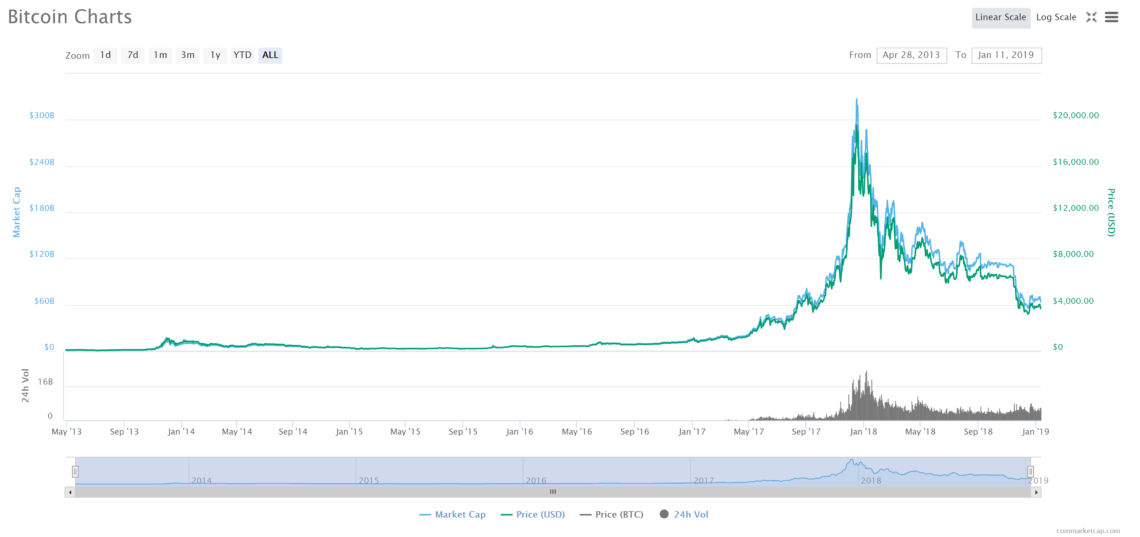

Spirits are high for many Bitcoin investors, despite the fact that the price of Bitcoin remains pretty dismal. This is primarily because the number of daily transactions on the Bitcoin network is at a one year high. BTC transactions were above 280,000 for the first time since January 2018.

The major difference, of course, is that Bitcoin prices were also near all-time highs in January 2018, with prices recently having touched $20,000 per coin.

Over the last year, the price of Bitcoin has dropped nearly 80 percent.

As of this writing, Bitcoin is trading at $3,700.

Why the contradiction?

Why are prices so low, yet transaction volume remains high? Some would say it is a positive indicator of the widespread adoption of cryptocurrency. They would use these numbers as a sign that more and more people are looking to Bitcoin as a trading tool, an investment, and a viable piece of their financial portfolio. However, other experts paint a much different picture of the reasons behind these high trading numbers. According to them, the proliferation of new wallets and the high transaction numbers are the results of wash trading and in no way indicate a flourishing trading market.

What is ‘wash trading?’

Wash trading is the unethical practice some exchanges engage in of selling Bitcoin at a loss, then repurchasing. Exchanges do this to create a false picture of high trading activity — leading to inaccurate trading volume reports. On the fiat stock exchange, a trade is considered a wash if the sale occurs within 30 days of the purchase of a security. The Commodities Exchange Act of 1936 made wash trading illegal in the United States. Losses resulting from wash sales are not considered a loss by the IRS and taxpayers do not stand to benefit from the tax breaks of washes resulting from wash sales. [bctt tweet=”In the cryptocurrency space, no global regulations currently exist against wash trading.” username=”beincrypto”] However, due to the fact that it falsely portrays market activity and data, it is considering a highly distasteful practice. Because of the U.S. Commodities Exchange Act and the fact that, at this time, bitcoin is considered under the authority of commodities regulations, the practice of wash trading is definitely an issue in the United States.

Legal recourse

[bctt tweet=”U.S. investors have the ability to take legal action against exchanges that have released misleading market data due to wash trading and any resultant market manipulation.” username=”beincrypto”] While this has not yet happened, it is a likely eventual outcome for exchanges that aren’t in compliance with U.S. commodities regulations. According to some estimates, up to 67 percent of exchanges engage in Bitcoin wash trading practices. As many as 80 percent of CoinMarketCap’s top 25 bitcoin trading pair volumes are wash traded. Fake and fraudulent trading is practically an epidemic.

Risk to tokens

Wash trading also poses a huge financial risk for token projects, as listing on top exchanges costs money. Tokens select exchanges to list on partially based on the liquidity and trading volume of the exchange. Exchanges that are practicing wash trading do not actually move the volume of coins indicated by their numbers. It is possible that some exchanges, lured by the prospect of charging a variety of tokens exorbitant fees, sometimes to the tune of $50,000 USD, are making as much as a million dollars a year just from wash trading. However, the news is worse for crypto overall. Lulled by big numbers and positively worded reports and data, investors really believe the widespread crypto adoption hype. It may not be true. Thankfully, some experts have taken the time to research the situation, and are willing to provide a more accurate picture of the state of Bitcoin trading. https://twitter.com/soleil_dusoir9/status/1083333742834434049?s=21 As is the case with any industry, information is power. Unfortunately, given the sheer volume of information out there, particularly about cryptocurrency, it is easy for investors to be misled by less-than-accurate information. Inaccurate information, especially when it is driven by fake data, can be quickly distributed throughout the community — leading to widespread misinformation sharing.

Silver lining?

Despite the unpleasant ramifications of situations such as this, there is also good news in this scenario. Crypto is undoubtedly growing, despite false data from wash trading and other unethical practices. As the industry grows, the demand for trusted sources will grow along with it. While Bitcoin was built upon the premise of being above the need for such things, when it comes to exchange issues and other Bitcoin support projects, it is important to remain vigilant, to check and double check sources, and to remember to use common sense. Most importantly, investors need to keep in mind what they first learned in second grade — to not believe everything they read on the internet. Think wash trading is fraud? Or is it just common business practice? Let us know in the comments below!Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored