Hedera (HBAR) has become the top loser out of the top 100 cryptocurrencies following a 20% price decrease in the last 24 hours. This HBAR price drop came just hours after the price rallied by 180%

BeInCrypto’s findings suggest that the recent notable market decline may be tied to growing speculation over the potential successor to the US SEC Chair position. However, this isn’t the sole factor influencing the downturn.

Hedera Slides in Several Areas Because of This

HBAR witnessed a price surge after Canary Capital filed its first exchange-traded fund (ETF) application for the asset. The news marked a significant milestone for Hedera, instilling optimism among investors and triggering an initial price hike.

However, the triple-digit rally in HBAR’s price seems more closely tied to speculation regarding the US president-elect Donald Trump’s potential nomination of Brian Brooks, a Hedera board member, as the next SEC chair.

But yesterday, November 19, the rumors changed, with some media platforms suggesting that crypto lawyer Teresa Goody Guillen could now be the top candidate. As a result, the HBAR price dropped by 20%.

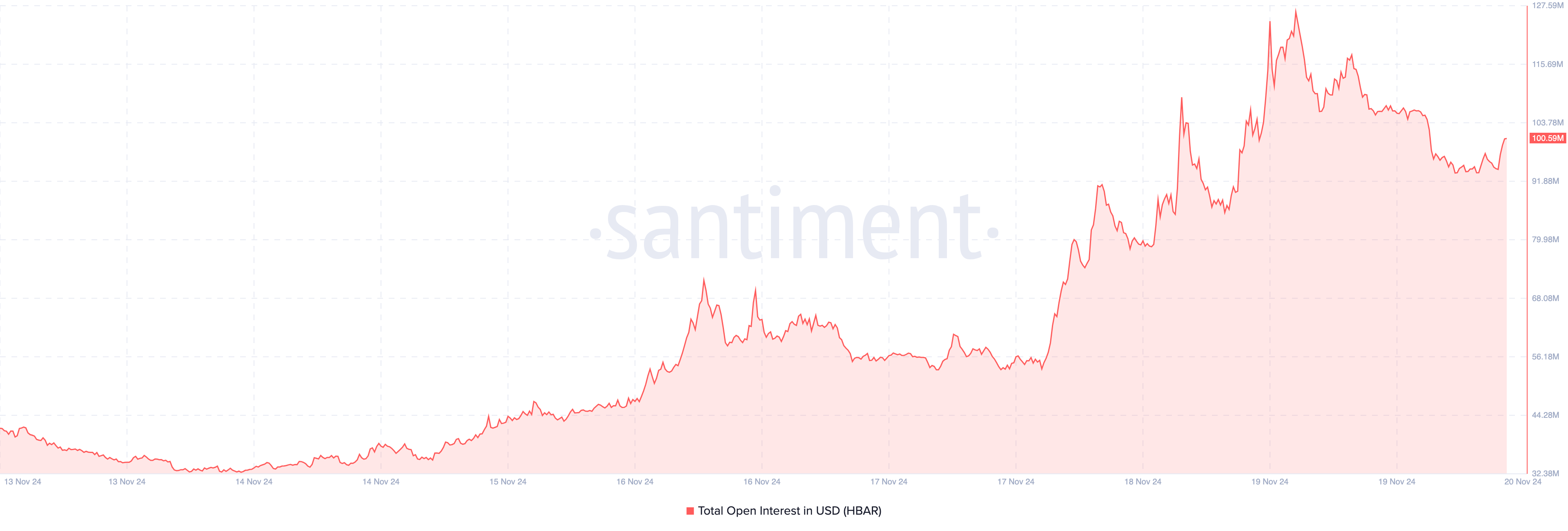

Following the development, total Open Interest (OI) in HBAR derivatives has dropped from $120 million to $100.95 million.

The decline in OI reflects reduced speculative activity, as fewer traders are initiating new positions. Further, this reduction in speculative activity often leads to diminished liquidity, suggesting the altcoin may struggle to sustain its recent uptrend.

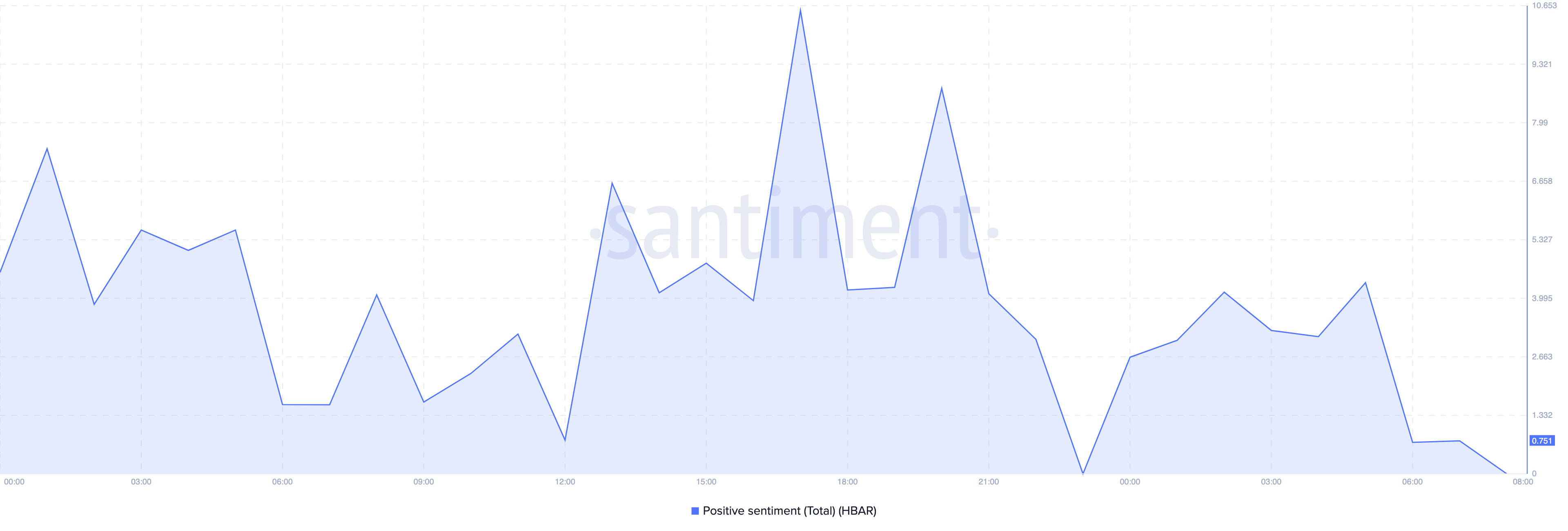

Additionally, the positive sentiment surrounding the project, which had previously increased, has now waned. Typically, a rise in positive sentiment indicates a surge in bullish commentary about the cryptocurrency.

However, the recent drop in sentiment suggests a decrease in these bullish discussions. If this trend persists, it could further challenge HBAR price ability to climb higher in the short term.

HBAR Price Prediction: Bearish

From a technical point of view, the HBAR price drop could be attributed to the fact that the altcoin had become overbought. This was indicated by the Relative Strength Index (RSI), which measures momentum,

Apart from measuring momentum, the RSI also shows if a cryptocurrency is overbought or oversold. When the reading is above 70.00, it is overbought. On the other hand, if it is below 30.00, it is oversold.

With this position, the HBAR price might likely drop from $0.13 to $0.095. However, if buying pressure increases again for the altcoin, this might change. If that happens, HBAR could rise to $0.016.