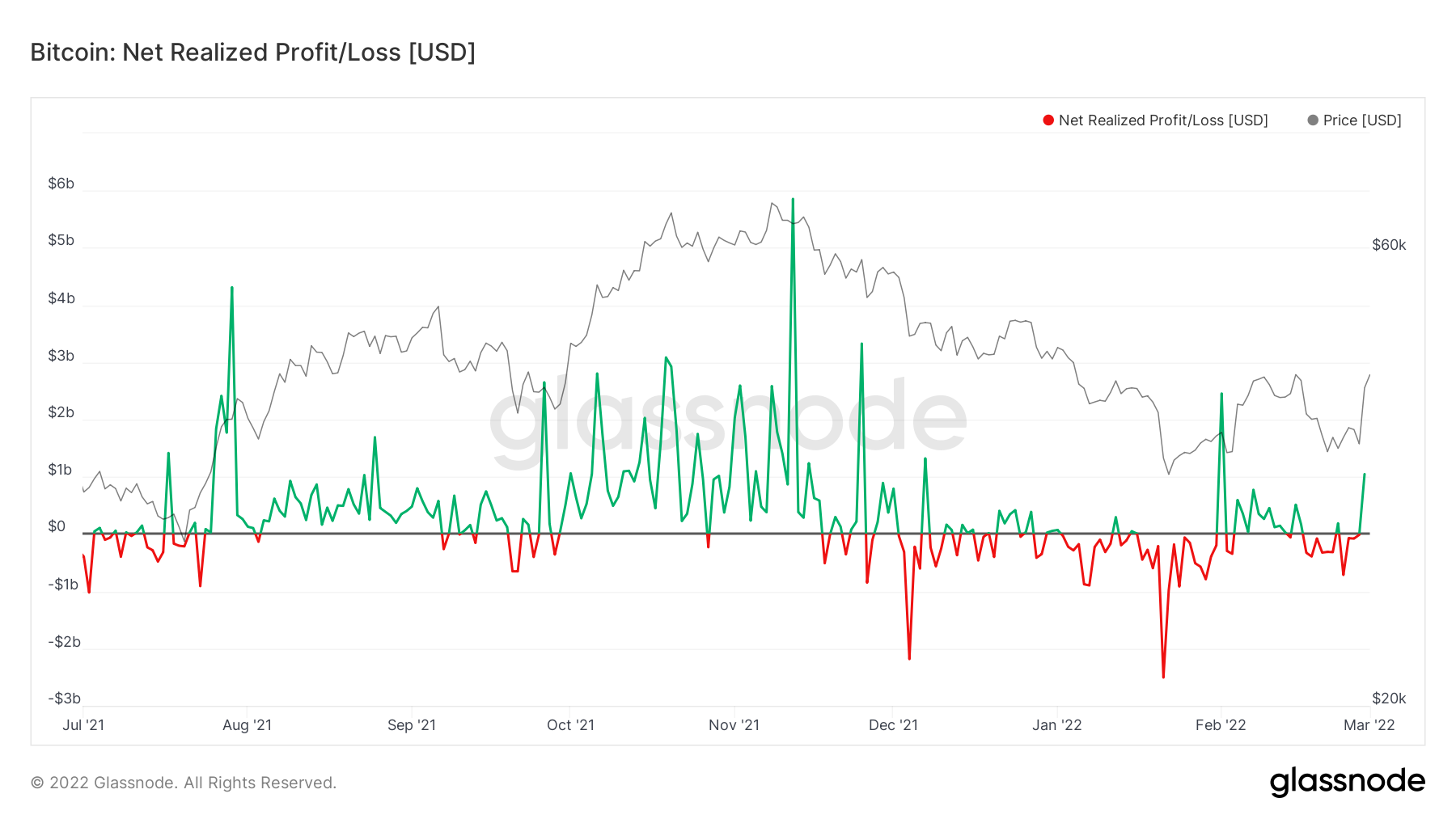

In order to determine whether market participants are exiting during the bounce, the Net Realized Profit/Loss indicator is analyzed. The indicator measures the net profit or loss of all coins that are moved.

An interesting development is a fact that the indicator is in profit. Therefore, those that bought the bottom on Jan and Feb 24 are likely realizing some profits. However, those that have bought higher are not using the bounce to exit their positions, rather are holding their coins.

