The price of Injective (INJ) has risen by 4.55% in the last 24 hours, following the integration of the Layer-1 blockchain by the Telegram-based project Toncoin (TON).

While the price increase suggests a positive market response to this expansion, on-chain analysis indicates that INJ could sustain its upward momentum. Here’s why.

Injective Gets Set to Break the Sell Wall

Earlier today, BeInCrypto reported the integration, which will see users bridge INJ tokens to the TON blockchain and vice versa. Before the announcement, INJ changed hands at $17.97.

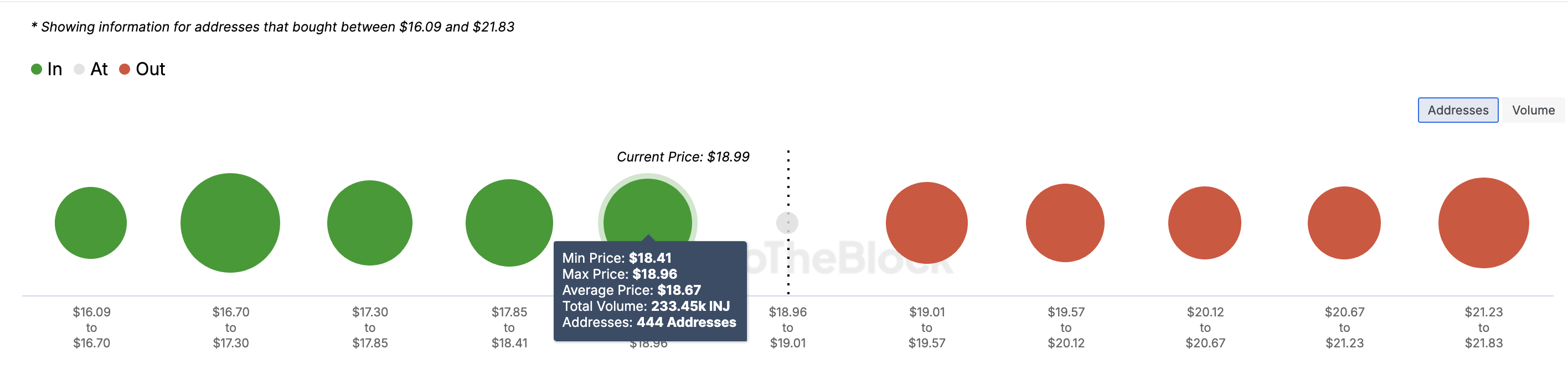

As of now, INJ is trading at $18.90 and could be poised to retest $20 or higher. According to IntoTheBlock, the In/Out of Money Around Price (IOMAP) indicator supports this possibility.

The IOMAP compares the token’s current price with the average purchase cost to determine if addresses are in the money, out of it, or at breakeven. This classification helps identify areas of strong support or resistance.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

Generally, when a large number of addresses is in the money at a particular price range, support is stronger. Conversely, if more addresses are out of the money at a range, resistance tends to be stronger.

As shown above, 360 addresses bought over 71,000 INJ at around $19.30 and are currently out of the money. On the other hand, 444 addresses accumulated 233,450 tokens at around $18.67 and are now in profit.

This suggests strong support between $18.41 and $18.96. Given this support, INJ’s price is likely to break past $19.30 in the short term.

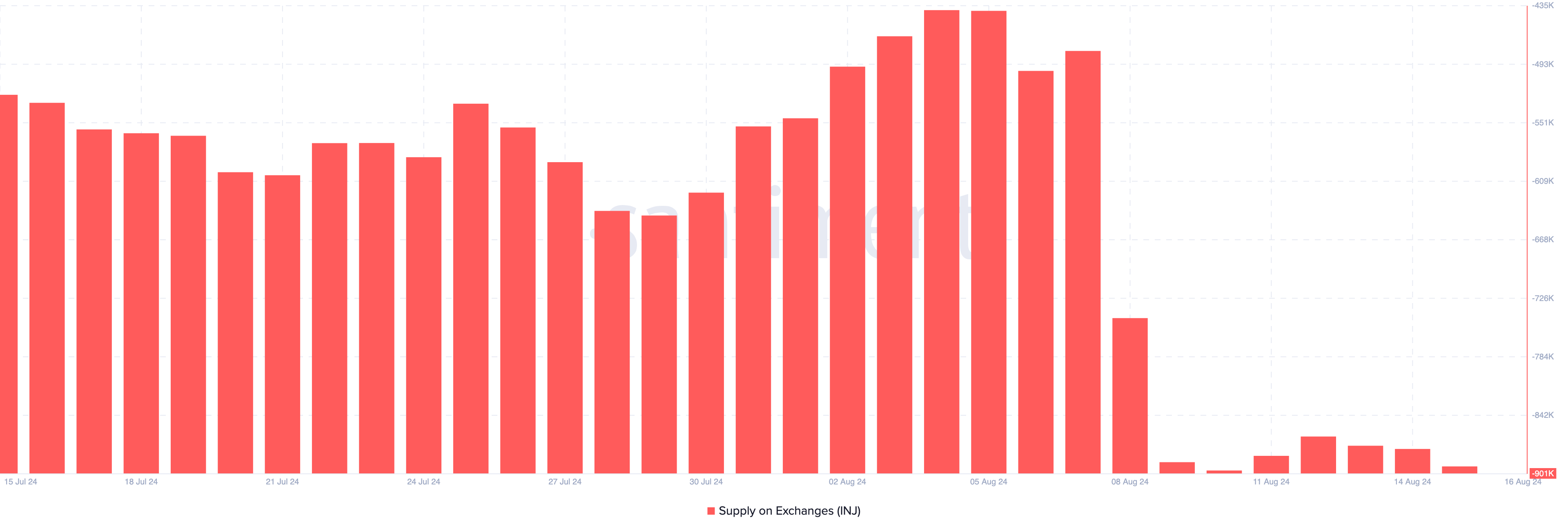

Another metric backing this outlook is INJ’s supply on exchanges. As the name suggests, this metric tracks the number of tokens flowing in and out of crypto exchanges. When supply on exchanges increases, it indicates that more tokens are being sent in, likely signaling that holders are preparing to sell.

However, at press time, on-chain data shows that about 901,000 tokens have been withdrawn from exchanges. When this happens, it implies that holders are unwilling to sell.

INJ Price Prediction: The Token Won’t Go Down Without a Fight

Based on the daily chart, INJ has formed a falling wedge. This bullish pattern appears when a downtrend loses momentum, and buyers capitalize on the exhaustion to accumulate more tokens.

BeInCrypto noticed proof of the increased buying pressure from the Money Flow Index (MFI). In simple terms, the MFI uses the price and volume data to measure buying and selling pressure.

When selling pressure increases, the Money Flow Index (MFI) reading declines. On the other hand, a rise in the MFI suggests participants are actively buying, potentially driving the price higher. For INJ, the indicator currently signals the latter, indicating upward pressure.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

If sustained, this could push INJ’s price to $20.22. Continued buying pressure might even propel it toward the $21.67 resistance. However, if the buying momentum fades, INJ could face a downtrend, potentially dropping to $17.57.