Police in Hong Kong have arrested staff working for the payments company behind the Hong Kong dollar and RMB stablecoins CNHC and HKDC.

A notice on Trust Reserve’s office door said the team had undergone judicial seizure on May 29, 2023.

Chinese RMB Favored For Cross-Border Transactions

Families of the arrested parties have been notified. It is not clear on what charges the police arrested Trust’s team.

The company did not widely promote the stablecoins used in its cross-border payment business. Stablecoins are digital currencies pegged to the value of fiat currencies.

Popular examples include Circle’s USDC, and Tether’s USDT coins pegged to the US dollar.

Trust Reserves raised $10 million in a recent funding round led by KuCoin Investments, Circle, and IDG Capital. The firm recently relocated its headquarters from the Cayman Islands to Hong Kong.

While the reason for the arrests is unclear, authorities could be clamping down on digital payments not using its RMB central bank digital currency.

The e-CNY has 260 million wallets and expanded to 25 cities. China has a strict ban on crypto trading and mining in force.

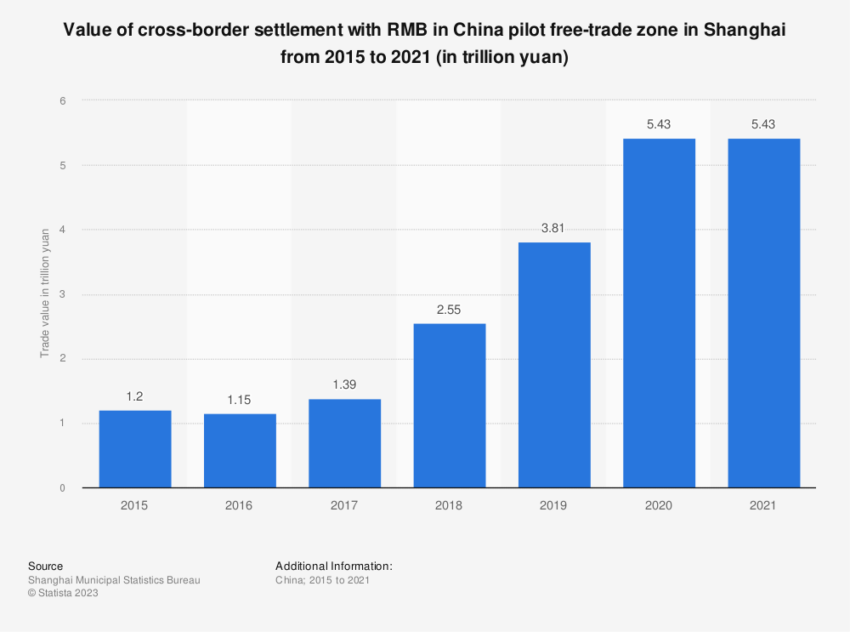

The communist state could also be looking to reduce its dependence on the US dollar in favor of the RMB to settle cross-border transactions.

Several countries, including Saudi Arabia, Bangladesh, and India, have expressed interest in trading using the digital yuan.

China beefed up its cross-border payments infrastructure after the 2008 financial crisis with bilateral currency swap agreements and the Cross-Border Interbank Payment System,

Chinese Central Television’s airing of a broadcast mentioning crypto last week fueled rumors China could lift its crypto ban. The broadcast has since been taken down with no further developments.

Learn more about stablecoin regulations around the world.

New Hong Kong Regulations Prohibit Stablecoins

Trust Reserve’s current domicile Hong Kong gazetted virtual asset platform registration requirements on May 25. Notably, the new regulations do not accommodate stablecoins.

Platforms can only list Cardano, Chainlink, Polygon, Avalanche, Solana, Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

The regulations will be effective from June 1.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.