Hedera has faced significant downside pressure in recent days, with its price falling 24% over the last two weeks. The decline extends beyond broader market weakness and is increasingly tied to investor behavior.

Weakening demand and sustained outflows are weighing heavily on HBAR’s ability to recover, creating obstacles for any upward movement.

Hedera Investors Withdraw Support And Money

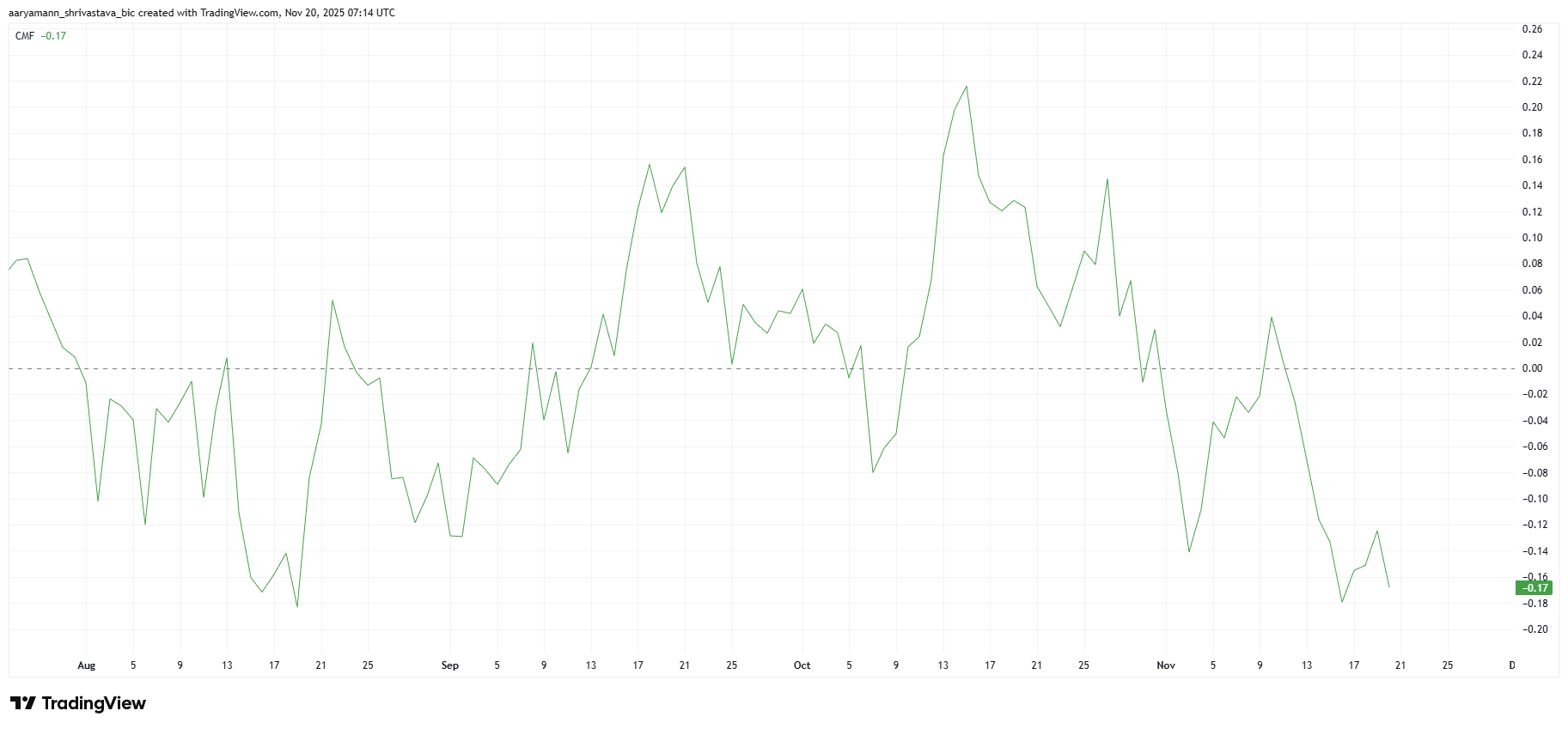

Market sentiment for HBAR has deteriorated sharply as the Chaikin Money Flow signals rising outflows. The indicator has dropped to a three-month low, reflecting a clear shift away from accumulation. When CMF falls this deeply, it often indicates that liquidity is leaving the asset at an accelerated pace.

Investors pulling capital out of HBAR suggest fading confidence in near-term recovery. This lack of conviction is directly impacting price stability, reducing buying pressure when the asset needs it most. Without renewed inflows, HBAR may struggle to generate upward momentum, delaying any meaningful rebound.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

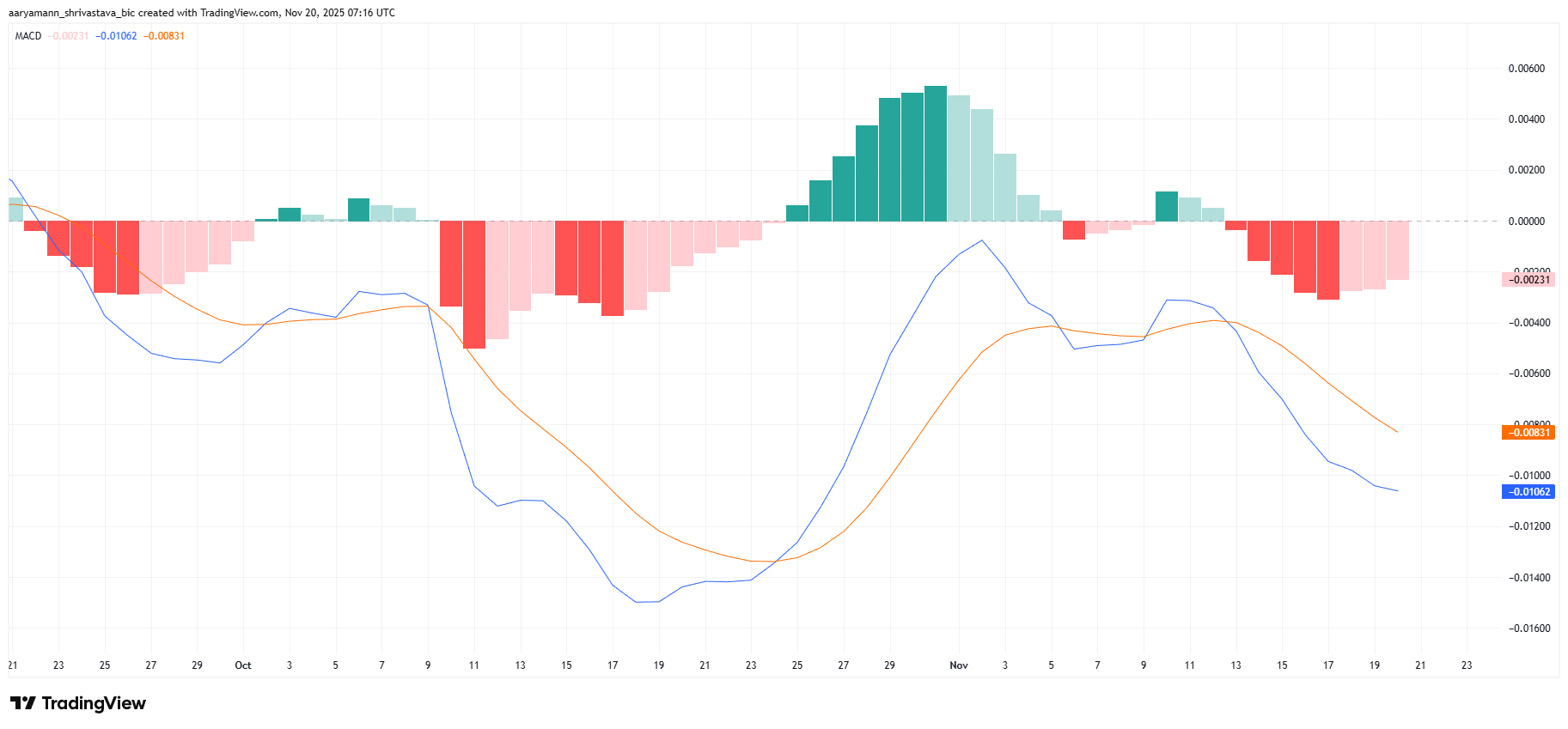

Macro momentum indicators are showing mixed signals. Hedera’s Moving Average Convergence Divergence indicator remains in a bearish crossover, confirming ongoing downside momentum. However, the histogram bars are shrinking, which suggests that bearish pressure may be weakening.

For a full shift in trend, the MACD must flip to a bullish crossover. Without that change, the broader bearish structure remains intact. If momentum fails to turn positive soon, HBAR may continue facing downward pressure as traders wait for clearer signals of strength.

Will HBAR Price Decline Continue?

