The Hong Kong Virtual Asset Consortium (HKVAC) announced major core and market indices adjustments. Effective January 19, 2024, the consortium will introduce pivotal changes. Notably, it will add Solana (SOL) while excluding Ripple’s XRP, among other adjustments.

These changes are set to resonate across the industry, given the implications.

HKVAC Reshuffles Global Index

The HKVAC Global Large-Cap Crypto Index, a benchmark for large cryptocurrencies excluding Bitcoin, Ethereum, and stablecoins, will retain its 30 constituents. However, it will see notable entrants such as Internet Computer (ICP), NEAR Protocol (NEAR), Optimism (OP), Injective (INJ), and Immutable (IMX). Concurrently, this index will remove Maker (MKR), Lido DAO (LDO), Mantle (MNT), Quant (QNT), and Arbitrum (ARB).

Most strikingly, the HKVAC’s top five Global Large-Cap Crypto Index will now feature Solana (SOL), replacing the well-known XRP. This decision underlines the shifting environment, where newer technologies and crypto narratives gain prominence over established ones.

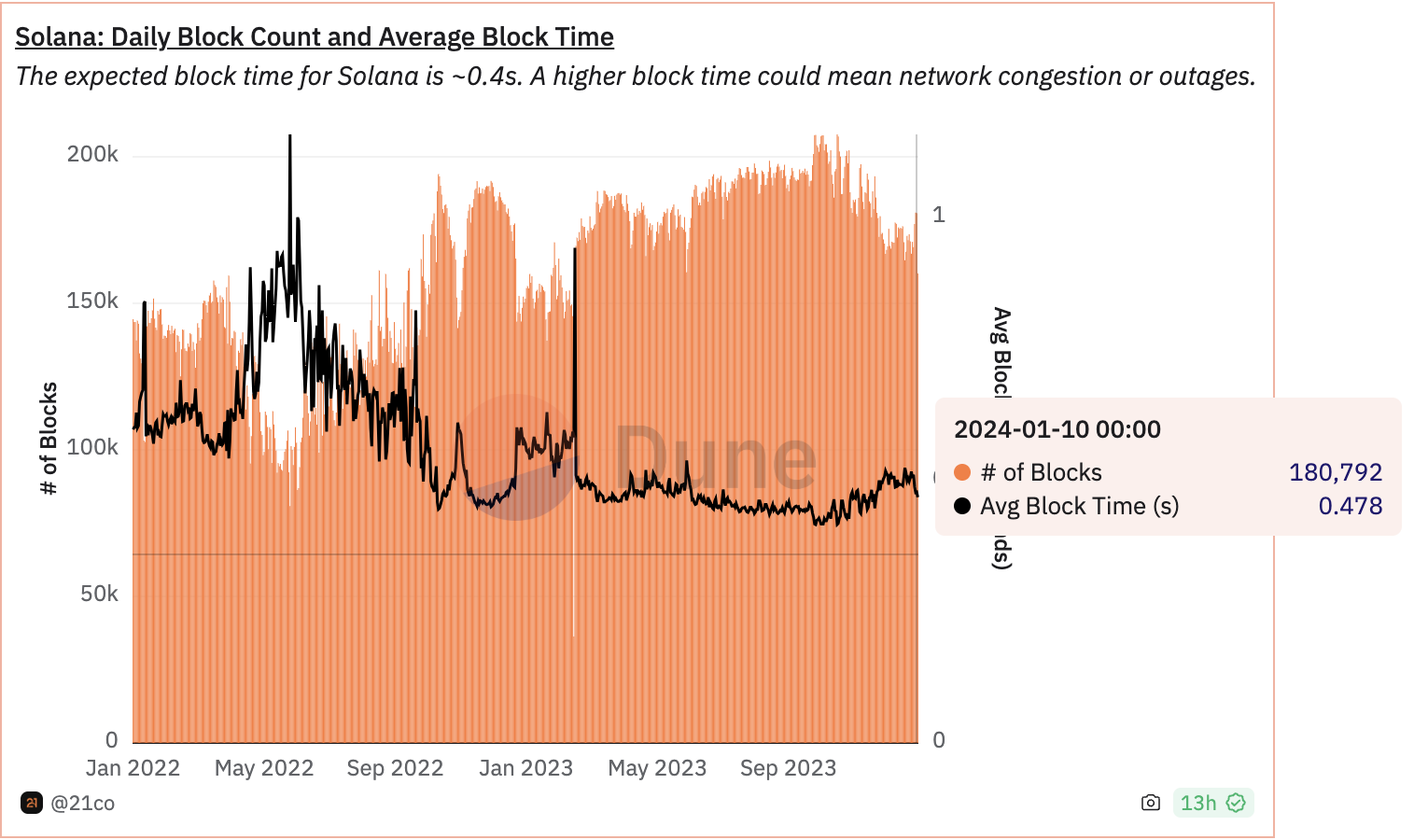

Therefore, including Solana suggests a strategic shift towards more innovative and scalable blockchain technologies. The Layer 1 blockchain is popular for its fast transaction speeds and growing ecosystem.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

Additionally, Avalanche (AVAX) will replace TRON (TRX) in both the top ten Global Large-Cap Crypto Index and its equal weight counterpart. This further indicates HKVAC’s focus on newer blockchain platforms that are making strides in terms of adoption and technological advancement.

Why This Matters to Investors

This reconfiguration by the HKVAC might influence investment and trading strategies significantly. Essentially, it is a barometer of the consortium’s standing and reputation in the wider crypto market.

Investors and traders will likely recalibrate their crypto portfolios in response to these changes mainly because the HKVAC’s decision is not just a reflection of the current market dynamics but also a pointer to where industry experts see potential future growth.

Solana’s addition, for instance, is a testament to its increasing acceptance and potential in the market. Conversely, removing XRP might hint at the market’s reaction to the ongoing regulatory challenges Ripple faces.

Read more: 13 Best Altcoins to Invest in January 2024

Indeed, the legal battle between the US Securities and Exchange Commission (SEC) and Ripple Labs remains fierce. The regulator recently filed a motion to compel Ripple Labs to disclose its financial statements for the years 2022-2023.

“The SEC seeks to compel Ripple to answer a single interrogatory setting forth the amount of XRP Institutional Sales proceeds that it received after the filing of the Complaint for contracts entered into pre-Complaint,” the court document reads.

As a result, the HKVAC’s latest index adjustments can be seen as potential concerns or shifting sentiment regarding XRP, indicating where leading market players are placing their bets. As the market prepares for these changes to take effect on January 19, the impact of these shifts on market trends and investor strategies remains to be seen.