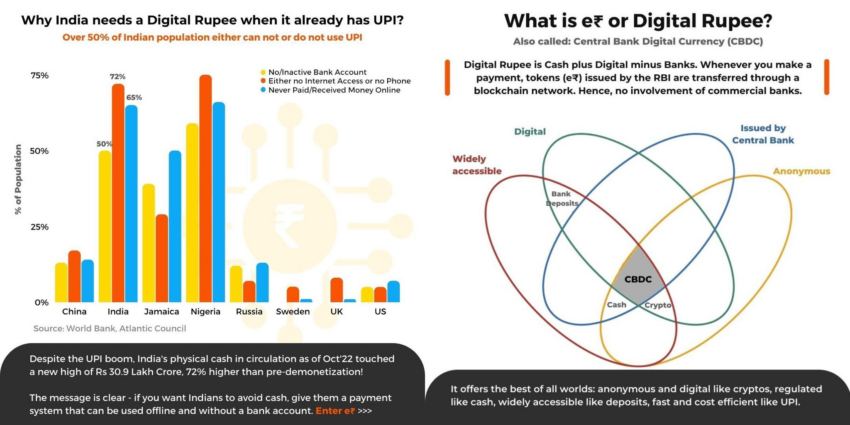

As India progresses towards widespread acceptance of a central bank digital currency (CBDC), leading Indian banks like HDFC and ICICI have increased their digital rupee offerings.

HDFC Bank has rolled out a Digital Rupee app to promote what it calls the “future of money.” Last week, ICICI Bank and online retailer Pine Labs partnered to make digital rupee payments possible.

India’s CBDC Pilot Expands More Offerings

India started a digital rupee test with four national banks in the final quarter of 2022.

The State Bank of India, ICICI Bank, Yes Bank, and IDFC First Bank wallets were once the only players where users could access the digital rupee. Only people living in four cities—Mumbai, Bengaluru, New Delhi, and Bhubaneshwar—were initially offered these wallets. Later, the government expanded its pilot program to at least nine banks.

Prior to HDFC, Pine Labs collaborated with ICICI Bank to enable the acceptance of the Digital Rupee on its point-of-sale terminals. As per reports, the partnership allowed Pine Labs to accept e-rupee payments across select retail outlets using QR codes.

Amrish Rau, the CEO of Pine Labs, stated that the Reserve Bank of India is supervising the inclusion of CBDC as a payment option in the pilot program.

Finance Minister Nirmala Sitharaman reported that as of Feb. 28, the pilot program for Digital Rupee had more than 15.8 million in circulation. This number has likely gone up quite a bit since in the months since then.

Nischal Shetty, the co-founder of Shardeum, told BeInCrypto that CBDCs offer a host of benefits to the developing, digital-savvy world.

He added,

“We might also witness a shift from the dollarization of the economy to each sovereign nation holding more power in monetary affairs.”

Pilot Hiccups

Moneycontrol reported that certain customers participating in the current trial for retail CBDC had expressed worries about technical malfunctions. These issues include digital transaction failures, error messages, and difficulties encountered while attempting to make payments, among other concerns.

Nikhil Kamath, the co-founder of the Zerodha stock trading portal, is among the many who have voiced support for the CBDC.

A recent related economic forecast anticipates that the Indian web3 market could skyrocket to $5.1 billion by 2032.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.