The International Monetary Fund (IMF) and the Financial Stability Board (FSB) have cautioned against implementing blanket bans on cryptocurrency assets. The joint report called for targeted regulatory actions to address the inherent risks associated with the cryptocurrency sector, reports noted.

The two agencies also recommend adopting sound monetary policies against the backdrop of upcoming G20 meetings.

Why Agencies Recommend Against a Blanket Crypto Ban

One of the major concerns expressed in the joint report is the potential impact of cryptocurrencies on a nation’s monetary policies.

The report emphasizes that an outright crypto ban may not effectively mitigate these challenges.

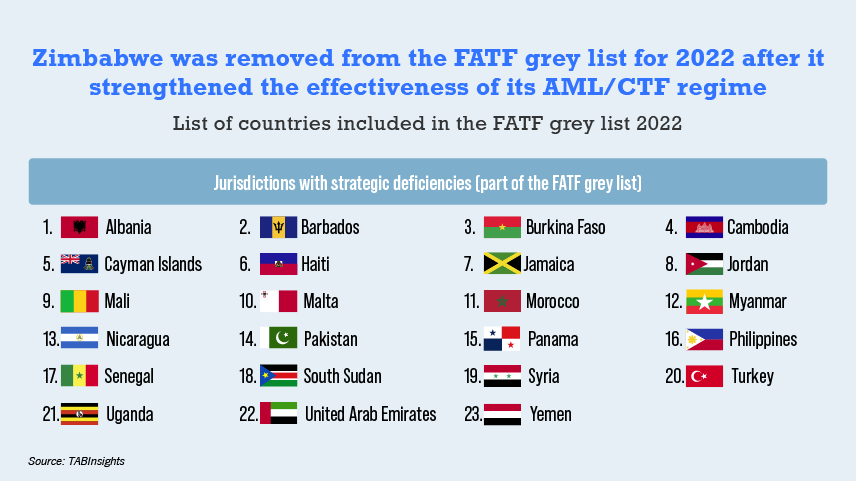

The paper suggests licensing cryptocurrency service providers and implementing the Financial Action Task Force’s (FATF) anti-money laundering and counter-terrorist financing (AML/CFT) standards within the crypto industry.

The agencies recommend a targeted approach due to crypto’s borderless nature. The paper advocates for a comprehensive framework that can oversee the markets, crypto-assets, stablecoins, and decentralized finance (DeFi).

Read more: Identifying & Exploring Risk on DeFi Lending Protocols

“To protect monetary stability, crypto-assets should not be granted official currency or legal tender status,” the report cautions. The IMF has made this recommendation several times since El Salvador granted Bitcoin a legal tender status.

Additionally, the report also advises central banks to refrain from holding crypto-assets in their official reserve assets. It calls on governments to minimize fiscal and operational risks associated with crypto. The paper also recommends unambiguous tax treatment for the asset class.

India Seeks Global Cooperation

BeInCrypto previously reported that India, which holds the presidency for the G20 Summit, will seek consensus on crypto recommendations outlined in the policy paper.

Rajagopal Menon, Vice President of WazirX, expressed his views on the IMF and FSB synthesis paper to BeInCrypto:

“The synthesis paper is a lighthouse for guiding regulatory framework and addresses minute details on financial inclusion, technological development, and improving the efficiency of transactions on transparent networks.”

He added that they firmly endorse the “same activity, same risk, same regulation’ principle, believing that international standards serve as ‘a foundation for innovation rather than a hindrance.'”

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Menon added,

“We look forward to the G20 recommendations which will give us a clear view of how we can build synergies with world leaders, and create a regulatory environment that protects investors while enabling the next wave of financial innovation.”

Indian Finance Minister Nirmala Sitharaman recently underscored the ongoing development of a global framework for regulating cryptocurrency assets. The need for international cooperation in regulating cryptocurrencies has been a recurring theme in discussions under India’s G20 presidency.

Meanwhile, the G20 meeting is reportedly expected to endorse around ten significant initiatives. According to the Hindustan Times report, the agenda includes a financial inclusion action plan for 2024-26 based on the Indian model of digital public infrastructure (DPI) and a “risk-proof” global framework for crypto assets.