Sentiment in the cryptocurrency market is volatile and can turn 180 degrees in days. Therefore, it is important to consider trends, and blockchain technology is one of them.

The market sentiment by definition is volatile and short-lived, and it is trends that last for a long time. Trends are important to follow when making long-term investments.

Investors who are inexperienced fall into the trap of following current market sentiment in a trend, and interpreting the trend based on their temporary emotions. This is a mistake because the cryptocurrency market has its own cycles.

An Investor Hides During a Bear Market

As I said, blockchain in combination with other technologies such as AI is a trend of the present and future. This topic has been covered in a wide variety of books and publications.

On the other hand, companies often need external funding, especially at the start-up stage. A bear market in cryptocurrencies is often where the barrier comes in, as companies fail to raise funds for their projects during this time. In presales, they have trouble selling their tokens.

This is not an uncommon problem, as quite a few companies when contacting us, ask how to raise money during a bear market.

On the one hand, I can understand this. Because the cryptocurrency market is cyclical, there are scares and depressions regularly, every few years. Investors then, unlike in a bull market, are less eager to invest in new tokens.

They watch every dollar two or even three times before spending it on some newly created project.

A bear market in crypto, however, is healthy because it filters the market and separates short-term speculative trends from projects that want to stay on the market longer. It means that the market is clearing itself of artificially inflated crypto projects with empty promises.

When the market is down, investors have the chance to invest in projects that are truly valuable. We can say that the bear market, in some way, protects investors’ capital and reduces fraud risks.

Crypto Projects Are Better During a Bear Market?

Projects built during a bear market are usually more rational. Companies in a bear market don’t usually spend too much money on marketing, so they must show investors their true value. They assume realistic goals without marketing hype. Investors during a bull market are more careful and skeptical, so colorful banners or big promises don’t work so “well” anymore.

A bear market is a time to come down to earth, so only the real utility of a project can convince an investor. A company that develops projects during a downturn shows investors that they are competent and strong. In fact, if they can build during difficult times, imagine how well they can do when Bitcoin reaches new highs.

We already know that launching new projects in a bear market can be advantageous. It is however still a challenge to organize project funding when investors do not want to look at the market and hold their funds away from crypto exchanges, often counting unrealized losses. Getting them involved is not always easy.

Nevertheless, it is possible to find new investors, those who haven’t had experience with Web 3.0 yet. Here, in fact, lies huge potential. To be honest, blockchain is at the beginning of its history, and most people still don’t fully understand its potential.

So it’s worth helping them get out of Web 2.0. The biggest opportunity for new Web 3.0 projects and true mass adoption of cryptocurrencies lies with people currently operating in Web 2.0 (about 95%).

The Bridge Between Traditional Finance and Blockchain

Companies need to build a technological bridge for people to help them move straight from Web 2.0 to Web 3.0. We are talking about the phenomenon of increasing adoption of new technologies among the public.

For a first-time investor, the most significant aspects of a project raising funding are the user experience (UX) during the process and the simplicity of the crypto wallet. The project needs to provide a simple tool for buying tokens during funding rounds.

For those in traditional finance, buying tokens on a crypto exchange is quite a problem. Let’s be honest, most potential investors won’t do it, even if they like the project. In addition, crypto exchanges have not had a good reputation lately, and each collapse is a new media narrative for the next few months and sometimes even years.

This Is What New Investors Want

As I said earlier, UX impact is key. Building simple wallets and payment gateways where an investor from traditional finance won’t feel too much discomfort buying tokens in Web 3.0. So it becomes crucial that the user can buy tokens directly on the company’s website. Without opening additional windows.

For companies with dedicated fans and site users, this can be a game changer. In addition, investors must have the option of moving directly from traditional money (fiat) to blockchain tokens.

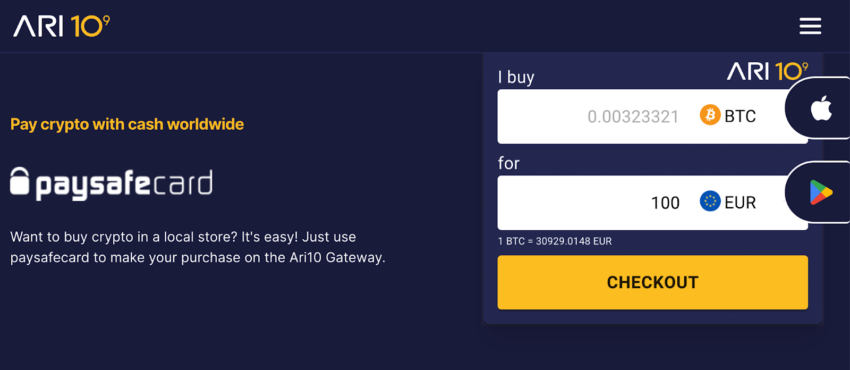

It is critical for companies to build software that allows investors to pay for their tokens with traditional banking methods. The company I represent is building this type of solution. This is the Ari10 Gateway widget.

It is a fiat-crypto payment gateway that we also share with other companies. In addition to paying via bank transfer or credit card, investors can also use paysafecard to purchase cryptocurrencies and tokens.

Our goal is to offer enough payment options to reach the widest possible range of customers. In a bear market, these factors make it easier for new projects to obtain financing and succeed.

– – –

Mateusz Kara

Co-founder and CEO of Ari10. Blockchain lawyer involved in many fintech and blockchain projects. University lecturer on blockchain technology law, investor, and advisor in many cryptocurrency and non-cryptocurrency-related companies.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.