The Financial Services Agency (FSA) will conduct a comprehensive review of Japan’s crypto laws, seeking to possibly loosen regulations and even lower capital gains taxes. However, unexpected election developments may impact the process.

The Liberal Democratic Party (LDP)’s new candidate has made few public statements on crypto, but industry figures are disappointed.

A Reclassification for Crypto

Bloomberg reported this upcoming review on September 30, claiming that the FSA is mainly aiming to assess Japan’s existing Payment Services Act.

Essentially, the goal of this review is to determine whether crypto should be regulated as a payment option, as it is currently, or an investment tool. An anonymous official claimed that Japan mostly uses crypto for the latter purpose, and this may change the entire legal paradigm.

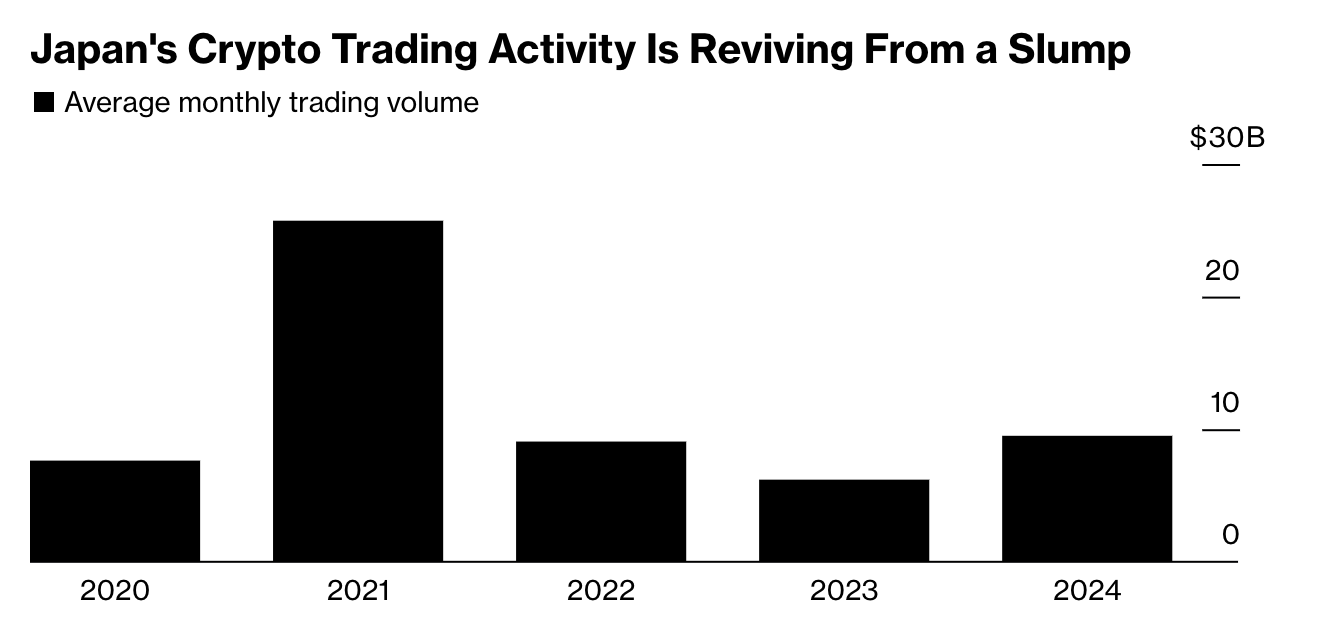

Japanese crypto trading has been recovering throughout 2024, and a number of specific measures may help boost it further. Obviously, the most enticing possible change is a lowered tax on crypto gains, from as high as 55% to 20%, similar to stocks. The FSA has also mentioned increased consumer protection, and business leaders have called for looser restrictions.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The demands from business leaders may prove especially salient to the FSA’s conclusions. Major corporations like Japan’s largest bank have already worked on a stablecoin since 2023, but they aren’t alone.

This year, electronics conglomerate Sony made headlines by acquiring an exchange. If Japan’s largest firms support relaxed measures, the FSA may listen.

Japan’s Election Shake-Up

A notable complication in the FSA’s survey is the upcoming election in Japan. Prime Minister Fumio Kishida is unable to seek re-election, and his constituency has made an unexpected choice for his successor: Shigeru Ishiba.

While Ishiba has expressed support for continuing previous economic policies, his selection follows a series of significant disagreements with his party, the LDP.

“If crypto had a vote, we would want Takaichi. She wants to continue ‘Abenomics’ which means more money printing and toleration of a weak yen,” prominent crypto entrepreneur Arthur Hayes claimed.

One of Ishiba’s first public statements as Kishida’s chosen successor has been to declare a snap election. As President of the LDP and presumptive new PM, Ishiba will dissolve the lower house of Parliament and hold an election on October 27. Kishida has been a valuable ally to Web3, but Ishiba has made few public statements on his own crypto policies.

Bloomberg quoted an FSA official who claimed that there are no clear conclusions on the length of the survey. However, he did state that is will likely last through the winter. In other words, it will certainly be ongoing when the election takes place, and Japanese stock markets have already wobbled since Ishiba became the new party leader.

Read more: Top 9 Crypto Friendly Countries For Digital Assets Investors

There are huge possibilities from this FSA study, but a bullish future for crypto is not guaranteed. If Ishiba loses or discontinues his predecessor’s pro-crypto policies, some opportunities for regulatory friendliness may be squandered. Still, as of yet, the FSA’s study has hardly begun, and it’s premature to make too many concrete predictions.