Two crypto entrepreneurs have put forth a hypothetical plan to purchase the IP of FTX and relaunch it as a new exchange. The plan covers opportunities, execution, and risks.

Crypto entrepreneurs are considering a hypothetical plan to purchase the IP of FTX and create a new exchange called Maven. CryptoJoe and Simeon.eth have been discussing the idea, saying there is a strong case for the opportunity.

CryptoJoe says that they are taking four parts to a potential purchase and launching of an exchange: rationale, business plan, operational improvements, investment and returns profile, and execution and risks. They also provided a hypothetical letter to the court of Delaware and a mock term sheet.

Explaining the rationale, he said that UI/UX and optionality brought users to FTX, not celebrity endorsements. He emphasized that the exchange “was loved for its usability, its tooling, and optionality in products & markets.” He then noted that Binance dominates the current exchange market share.

As such, he posited a tender offer for FTX’s IP and several improvements; it could have some potential. The operational changes stated include custody and governance. The relaunched exchange would have the name, Maven.

CryptoJoe sees two main areas of revenue generation going forward, which are Maven trading and Maven staking. The former will include a spot and derivatives platform and a margin lending and borrowing product. Staking allows users to commit stablecoins, which can be converted into fiat and held by regulated third-party banks to buy U.S. Treasuries.

The Revenue Estimates, Execution Plan, and Risks of Maven

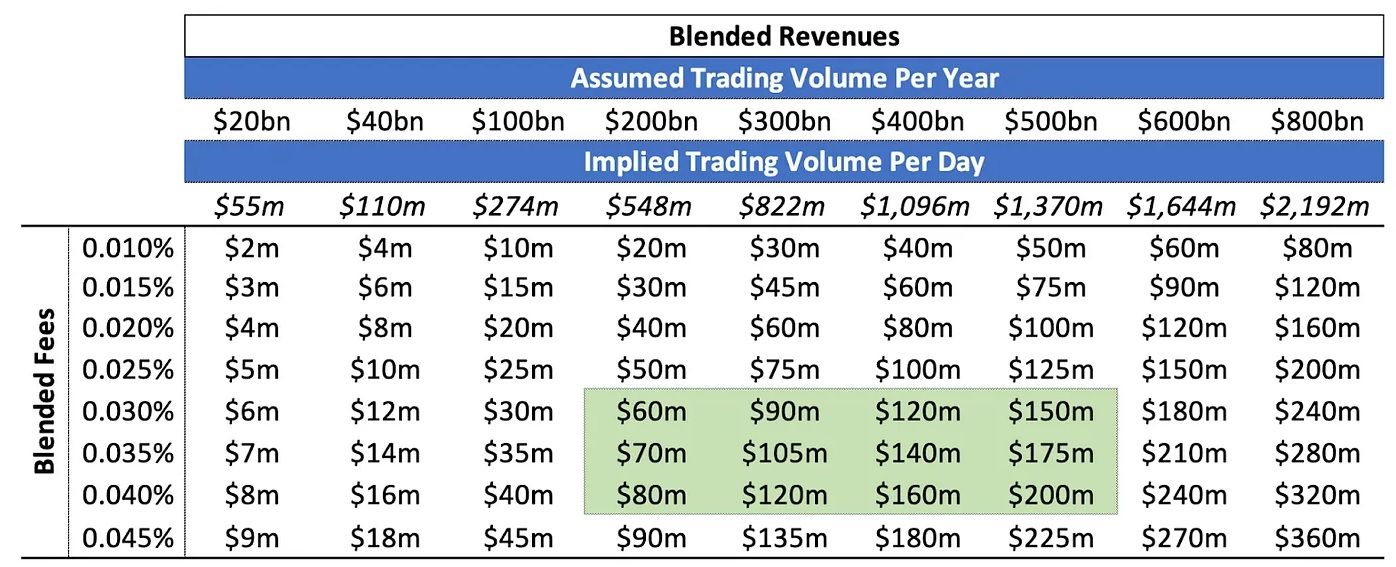

The two individuals also discuss revenue estimates for Maven. The estimated trading revenue is $140 million per year based on trading fees. These are based on certain assumptions but offer a rough idea of what revenue may be like.

As for staking, they believe that this exchange could generate over $10 million. Using ETH staking in this estimate puts the figure at $2 million. As such, the total revenue estimated is $152 million.

They also go over the execution plan of a relaunch, which would include creating a syndicate of investors, building an advisory team and board, delivering a term sheet, and paying funds in tranches. Risks assessed include negative macro conditions, volatility, securing a license, regulation, and cyberattacks.

Former FTX CEO Sam Bankman-Fried Pleads Not Guilty

While the two have discussed a potential bid, the Manhattan U.S. Attorney’s Office has created an FTX task force to track and recover the victims’ assets and handle investigations.

Sam Bankman-Fried has pleaded not guilty while also asking the judge to keep the identity of his bail guarantors secret. Two individuals have intended to sign the legal document of his $250 million bail.