INJ, the utility token of Injective, a layer-1 blockchain that allows trading across several chains, is down 18.77% in the last five days. In several instances, market participants will view this decline as a “buy the dip” opportunity.

However, data gathered on-chain shows that this is unlikely. Instead, INJ may encounter another decline unless the broader market condition changes.

Market Interest In Buying the Injective Dip Fizzles

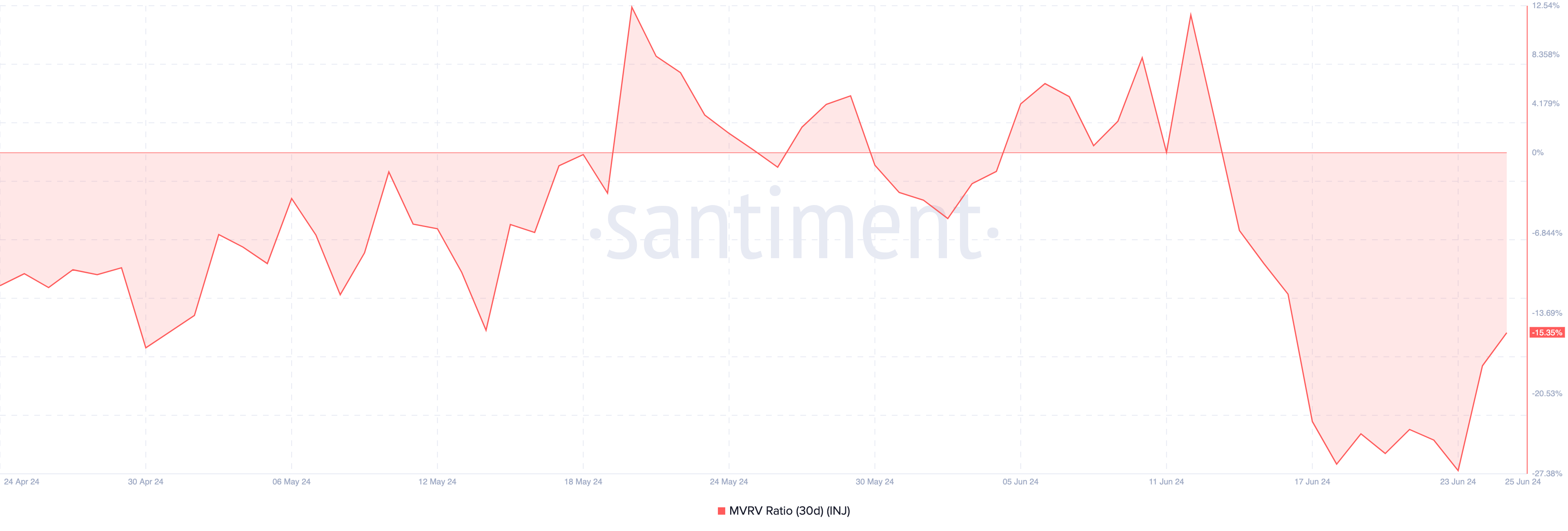

When analyzing holder behavior or sentiment, it is important to evaluate the Market Value to Realized Value (MVRV) ratio. This ratio allows investors to make informed presumptions about the potential impact on price.

For those unfamiliar with the market terrain, the MVRV ratio gives insights into profitability. To make it clear, during a bull run, the ratio tends to increase. However, a bear market sees the MVRV ratio reaching lower levels as the price falls.

Also, the higher the MVRV ratio, the more it nears overvalued regions, and the more participants will be willing to sell.

Read More: What is a Layer-1 Blockchain?

As shown above, Injective’s 30-day MVRV ratio is 15.35%. Typically, INJ holders are supposed to refrain from selling, considering the low profitability. However, the ratio is higher than it was on July 23, indicating that some holders’ unrealized losses have decreased.

Considering INJ’s underwhelming price performance on a Year-To-Date (YTD) basis, some holders may have lost total confidence in the cryptocurrency and will likely sell at a loss.

