The American billionaire Hedge fund manager Paul Tudor Jones holds Bitcoin. What is other big investors’ approach towards BTC?

In an interview, the founder of Tudor Investment Corporation, Paul Tudor Jones II, said that he still has a very minor allocation of Bitcoin. The hedge firm has over $24 billion in assets under management, according to their latest 13F filings.

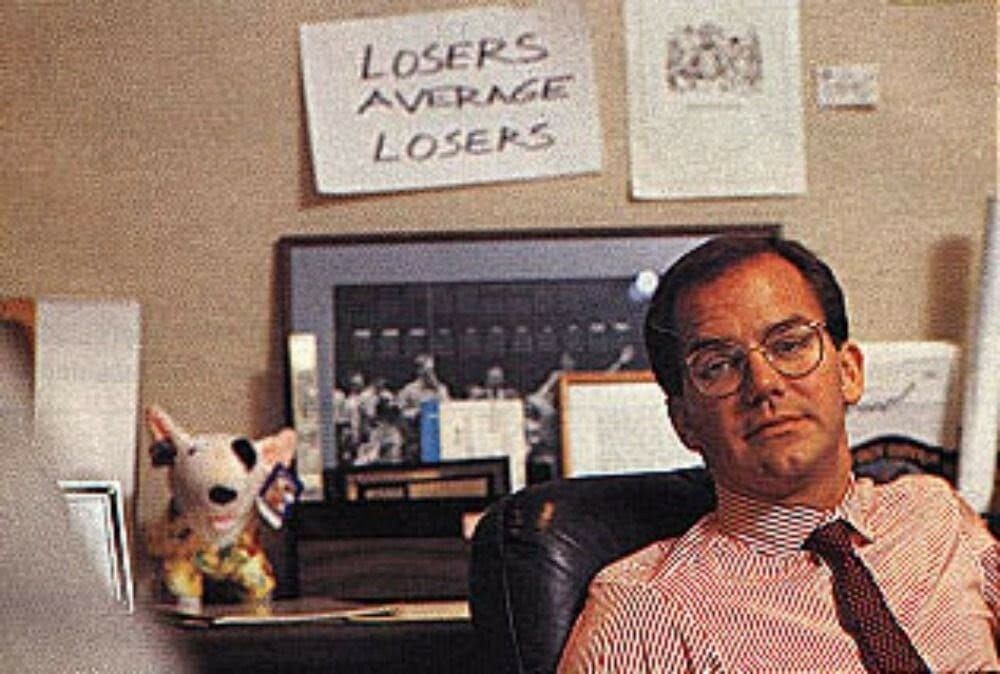

Generally, Paul Tudor is believed to be a trend follower, which means he doesn’t hold on to an investment instrument in a downtrend. There is a famous picture of Paul Tudor, with a poster in the background that reads “Losers Average Losers,” basically indicating that he does not believe in popular strategies like Dollar-cost averaging.

He might have made an exception for Bitcoin and still holds it, a small allocation, though.

“So in a time when there is too much money, which is why we have inflation and too much fiscal spending, something like crypto, specifically Bitcoin and Ethereum, where there is a finite amount, that will have value at some point, someday. I don’t know when that will be, it will have value,” Paul said in the interview.

MicroStrategy

The co-founder of business intelligence firm MicroStrategy, Michael Saylor, is the most well-known Bitcoin whale. Most recently, MicroStrategy added 301 BTC to its balance sheet according to a form 8-k filing with The Security and Exchange Commission.

They started aggressively buying Bitcoin in 2020 and plan to HODL through adversity According to Saylor, MicroStrategy, the firm now holds 130,000 BTC at an average price of $30,639.

El Salvador

Not just individuals or institutions, there is a country in the list of Bitcoin HODLers. In September 2021, El Salvador bought their first 200 Bitcoin, president Nayib Bukele announced through a tweet.

Their most recent purchase was on July 1st, 2022, when the country purchased an additional 80 BTC at $19,000 each. The country’s total holdings stand at 2381 BTC at an average price of $45,004, according to Nayib tracker, a website that tracks the president’s Bitcoin buys. El Salvador is 57% down in its Bitcoin bet, but president Nayib Bukele isn’t giving up.

Kevin O’Leary

The shark tank fame Kevin O’Leary is bullish on crypto and Bitcoin adoption. He revealed in an exclusive interview that he holds 32 positions in cryptos like Solana, Bitcoin, and Polygon.

He was a critic of cryptocurrency in 2017 but changed his view when the clients started asking for exposure to crypto and when he realized the efficiency of stablecoins for international payments.

This is whales’ approach towards Bitcoin in bear markets, what approach do you follow?

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here