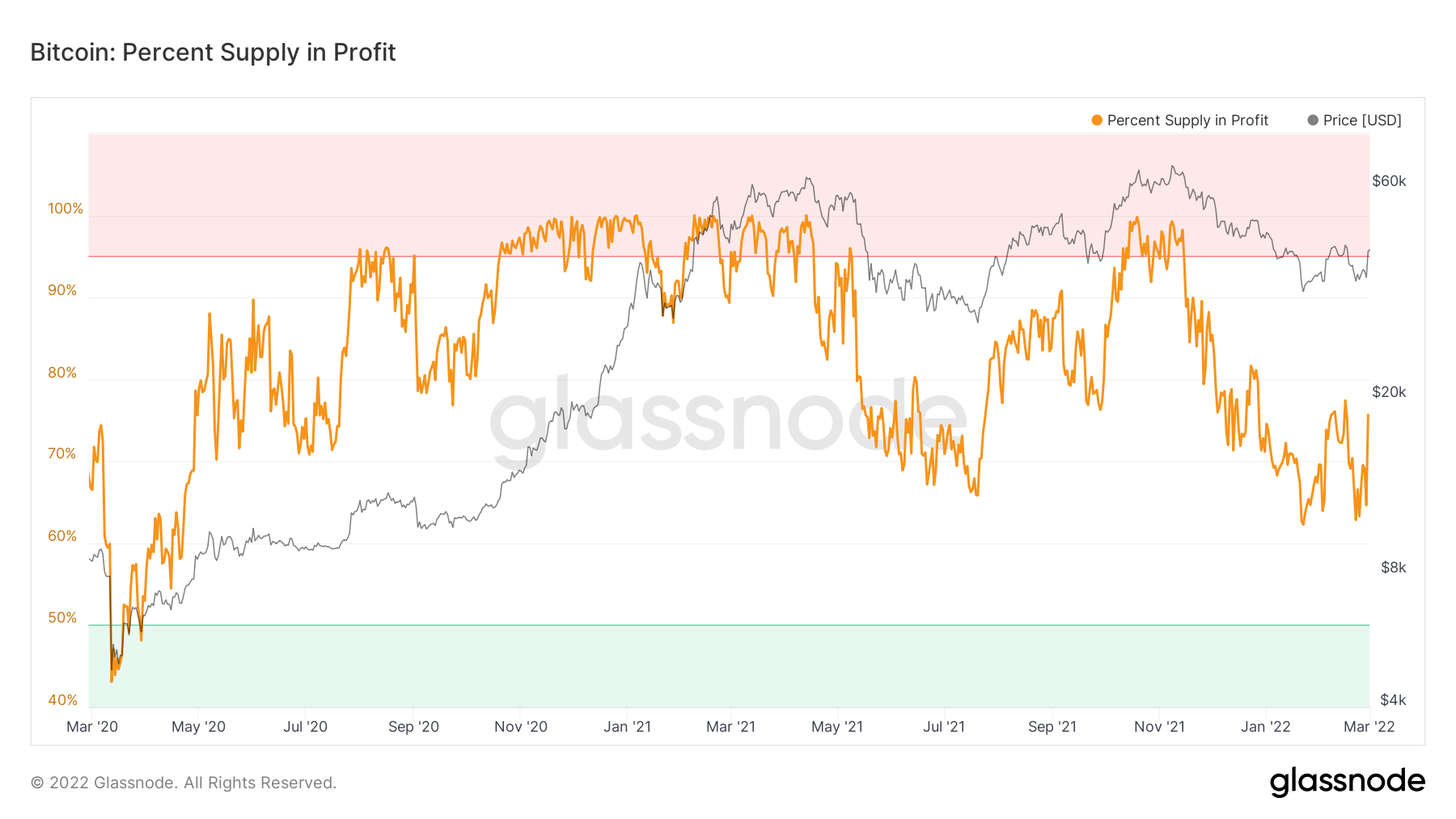

Percentage of BTC supply in profit

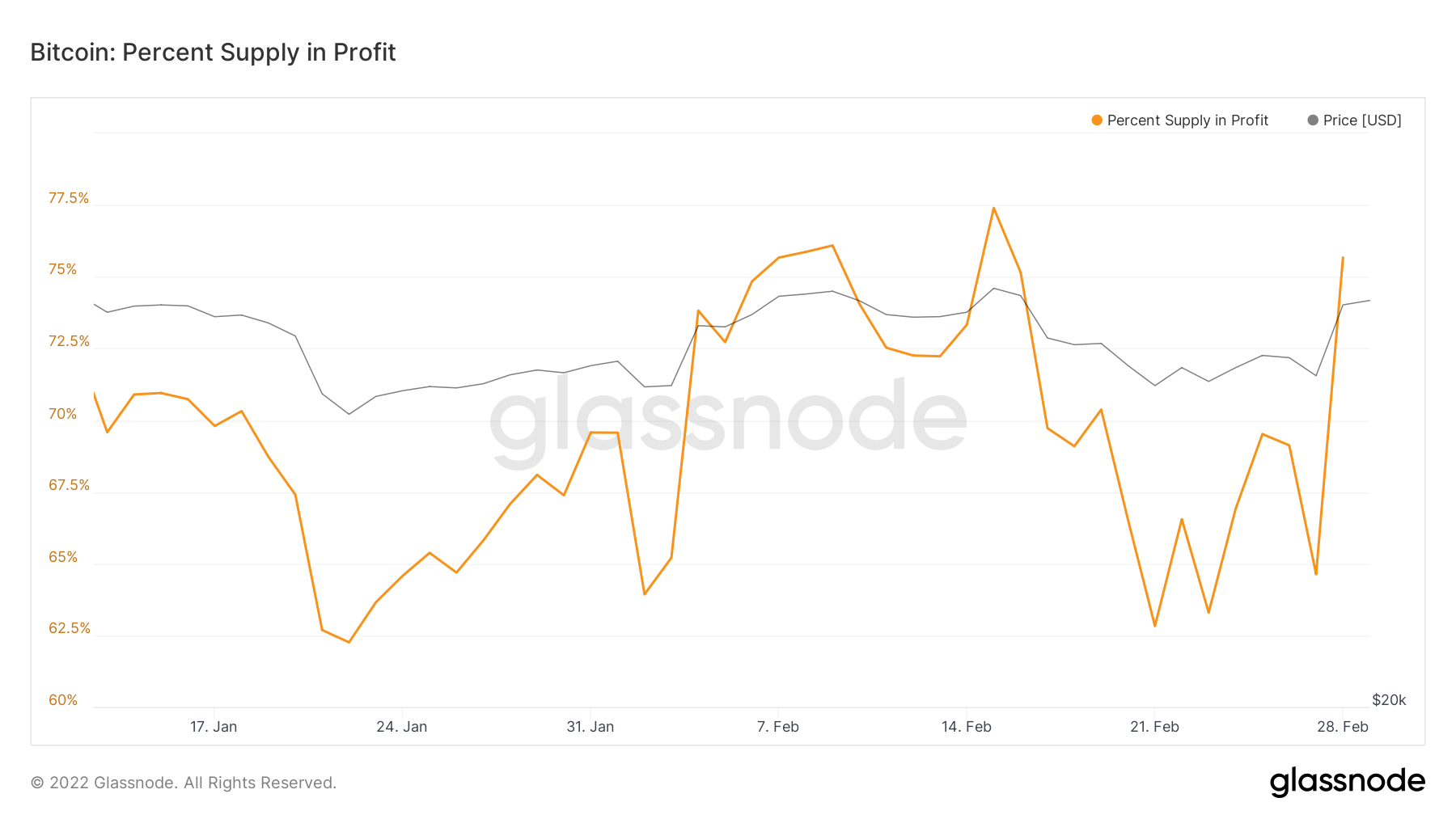

A look at the percent supply in profit indicators shows that 71% of the BTC supply is currently in profit. The value is similar to that of July 2021.

The percentage of BTC in profit spiked from 64% to 71% during the ongoing upward movement.

This speaks to a very significant number of coins that were bought between $37,000 and $43,000, an area that is expected to provide support.

