The Injective (INJ) price momentum turned bearish following the formation of its all-time high nearly two weeks ago.

INJ is now recovering again, rising by more than 15% in the past three days, but will it be able to break consolidation?

Injective Investors Are Pushing On

Injective price is currently trading at $40.17, up from $35.02 just 72 hours ago. This has given bullish signs for investors once again, who were reeling from the 32% correction observed since mid-March.

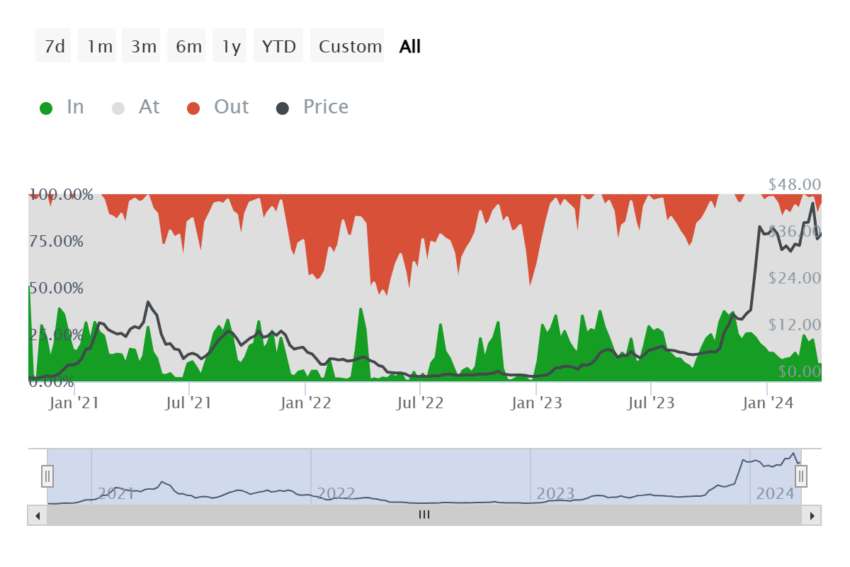

As a result, as Injective price attempts to escape consolidation, investors are contributing to the network as well. The addresses that have been conducting transactions on the network tend to drive the price. In the case of INJ, these are majorly dominated by investors at the money.

These investors are presently breaking even and are waiting for the price to shoot up in order to find profits. Their activeness shows that INJ holders are still optimistic about the Injective price rising further, which will boost the bullish momentum.

Read More: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

However, an important cohort has been rather dormant and needs to engage in transactions in order to rally Injective prices. This cohort is the whale addresses that dominate more than 84% of the circulating supply of INJ.

At the moment, these holders are only conducting $7 million worth of transactions on average against the total volume of $14 million. This shows that despite their dominance, their participation is limited, which, if improved, would push the INJ price higher.

INJ Price Prediction: $45 Is the Target

The injective price is testing the local resistance level marked at $41, which, if breached successfully, would enable INJ to rise further. Presently, the cryptocurrency is consolidated between $35 and $45.

Once the Injective price breaches $45, it would have a shot at rallying towards the all-time high of $51.85, provided it can break through the $50 resistance level.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

However, should this breach fail, the Injective price would be vulnerable to a retrace towards $35. Losing this support floor would invalidate the bullish thesis and send INJ back to $31.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.