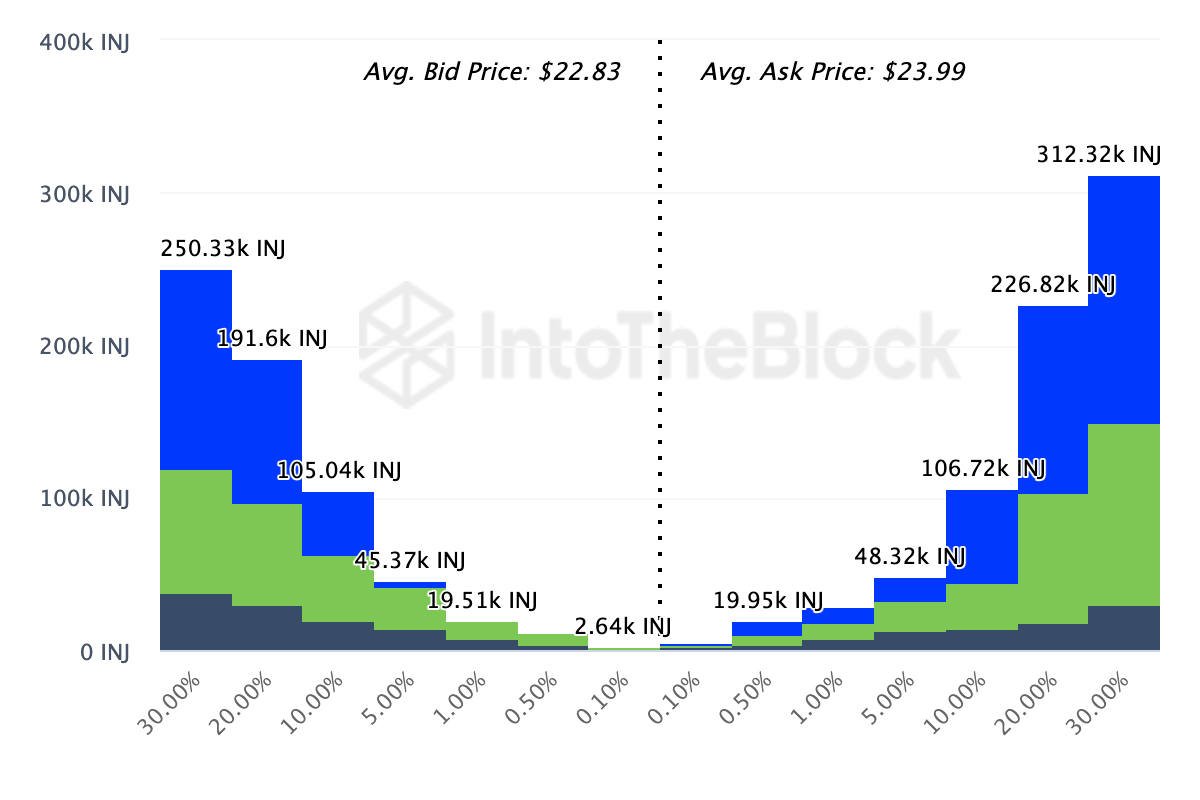

If this happens, INJ’s price may experience another round of downward pressure. In addition, the Exchange On-Chain Market Depth reflects further proof of this. This metric gives insights into the happenings on the order books of the 20 exchanges.

Divided into two parts, a higher figure at the bid (buy) side increases the chance of a price increase. However, if the ask (sell) segment exceeds the bid, a cryptocurrency will likely experience a price decrease.

For INJ, participants are prepared to sell 738,620 tokens at an average price of $23.99. Meanwhile, the number in line to be bought is low. Therefore, this sale may go through as INJ’s price continues to fall.

INJ Price Prediction: Time to Return to $20?

Currently, INJ is 54.25% below the all-time high it reached in March. On the daily chart, the cryptocurrency traded between a descending channel between June 13 and the same date in July.

A descending channel is a technical pattern formed by downward trendlines. The upper trendline represents declining resistance spots, and the lower one indicates falling support. Also known as a channel down, this pattern is a bearish one.

INJ, however, broke out of this pattern as the price rallied to $28.12 (dotted lines). Since falling from that peak, INJ’s previously bullish momentum, as indicated by the Relative Strength Index (RSI), has waned.

If the RSI reading continues to fall, so will INJ’s price. Should this be the case, the cryptocurrency’s value may drop to $20.22, which was once a solid support.

Read More: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

However, if bulls fail to defend the support, the price may fall to $18.19. Meanwhile, INJ’s potential decline may be invalidated if Bitcoin’s (BTC) price bounces.

This is due to the strong correlation between both cryptocurrencies. At press time, BTC trades at $64,000.If the coin jumps and revisits $66,000, the price of INJ can restest $27.49, where the 61.8% Fibonacci retracement level, often called the golden ratio, lies.