Fear, uncertainty, and doubt (FUD) have grown in both the cryptocurrency and legacy market spaces. Anxiety over government stability, financial retreat, and apparently-weakening investment markets are increasing concerns among investors. Additionally, the proliferation of possible investments in initial coin offerings (ICOs) can cause additional confusion about the best places to turn for safety and growth.

BeInCrypto had a chance to sit down with Kyle Cox, CFA and Senior Investment Analyst at Invictus Capital, to gain some valuable insight into the current market landscape. Kyle’s awareness of the cryptocurrency market and the complexities of how external forces may affect prices is an invaluable resource for those seeking direction in a changing political and financial climate.

Based on your own experience, what do you see happening currently in the ICO vs. VC capital market?

In 2018 we witnessed a radical shift in the conditions for ICOs, which have all but fallen from grace as a fund raising method for blockchain projects. We expect 2019 to continue to be muted in terms of fiat value raised from ICOs. The boom in ICOs in 2017 and subsequent failure of many projects to deliver anything meaningful has left investors and speculators with a healthy distrust that will not be easy to repair or forget. ICO activity going forward is likely to come under more scrutiny from investors and regulators alike, which means that only projects with a healthy chance of delivering on their objective will gain access to financing. In this sense, we expect fewer projects that show more promise, with fairly-stable and lower actual amounts of fundraising in 2019. Fundraising activity is likely to pivot towards venture capitalism (VC) and, potentially, security token offerings (STOs) going forward. Following the ICO boom and bust, investors are seeking more tangible ownership value for investments, such as company equity, which these forms of investing can offer. It is true that ICO investors have learned much from the 2017/2018 cycle, and those that continue to invest in the space are more likely to have a closer resemblance to traditional VC investors.Where do you see the most risk-averse investment potential in the current crypto market?

We think the most attractive investments, in terms of risk and return, in the crypto space are equity investments into projects that are focusing on infrastructure development — those that create on-ramps for adoption and those that are aiming to successfully innovate current consumer offerings by incorporating blockchain within new and enhanced product offerings.Would you say that blockchain technology has survived the ‘crypto winter?’ Have we moved past it?

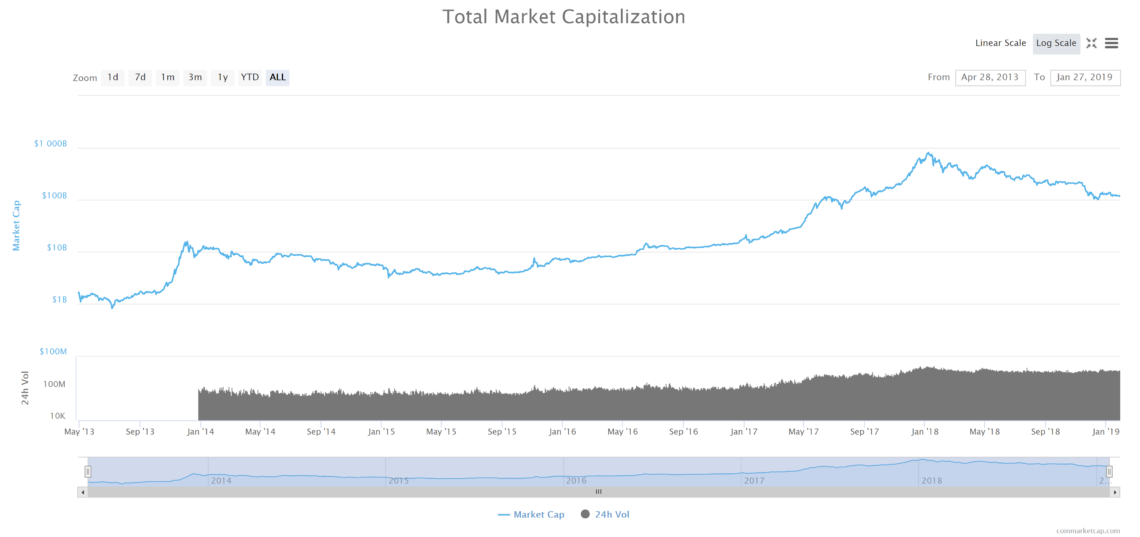

It’s difficult to say definitively that the cryptowinter is over. We should always be aware of and try to counter behavioural biases when attempting to gain perspective on a market. The cryptomarket is still in its infancy, and it’s important that investors be aware of the framing and recency bias when contemplating future developments. Price movements in 2018 paint a very bleak picture. However, when we expand the time horizon, we can better understand the full and longer-term picture of development. Looking at longer-term price development certainly makes the case for removing the extreme hype cycle at the end of 2017 from the meaningful analysis — as this was all but an outlier event that had no connection to fundamentals. In so doing, investors can have more realistic price expectations going forward. As the crypto market matures, realism will be important. It is our belief that investors are far more skeptical following the rise and fall of cryptoassets in 2017/2018. In this sense, we think the market is far more likely to reflect key fundamental developments — which look positive for 2019.

Will the current legacy market chaos bleed into the crypto market and affect that positive outlook?

Undoubtedly, crypto markets are being affected by the animal spirits present in other markets. Crypto’s market structure and nascent development stage mean that it is one of the most risky assets available to investors. With this risk comes the prospect of mouthwatering returns and, also, heightened periods of short-term volatility. Investor behaviour affects all markets and, in times of heightened optimism or pessimism, those assets that are most risky are either benefited or hurt most. No matter how insulated one thinks the cryptoassets market is, there is decent evidence of correlation with traditional markets — particularly at points of heightened volatility. On the other side of the coin, there is a thesis or school of thought that cryptoassets, such as Bitcoin (BTC), will behave like safe-haven assets in the event of a severe market crisis such as that of the Global Financial Crisis of 2008. This remains somewhat untested, as we have not had such conditions since cryptocurrencies came into existence. It is, however, plausible that selected cryptoassets may show at least some form of insulation from a severe downturn in traditional capital markets — particularly if a downturn is systemic in nature. The reason for this is that cryptoassets essentially exist within in their own system. Only time will tell on this one.With that said, do you see Bitcoin closing the year ahead of or behind current levels?

Once again, this is very difficult to predict. Undoubtedly, many investors will be keenly awaiting any form of good news from the cryptomarkets in 2019. Many, too, will be scratching their heads as they contemplate the future of the nascent digital asset market — given the polarity of powerful opinions. The good news is that cryptoassets have shown remarkable resilience in the face of severe market downturns and powerful naysayers. The Bitcoin blockchain is now in its second decade of existence, which is a feat that should not be overlooked in terms of significance. We think the future is bright, for many reasons, but we urge investors to focus on fundamental developments rather than short term price fluctuations stimulated by over-hyped news and expectations. [bctt tweet=”We think the future is bright for many reasons, but we urge investors to focus on fundamental developments rather than short term price fluctuations stimulated by over-hyped news and expectations. ” username=”beincrypto”] As we look forward to the new year, we believe that the key areas to watch will be adoption, an evolving fundraising environment, institutional adoption, and overall market consolidation. Given our positive view on these aspects, we see bitcoin having a positive year. However, it is notoriously difficult to provide a precise price-point estimation.

Are there any applications/use-cases for blockchain or crypto that you’re most excited about?

We are very excited about the security-token space. Security tokens offer the potential to merge the benefits of digital assets — transparency, cost efficiency, and accessibility — with those of traditional assets (trust and investor protection through smart regulation and oversight). Robert Greifeld, the former Chairman and CEO of NASDAQ, has stated that “100 oercent of the stocks and bonds trading on Wall Street today could be tokenized and, in five years, 100 percent of the stocks and bonds on Wall Street will be tokenized.” We believe we are on the cusp of a massive disruption of capital market securities that will see many efficiencies and new use cases unlocked. What do you think? Let us know your thoughts in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored

![Invictus Capital CFA: Future Looks Bright for Bitcoin [Interview]](https://beincrypto.com/wp-content/uploads/2019/01/bic_Invictus_Capital.jpg.optimal.jpg)