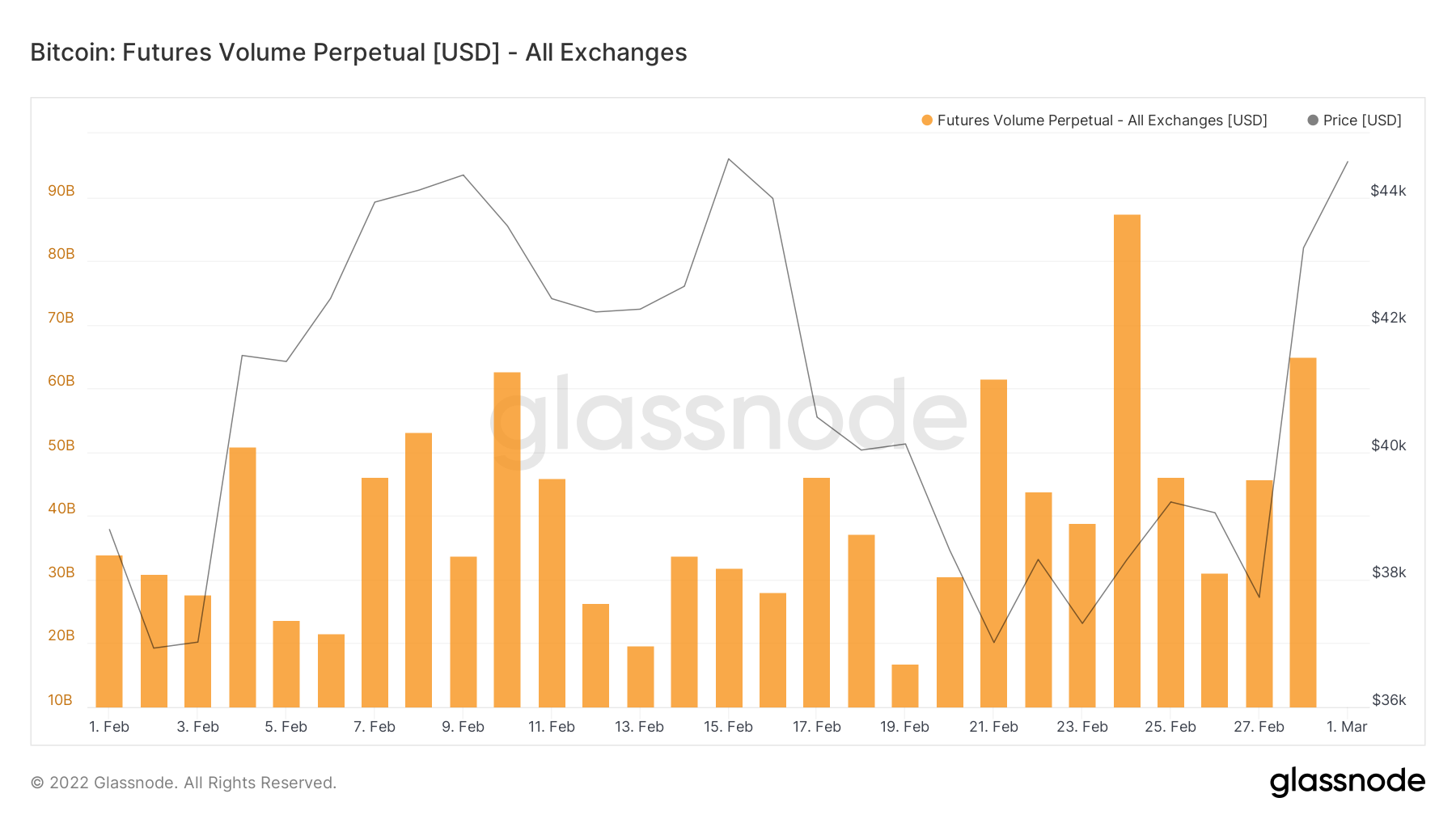

Derivatives market

In addition to this, the volume on futures is not that big, and considerably lags that of Feb 24. On Feb 28, there was a total volume of $70 billion, which was roughly 30% lower than the $98 billion on Feb 24.

On-chain analyst @mskvsk tweeted a chart that shows a minuscule amount of BTC short liquidations, indicating that the current price increase is not driven by the futures market.

Therefore, these two indicators combined suggest that the ongoing decrease is not a short squeeze, rather it is driven by a legitimate demand.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.