyst at broker Oanda, predicts that BTC prices might surge further in the coming days. Barron’s quoted the analyst saying, “It has all the feeling of a bear-market rally, as we may be seeing in equity markets, but that doesn’t mean it won’t have further to run,”

BTC had surpassed the $24,600 level over the weekend but was unable to sustain the price point, soon falling under the highest peak it touched after mid-June.

“It [Bitcoin] showed a lot of resilience below $20,000 at times as conditions were far from ideal, which may provide some confidence that the worst is behind it but I’m not convinced it is,” Erlam said.

With additional bouts of volatility inevitable, the month of August “promises to be every bit as stomach-churning for Bitcoin,” according to Antoni Trenchev, co-founder and managing partner at cryptocurrency lender Nexo.

Solana remains investor’s favorite

That said, multi-asset investment products saw outflows totaling $3.7 million for the second week in a row.

In the alt-verse, Solana had modest inflows totaling $1.5 million; with $114 million in inflows so far this year as it continues to be the investor favorite, CoinShares underlined.

While in the case of Ethereum, the largest altcoin which had recorded $8.1 million in inflows in the week prior, this time it fell short, recording only $1.1 million in weekly flows. However, its year-to-date flows still remain negative at around $315 million.

In terms of the price, ETH is maintaining a 24-hour range of $1,641.88 and $1,743.65 on CoinGecko. The price is still about 65% down against its all-time high of over $4,800 in November 2021. Meanwhile, the second-largest crypto is also bracing up for The Merge expected to take place in September.

Polkadot also experienced inflows last week, amounting to $0.4 million.

Meanwhile, inflows from the US and Canada totaled $15 million and $67 million, respectively, while North America accounted for the majority of regional inflows. Small outflows were seen in Sweden and Brazil.

What do you think about this subject? Write to us and tell us!