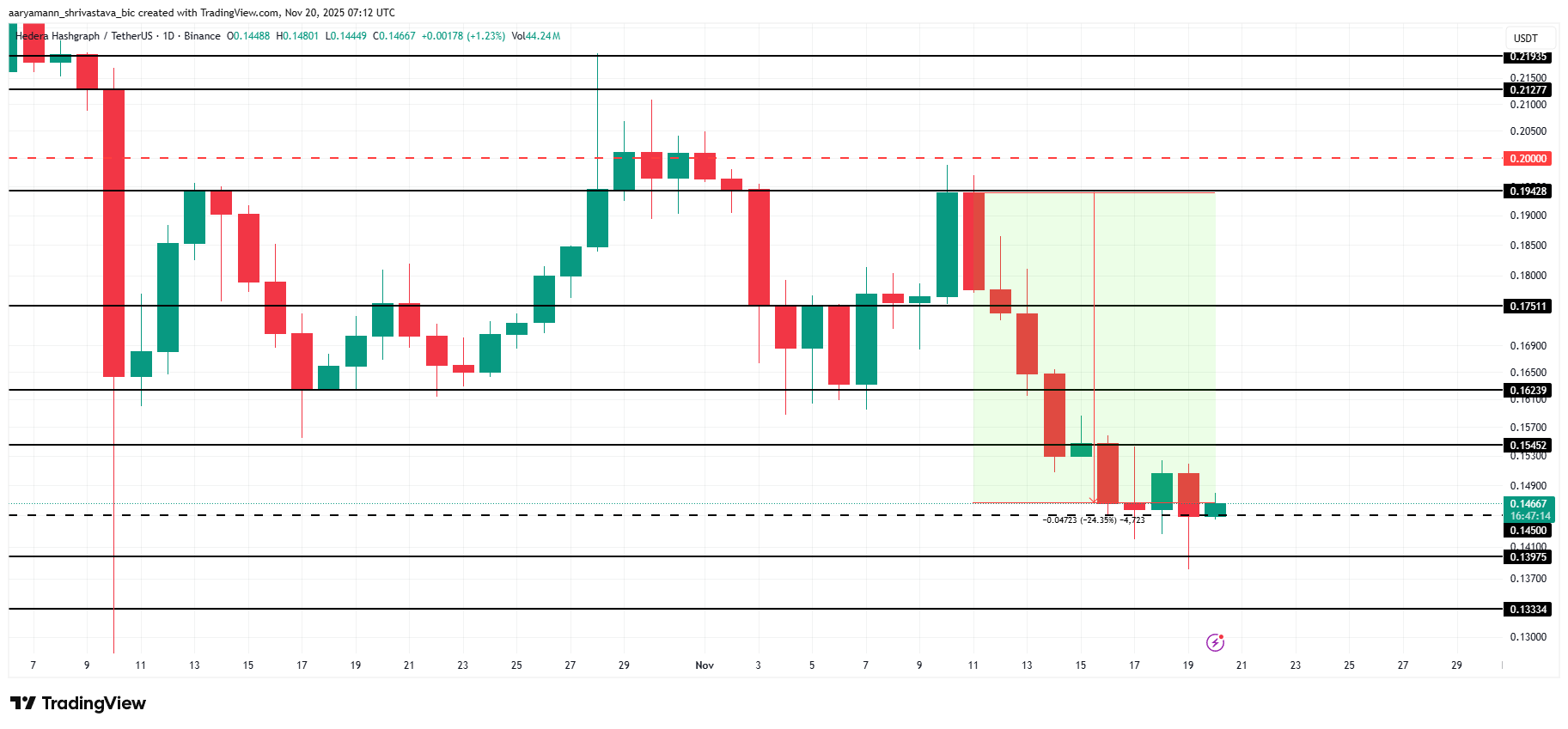

HBAR trades at $0.146 after dropping 24% in the past 10 days. The altcoin has managed to hold above the $0.145 support level, which has provided temporary stability. Maintaining this range is crucial for preventing deeper losses and keeping recovery prospects alive.

If bearish momentum intensifies, HBAR could break below $0.145 and drop toward $0.139 or even $0.133. Such a move would extend investor losses and reinforce market concerns. Weak demand and persistent outflows make this scenario increasingly plausible unless conditions improve.

If bullish momentum returns, HBAR could rebound and climb toward $0.154 or $0.162. A recovery of this magnitude would help restore confidence and invalidate the bearish thesis. Renewed inflows and improving sentiment would be essential to supporting this upward move.